- China

- /

- Entertainment

- /

- SZSE:300291

Beijing Baination Pictures Co.,Ltd. (SZSE:300291) Shares May Have Slumped 27% But Getting In Cheap Is Still Unlikely

Beijing Baination Pictures Co.,Ltd. (SZSE:300291) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 43% in that time.

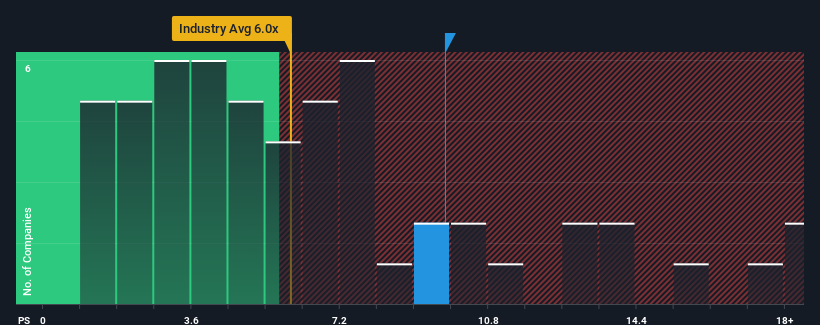

Although its price has dipped substantially, you could still be forgiven for thinking Beijing Baination PicturesLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 9.8x, considering almost half the companies in China's Entertainment industry have P/S ratios below 6x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Beijing Baination PicturesLtd

How Beijing Baination PicturesLtd Has Been Performing

As an illustration, revenue has deteriorated at Beijing Baination PicturesLtd over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Beijing Baination PicturesLtd will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Beijing Baination PicturesLtd would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 8.0%. Still, the latest three year period has seen an excellent 111% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

It's interesting to note that the rest of the industry is similarly expected to grow by 28% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's curious that Beijing Baination PicturesLtd's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

What Does Beijing Baination PicturesLtd's P/S Mean For Investors?

Even after such a strong price drop, Beijing Baination PicturesLtd's P/S still exceeds the industry median significantly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We didn't expect to see Beijing Baination PicturesLtd trade at such a high P/S considering its last three-year revenue growth has only been on par with the rest of the industry. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term trends, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

You should always think about risks. Case in point, we've spotted 2 warning signs for Beijing Baination PicturesLtd you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Baination PicturesLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300291

Beijing Baination PicturesLtd

Operates as a film and television company in China.

Excellent balance sheet very low.

Market Insights

Community Narratives