Shareholders in BlueFocus Intelligent Communications Group (SZSE:300058) have lost 30%, as stock drops 16% this past week

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But if you try your hand at stock picking, you risk returning less than the market. Unfortunately, that's been the case for longer term BlueFocus Intelligent Communications Group Co., Ltd. (SZSE:300058) shareholders, since the share price is down 31% in the last three years, falling well short of the market decline of around 19%. Unfortunately the last month hasn't been any better, with the share price down 31%.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

View our latest analysis for BlueFocus Intelligent Communications Group

Because BlueFocus Intelligent Communications Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, BlueFocus Intelligent Communications Group saw its revenue grow by 19% per year, compound. That's a fairly respectable growth rate. Shareholders have endured a share price decline of 9% per year. So the market has definitely lost some love for the stock. With revenue growing at a solid clip, now might be the time to focus on the possibility that it will have a brighter future.

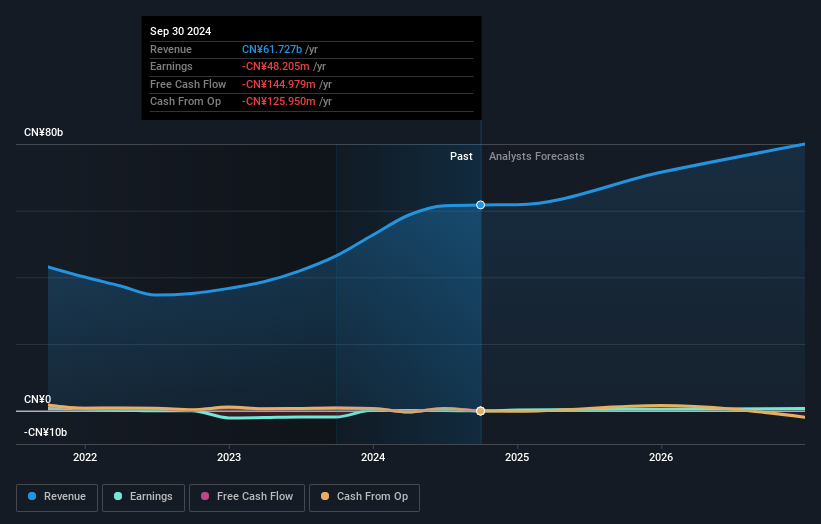

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that BlueFocus Intelligent Communications Group shareholders have received a total shareholder return of 21% over the last year. And that does include the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 4% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with BlueFocus Intelligent Communications Group , and understanding them should be part of your investment process.

We will like BlueFocus Intelligent Communications Group better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if BlueFocus Intelligent Communications Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300058

BlueFocus Intelligent Communications Group

BlueFocus Intelligent Communications Group Co., Ltd.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives