As China's economy shows signs of improvement with a surprising uptick in economic growth and industrial production, the local stock market has responded positively, as evidenced by gains in key indices like the Shanghai Composite. In this dynamic environment, identifying promising stocks involves looking for companies that can capitalize on these favorable economic indicators while navigating deflationary pressures effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In China

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tianjin Lisheng PharmaceuticalLtd | 1.23% | -6.38% | 19.81% | ★★★★★★ |

| Hubei Three Gorges Tourism Group | 11.32% | -9.98% | 7.95% | ★★★★★★ |

| Forest Packaging GroupLtd | 14.94% | -8.49% | -7.06% | ★★★★★★ |

| Wuxi Taclink Optoelectronics Technology | 0.91% | 35.55% | -1.25% | ★★★★★★ |

| Tibet Development | 52.25% | -1.03% | 55.10% | ★★★★★★ |

| Chongqing Changjiang River Moulding Material (Group) | 7.21% | 13.67% | 13.33% | ★★★★★☆ |

| ZHEJIANG DIBAY ELECTRICLtd | 28.50% | 8.58% | -0.18% | ★★★★★☆ |

| Hunan Investment GroupLtd | 7.19% | 29.97% | 17.84% | ★★★★★☆ |

| Beijing Aerospace Shenzhou Intelligent Equipment Technology | 19.97% | 10.19% | -10.91% | ★★★★★☆ |

| Sunny Loan TopLtd | 55.39% | -11.58% | 9.47% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Beijing Tricolor Technology (SHSE:603516)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing Tricolor Technology Co., Ltd specializes in the manufacturing and sale of professional audio and video products globally, with a market capitalization of CN¥7.10 billion.

Operations: Tricolor Technology generates revenue primarily from the display control industry, amounting to CN¥511.31 million. The company's market capitalization stands at CN¥7.10 billion.

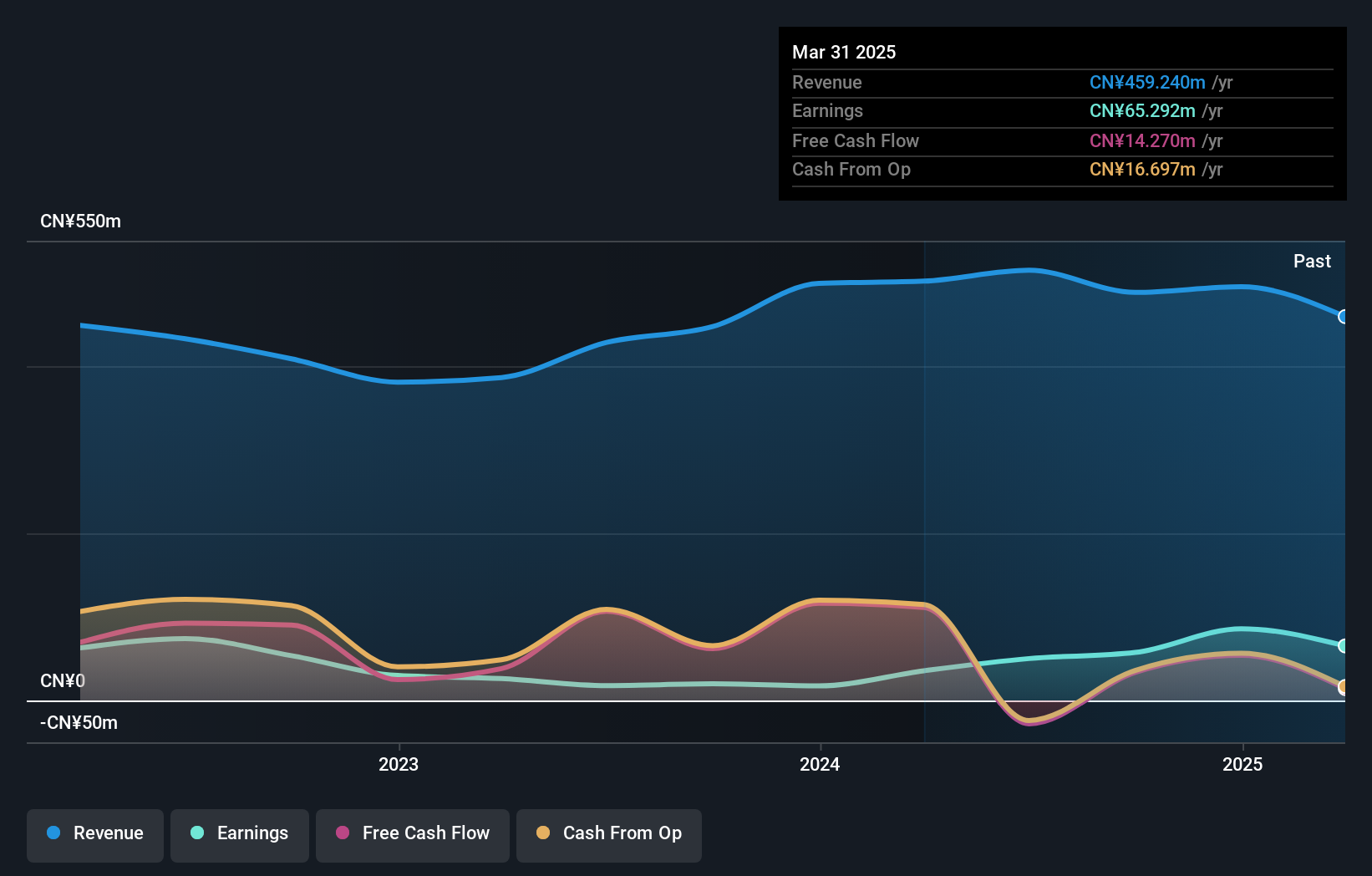

Beijing Tricolor Technology, a smaller player in the electronics sector, showcases impressive earnings growth of 181.9% over the past year, outpacing the industry's -2.8%. Despite its volatile share price recently, the company remains debt-free and boasts high-quality earnings. For the half-year ending June 2024, revenue reached ¥233.62 million (approx US$32 million), up from ¥217.9 million last year; net income jumped to ¥39.24 million (approx US$5 million) from ¥6.61 million previously. However, shareholder dilution occurred over the past year while future earnings are projected to grow at 48.23% annually, suggesting potential for further expansion.

Shenzhen Soling IndustrialLtd (SZSE:002766)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Soling Industrial Co., Ltd specializes in providing car-road-cloud solutions and has a market cap of CN¥5.63 billion.

Operations: The company generates revenue primarily from its Vehicle Electronics segment, which accounts for CN¥1.46 billion, and a smaller portion from Consumer Electronics at CN¥46.73 million.

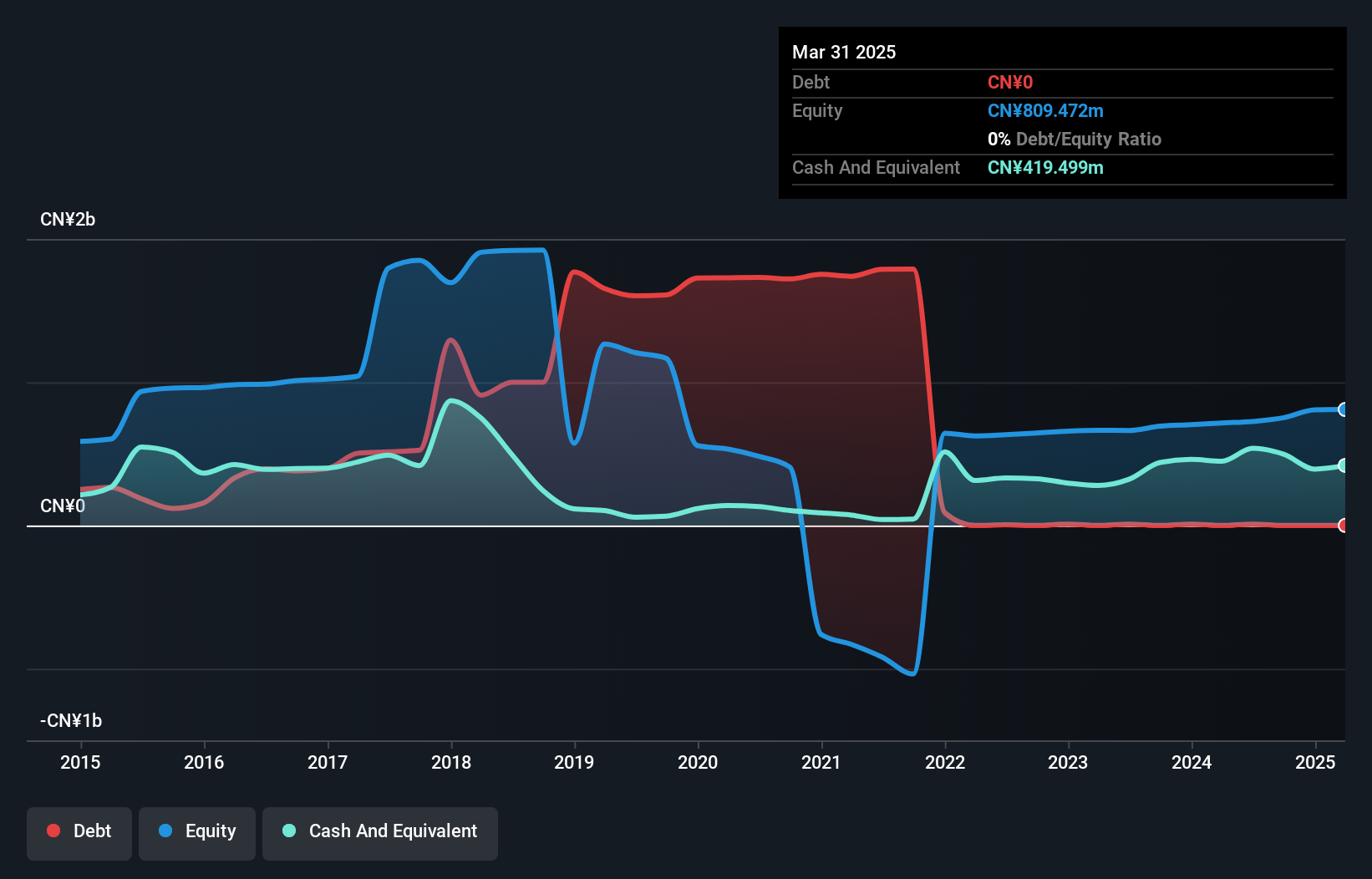

Shenzhen Soling Industrial, a promising player in the auto components sector, has shown impressive earnings growth of 399.8% over the past year, significantly outpacing the industry's 17.9%. This performance is bolstered by high-quality earnings and a debt-to-equity ratio that has improved from 132.9% to just 1.4% over five years, indicating robust financial health. The recent half-year results reflect this strength with sales reaching CNY 636 million compared to CNY 385 million previously, and net income rising to CNY 22.31 million from CNY 3.24 million last year, showcasing its potential as an investment opportunity in China’s market landscape.

- Navigate through the intricacies of Shenzhen Soling IndustrialLtd with our comprehensive health report here.

Gain insights into Shenzhen Soling IndustrialLtd's past trends and performance with our Past report.

Guangdong Insight Brand Marketing GroupLtd (SZSE:300781)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangdong Insight Brand Marketing Group Ltd (SZSE:300781) is a company focused on providing brand marketing services, with a market capitalization of CN¥7.32 billion.

Operations: Insight Brand Marketing generates revenue primarily through its direct marketing segment, amounting to CN¥740.52 million.

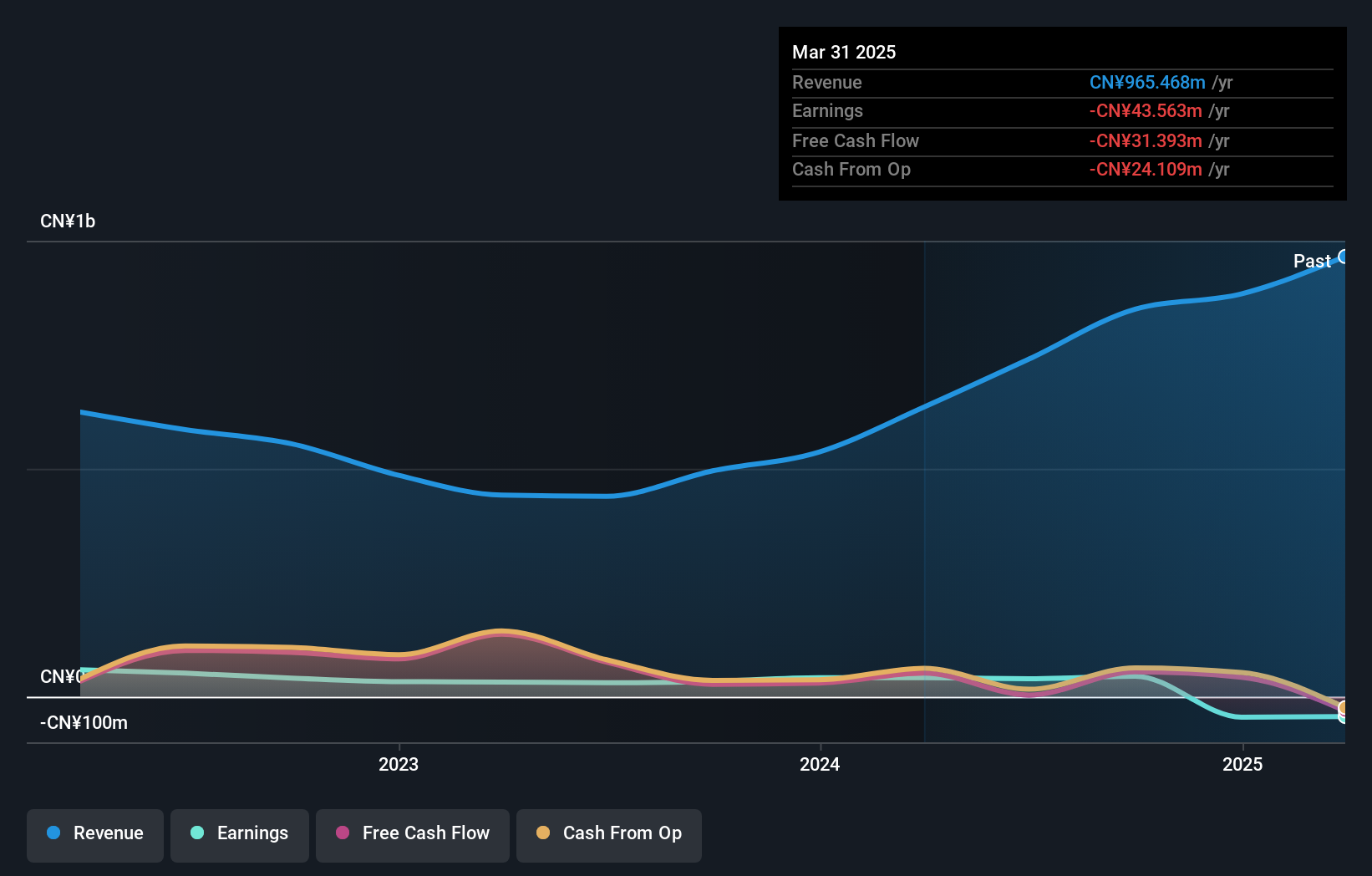

Guangdong Insight Brand Marketing Group, a small player in the media industry, has shown impressive earnings growth of 29.6% over the past year, outpacing the industry's 1.6%. Despite this, their net income for the first half of 2024 was CNY 19.92 million, slightly down from CNY 22.09 million last year. The company's debt to equity ratio has risen to 3.5% over five years but remains manageable with more cash than total debt on hand. Recently added to the S&P Global BMI Index, it seems poised for greater visibility and potential future opportunities in its sector.

Taking Advantage

- Unlock more gems! Our Chinese Undiscovered Gems With Strong Fundamentals screener has unearthed 887 more companies for you to explore.Click here to unveil our expertly curated list of 890 Chinese Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300781

Guangdong Insight Brand Marketing GroupLtd

Guangdong Insight Brand Marketing Group Co.,Ltd.

Adequate balance sheet minimal.

Market Insights

Community Narratives