BlueFocus Intelligent Communications Group Co., Ltd. (SZSE:300058) Stock Catapults 36% Though Its Price And Business Still Lag The Industry

The BlueFocus Intelligent Communications Group Co., Ltd. (SZSE:300058) share price has done very well over the last month, posting an excellent gain of 36%. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

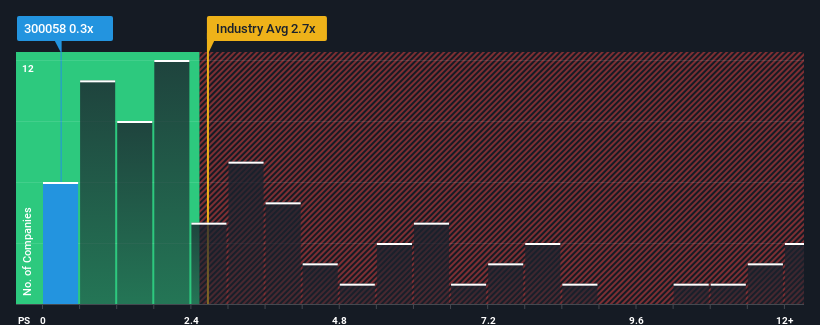

In spite of the firm bounce in price, BlueFocus Intelligent Communications Group's price-to-sales (or "P/S") ratio of 0.3x might still make it look like a strong buy right now compared to the wider Media industry in China, where around half of the companies have P/S ratios above 2.7x and even P/S above 6x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for BlueFocus Intelligent Communications Group

What Does BlueFocus Intelligent Communications Group's P/S Mean For Shareholders?

BlueFocus Intelligent Communications Group certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think BlueFocus Intelligent Communications Group's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For BlueFocus Intelligent Communications Group?

In order to justify its P/S ratio, BlueFocus Intelligent Communications Group would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered an exceptional 47% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 36% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 8.8% during the coming year according to the five analysts following the company. With the industry predicted to deliver 13% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why BlueFocus Intelligent Communications Group's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Shares in BlueFocus Intelligent Communications Group have risen appreciably however, its P/S is still subdued. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of BlueFocus Intelligent Communications Group's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for BlueFocus Intelligent Communications Group with six simple checks.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if BlueFocus Intelligent Communications Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300058

BlueFocus Intelligent Communications Group

BlueFocus Intelligent Communications Group Co., Ltd.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives