- China

- /

- Entertainment

- /

- SZSE:300133

Zhejiang Huace Film & TV Co., Ltd. (SZSE:300133) Shares Slammed 25% But Getting In Cheap Might Be Difficult Regardless

The Zhejiang Huace Film & TV Co., Ltd. (SZSE:300133) share price has softened a substantial 25% over the previous 30 days, handing back much of the gains the stock has made lately. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 24% in that time.

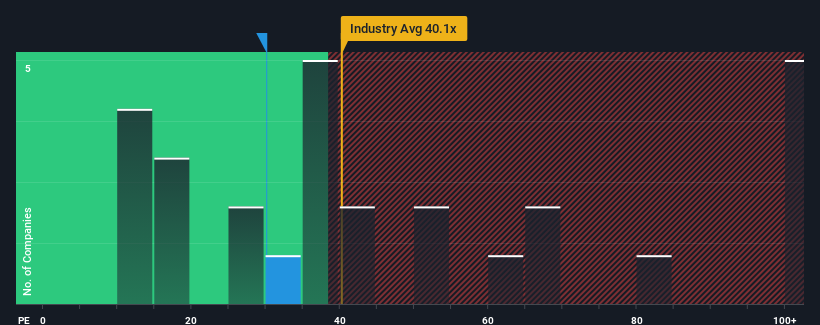

Although its price has dipped substantially, there still wouldn't be many who think Zhejiang Huace Film & TV's price-to-earnings (or "P/E") ratio of 30.1x is worth a mention when the median P/E in China is similar at about 29x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Zhejiang Huace Film & TV certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Zhejiang Huace Film & TV

How Is Zhejiang Huace Film & TV's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Zhejiang Huace Film & TV's to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 14% last year. Still, EPS has barely risen at all in aggregate from three years ago, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 34% over the next year. That's shaping up to be similar to the 35% growth forecast for the broader market.

With this information, we can see why Zhejiang Huace Film & TV is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Zhejiang Huace Film & TV's P/E?

With its share price falling into a hole, the P/E for Zhejiang Huace Film & TV looks quite average now. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Zhejiang Huace Film & TV's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Zhejiang Huace Film & TV (1 is concerning) you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Huace Film & TV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300133

Zhejiang Huace Film & TV

Engages in the production, distribution, and derivative of film and television dramas in China and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives