- China

- /

- Entertainment

- /

- SZSE:300182

The Market Lifts Beijing Jetsen Technology Co., Ltd (SZSE:300182) Shares 29% But It Can Do More

Those holding Beijing Jetsen Technology Co., Ltd (SZSE:300182) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 7.0% over the last year.

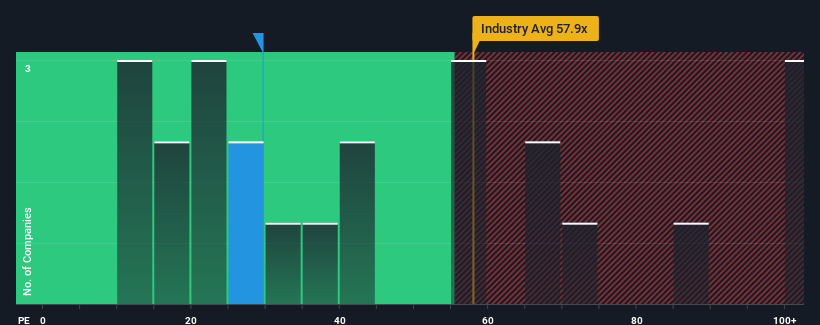

Although its price has surged higher, you could still be forgiven for feeling indifferent about Beijing Jetsen Technology's P/E ratio of 29.6x, since the median price-to-earnings (or "P/E") ratio in China is also close to 30x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times haven't been advantageous for Beijing Jetsen Technology as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Beijing Jetsen Technology

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Beijing Jetsen Technology's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 13%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 69% during the coming year according to the only analyst following the company. That's shaping up to be materially higher than the 41% growth forecast for the broader market.

With this information, we find it interesting that Beijing Jetsen Technology is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Beijing Jetsen Technology's P/E?

Its shares have lifted substantially and now Beijing Jetsen Technology's P/E is also back up to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Beijing Jetsen Technology currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 1 warning sign for Beijing Jetsen Technology that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Jetsen Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300182

Beijing Jetsen Technology

Engages in the film and television business in China.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives