- China

- /

- Entertainment

- /

- SZSE:300182

Positive Sentiment Still Eludes Beijing Jetsen Technology Co., Ltd (SZSE:300182) Following 26% Share Price Slump

The Beijing Jetsen Technology Co., Ltd (SZSE:300182) share price has fared very poorly over the last month, falling by a substantial 26%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 41% share price drop.

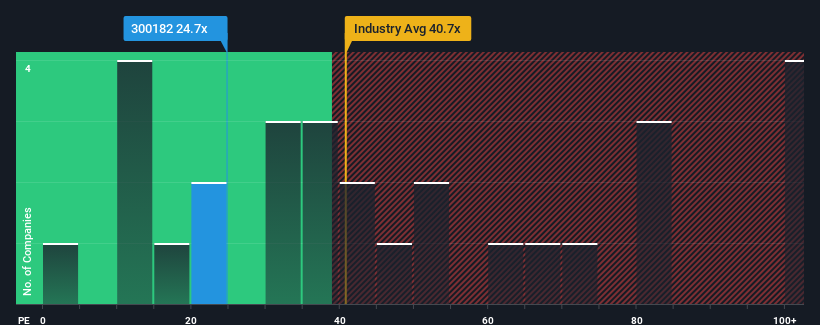

Since its price has dipped substantially, Beijing Jetsen Technology may be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 24.7x, since almost half of all companies in China have P/E ratios greater than 31x and even P/E's higher than 59x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Beijing Jetsen Technology certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Beijing Jetsen Technology

Is There Any Growth For Beijing Jetsen Technology?

Beijing Jetsen Technology's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a decent 3.8% gain to the company's bottom line. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings should grow by 49% over the next year. That's shaping up to be materially higher than the 38% growth forecast for the broader market.

With this information, we find it odd that Beijing Jetsen Technology is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Beijing Jetsen Technology's P/E has taken a tumble along with its share price. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Beijing Jetsen Technology's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Having said that, be aware Beijing Jetsen Technology is showing 1 warning sign in our investment analysis, you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Beijing Jetsen Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beijing Jetsen Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300182

Beijing Jetsen Technology

Engages in the film and television business in China.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives