- China

- /

- Entertainment

- /

- SZSE:300251

Optimistic Investors Push Beijing Enlight Media Co., Ltd. (SZSE:300251) Shares Up 41% But Growth Is Lacking

Beijing Enlight Media Co., Ltd. (SZSE:300251) shares have had a really impressive month, gaining 41% after a shaky period beforehand. Looking further back, the 21% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

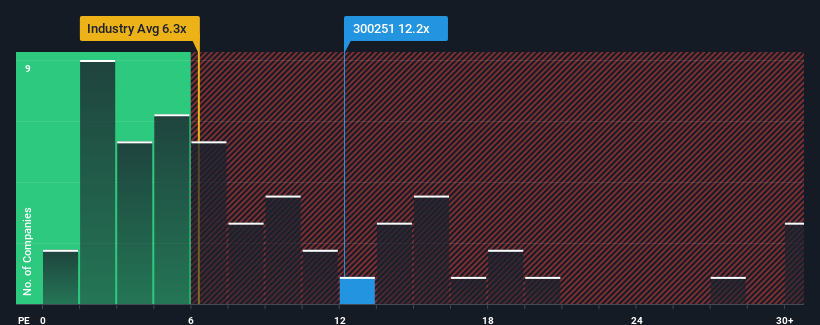

Since its price has surged higher, Beijing Enlight Media may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 12.2x, when you consider almost half of the companies in the Entertainment industry in China have P/S ratios under 6.3x and even P/S lower than 3x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Beijing Enlight Media

What Does Beijing Enlight Media's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Beijing Enlight Media has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Beijing Enlight Media.How Is Beijing Enlight Media's Revenue Growth Trending?

Beijing Enlight Media's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered an exceptional 193% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 37% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 13% as estimated by the analysts watching the company. That's shaping up to be materially lower than the 28% growth forecast for the broader industry.

In light of this, it's alarming that Beijing Enlight Media's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does Beijing Enlight Media's P/S Mean For Investors?

Shares in Beijing Enlight Media have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It comes as a surprise to see Beijing Enlight Media trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Plus, you should also learn about this 1 warning sign we've spotted with Beijing Enlight Media.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Enlight Media might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300251

Beijing Enlight Media

Engages in the investment, production, and distribution of film and television projects in China.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives