- China

- /

- Entertainment

- /

- SZSE:300052

Subdued Growth No Barrier To Shenzhen Zqgame Co., Ltd (SZSE:300052) With Shares Advancing 30%

Those holding Shenzhen Zqgame Co., Ltd (SZSE:300052) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 21% in the last twelve months.

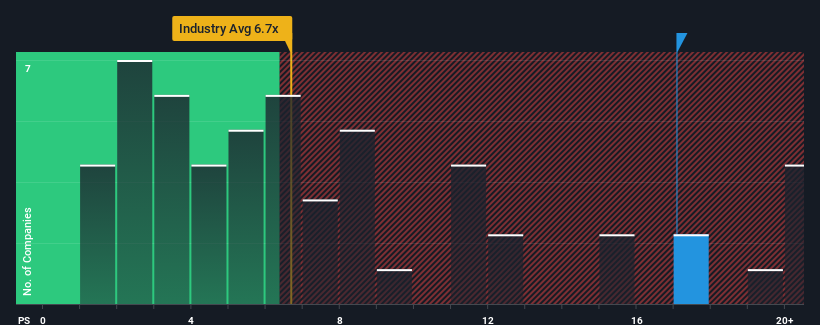

Since its price has surged higher, Shenzhen Zqgame may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 17.1x, when you consider almost half of the companies in the Entertainment industry in China have P/S ratios under 6.7x and even P/S lower than 3x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Shenzhen Zqgame

How Has Shenzhen Zqgame Performed Recently?

While the industry has experienced revenue growth lately, Shenzhen Zqgame's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shenzhen Zqgame.Is There Enough Revenue Growth Forecasted For Shenzhen Zqgame?

The only time you'd be truly comfortable seeing a P/S as steep as Shenzhen Zqgame's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 19% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 42% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 29% as estimated by the sole analyst watching the company. That's shaping up to be materially lower than the 34% growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that Shenzhen Zqgame's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Shenzhen Zqgame's P/S?

The strong share price surge has lead to Shenzhen Zqgame's P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've concluded that Shenzhen Zqgame currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Shenzhen Zqgame with six simple checks.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300052

Shenzhen Zqgame

Engages in the development, operation, and distribution of online games in China.

Mediocre balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives