Spotlight On Asian Penny Stocks With Market Caps Over US$100M

Reviewed by Simply Wall St

As global markets navigate shifting economic landscapes, Asian stock markets have captured investor attention with their diverse opportunities. Penny stocks, despite the seemingly outdated terminology, continue to present intriguing prospects for those seeking untapped potential in smaller or newer companies. This article will explore three such stocks that combine robust financial health with promising growth potential, offering investors a chance to uncover value in the Asian market.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB4.04 | THB3.99B | ✅ 4 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.58 | HK$977.26M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.63 | HK$2.19B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.615 | SGD249.25M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.78 | THB2.87B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.87 | SGD11.3B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.68 | THB9.46B | ✅ 3 ⚠️ 3 View Analysis > |

| Skellerup Holdings (NZSE:SKL) | NZ$5.00 | NZ$980.36M | ✅ 3 ⚠️ 1 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.92 | SGD1.08B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 975 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

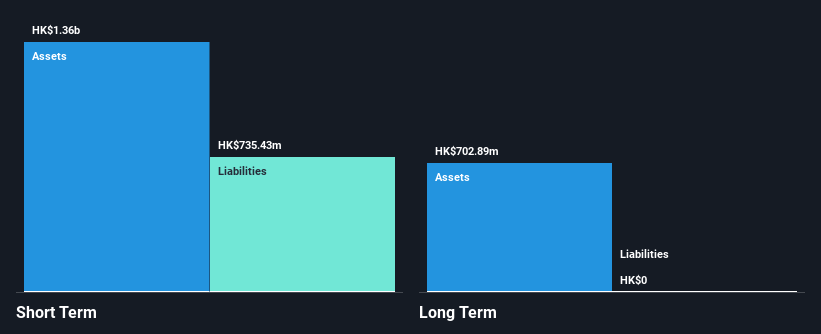

Huanxi Media Group (SEHK:1003)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Huanxi Media Group Limited is an investment holding company operating in the media and entertainment sectors in the People’s Republic of China and Hong Kong, with a market cap of HK$1.19 billion.

Operations: The company generates its revenue of HK$34.18 million from its investment in film and TV programmes rights.

Market Cap: HK$1.19B

Huanxi Media Group, with a market cap of HK$1.19 billion and revenue of HK$34.18 million, operates in the media sector but does not have meaningful revenue, indicating it may be pre-revenue. The company faces high share price volatility and has less than a year of cash runway based on current free cash flow. Despite being unprofitable, it has reduced losses over the past five years and forecasts suggest significant revenue growth ahead. Recent management changes include Ms. Hu Hui's appointment as an executive director following Mr. Dong Ping's resignation, potentially impacting strategic direction positively given her extensive industry experience.

- Take a closer look at Huanxi Media Group's potential here in our financial health report.

- Review our growth performance report to gain insights into Huanxi Media Group's future.

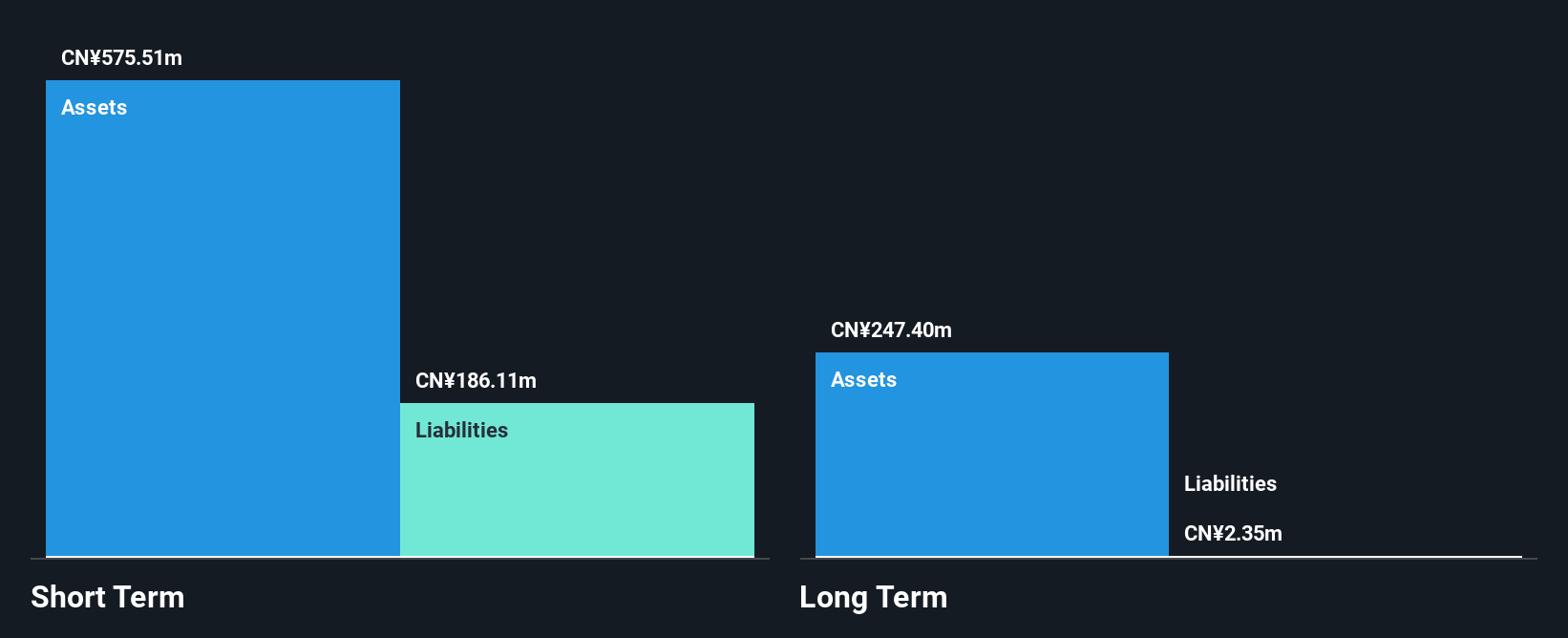

Leo Group (SZSE:002131)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Leo Group Co., Ltd., with a market cap of CN¥31.43 billion, operates in China through its subsidiaries by researching, developing, manufacturing, and selling pumps and garden machinery products.

Operations: Leo Group Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥31.43B

Leo Group Co., Ltd., with a market cap of CN¥31.43 billion, has demonstrated financial resilience through its substantial short-term assets (CN¥14.3 billion) exceeding both short-term and long-term liabilities. The company's cash reserves surpass its total debt, indicating prudent financial management despite declining earnings over the past five years and recent negative growth. A dividend of CNY 0.30 per share was approved, though it is not well covered by earnings or free cash flow, raising sustainability concerns. Additionally, the firm faces high share price volatility and low return on equity at 0.3%, potentially impacting investor sentiment in this category.

- Click to explore a detailed breakdown of our findings in Leo Group's financial health report.

- Understand Leo Group's track record by examining our performance history report.

Shenzhen Hemei GroupLTD (SZSE:002356)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shenzhen Hemei Group Co., LTD. operates in the sale of clothing and accessories both in China and internationally, with a market cap of CN¥4.34 billion.

Operations: Shenzhen Hemei Group Co., LTD. has not reported specific revenue segments.

Market Cap: CN¥4.34B

Shenzhen Hemei Group Co., LTD. has shown significant revenue growth, reporting CN¥317.48 million for the first half of 2025 compared to CN¥66.79 million a year ago, though it remains unprofitable with a net loss of CN¥10 million. The company benefits from strong short-term asset coverage over both its short and long-term liabilities and is debt-free, suggesting solid financial footing despite ongoing losses. Its cash runway extends beyond a year under current conditions, providing some stability in the volatile penny stock market segment. However, its management team and board lack extensive experience, which could influence strategic execution moving forward.

- Get an in-depth perspective on Shenzhen Hemei GroupLTD's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Shenzhen Hemei GroupLTD's track record.

Next Steps

- Click here to access our complete index of 975 Asian Penny Stocks.

- Want To Explore Some Alternatives? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002131

Adequate balance sheet with slight risk.

Market Insights

Community Narratives