- China

- /

- Interactive Media and Services

- /

- SZSE:300785

High Growth Tech Stocks Including None Lead These 3 Top Picks

Reviewed by Simply Wall St

In a week marked by a flurry of earnings reports and economic data, global markets saw mixed performances with small-cap stocks showing resilience compared to their larger counterparts. Amidst this backdrop, high growth tech stocks remain an area of interest as investors seek opportunities that balance innovation with the ability to navigate market volatility and economic uncertainties. A good stock in this context often combines robust technological advancements with strong management strategies capable of adapting to shifting macroeconomic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

Click here to see the full list of 1281 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Shenzhen Jieshun Science and Technology IndustryLtd (SZSE:002609)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Jieshun Science and Technology Industry Co., Ltd. operates in the technology sector, focusing on intelligent parking management and other related solutions, with a market cap of CN¥5.39 billion.

Operations: Jieshun Science and Technology generates revenue primarily through its intelligent parking management solutions. The company's operations are centered around developing technology-driven systems for efficient parking management, catering to various clients in the sector.

Shenzhen Jieshun Science and Technology Industry Co., Ltd. has demonstrated a robust trajectory with its earnings forecast to surge by 44.1% annually, significantly outpacing the broader Chinese market's growth rate of 26.3%. This performance is underpinned by an aggressive R&D investment strategy, which not only fuels innovation but also aligns with the company's recent revenue growth forecast of 19.5% per year—faster than the market average of 14%. Despite a challenging past year where earnings dipped by 20.6%, their commitment to reinvesting in technology and completing a share repurchase of CNY 25.49 million for 0.56% of shares underlines a strategic push to enhance shareholder value and stabilize stock performance amidst fluctuating market conditions.

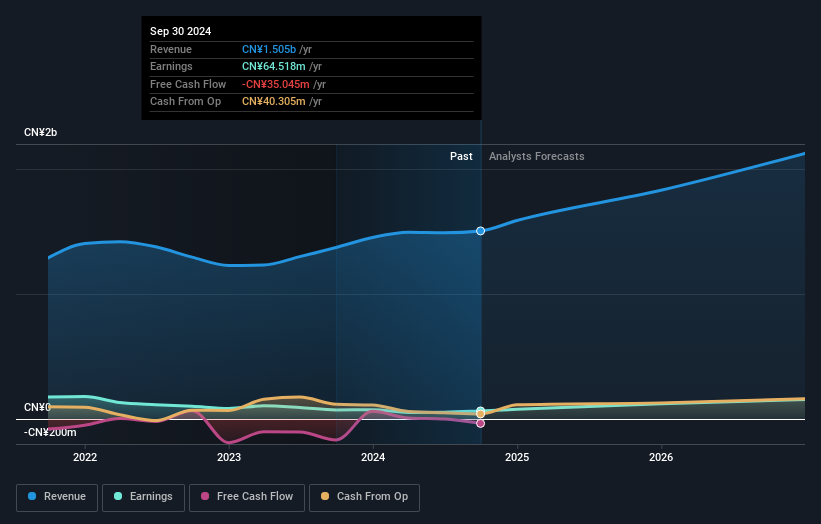

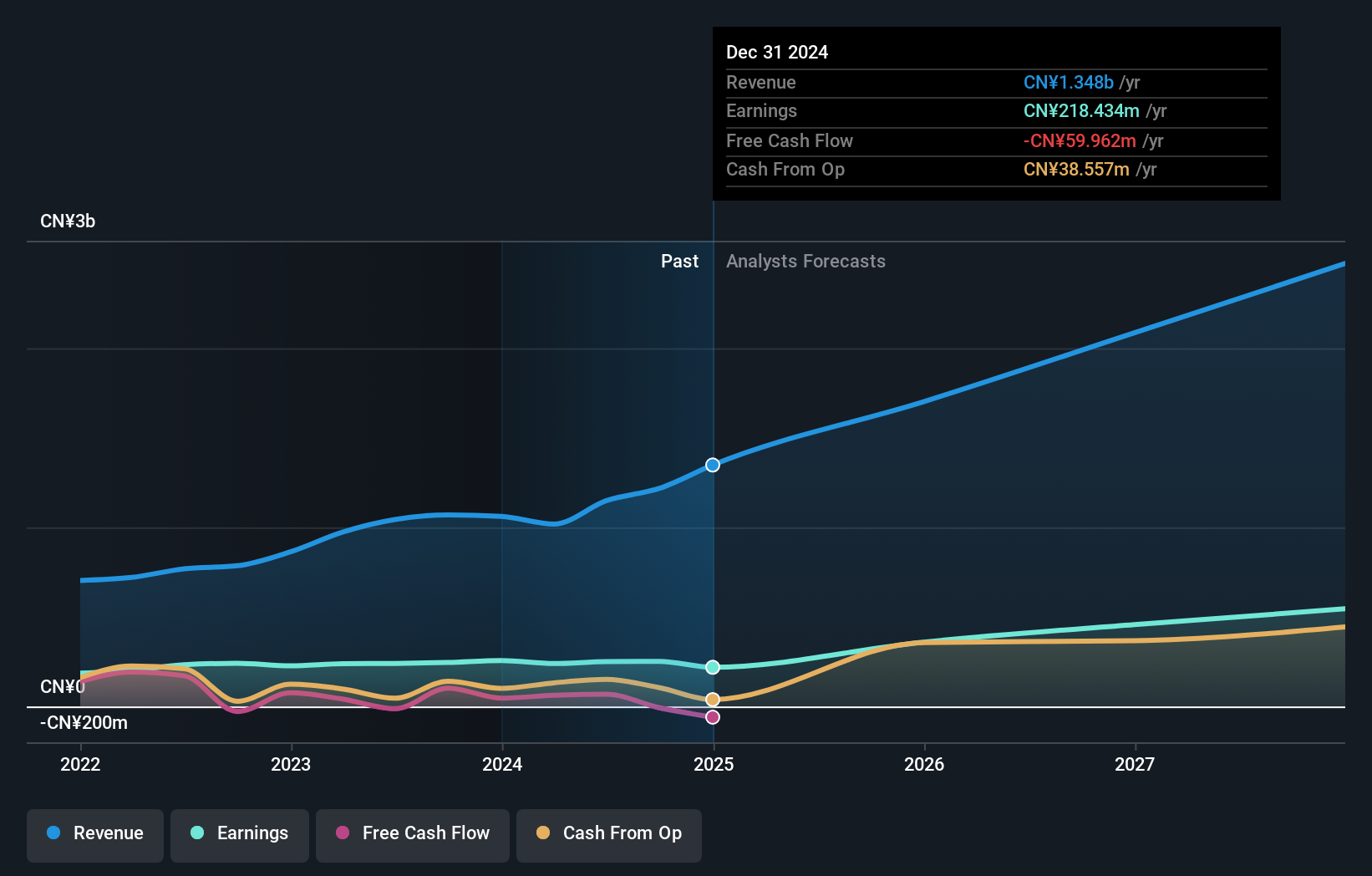

Beijing Zhidemai Technology (SZSE:300785)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Zhidemai Technology Co., Ltd. operates in the field of Internet information promotion both within China and internationally, with a market capitalization of CN¥5.54 billion.

Operations: Zhidemai Technology focuses on Internet information promotion, leveraging digital platforms to generate revenue. The company operates both domestically in China and on an international scale.

Beijing Zhidemai Technology's recent performance underscores a dynamic yet challenging landscape. With earnings forecasted to grow by 39.5% annually, the company outstrips the broader Chinese market growth of 26.3%. This aggressive expansion is fueled by substantial R&D investments, which have notably risen to capture a significant portion of revenue, aligning with an industry-wide acceleration towards innovative tech solutions. Despite these promising figures, the firm navigated a tough period with net income falling to CNY 3.8 million from CNY 14.06 million year-over-year as reported in their latest quarterly results on October 27, 2024. However, their strategic adjustments and governance changes suggest a proactive stance towards future challenges and opportunities within the tech sector.

- Delve into the full analysis health report here for a deeper understanding of Beijing Zhidemai Technology.

Understand Beijing Zhidemai Technology's track record by examining our Past report.

Jiangsu Zeyu Intelligent PowerLtd (SZSE:301179)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Zeyu Intelligent Power Co., Ltd. provides engineering construction, operation and maintenance, system integration, and design and consulting services for the power industry in China, with a market cap of CN¥5.85 billion.

Operations: Jiangsu Zeyu Intelligent Power Ltd. focuses on delivering comprehensive services to the power sector in China, including engineering construction, system integration, and consulting. The company generates revenue through these specialized services tailored for the power industry.

Jiangsu Zeyu Intelligent Power has demonstrated robust growth, with revenue surging by 26.1% annually, outpacing the broader Chinese market's 14% growth rate. This momentum is further underscored by an impressive forecast of earnings growth at 30.4% per year. Central to this performance is the company's commitment to R&D, which not only fuels innovation but also aligns with industry trends towards advanced tech solutions, ensuring its competitive edge in a rapidly evolving sector. Despite facing challenges such as a slight dip in net income from CNY 136.25 million to CNY 131.59 million year-over-year for the nine months ended September 2024, strategic initiatives and governance adjustments position Jiangsu Zeyu for potential future gains in both domestic and global markets.

Turning Ideas Into Actions

- Delve into our full catalog of 1281 High Growth Tech and AI Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Zhidemai Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300785

Beijing Zhidemai Technology

Engages in the Internet information promotion activities in China and internationally.

Flawless balance sheet with reasonable growth potential.