- China

- /

- Electronic Equipment and Components

- /

- SZSE:300667

Three High Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

As global markets navigate mixed performances and economic uncertainties, investors are increasingly focusing on companies with strong internal confidence, as evidenced by significant insider ownership. In this context, growth companies with substantial insider stakes can offer a compelling proposition, suggesting that those who know the business best have a vested interest in its success.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.6% |

| Medley (TSE:4480) | 34% | 27.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

Let's uncover some gems from our specialized screener.

Rigol Technologies (SHSE:688337)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rigol Technologies Co., Ltd. manufactures and sells test and measurement instruments globally, with a market cap of approximately CN¥7.20 billion.

Operations: The company generates revenue primarily from its Electronic Test & Measurement Instruments segment, amounting to CN¥732.68 million.

Insider Ownership: 22%

Revenue Growth Forecast: 20.5% p.a.

Rigol Technologies is poised for growth, with earnings projected to rise 35.9% annually, outpacing the Chinese market's average. Despite recent shareholder dilution, the stock trades slightly below its estimated fair value. Recent product launches like the DG5000 Pro Series Generators and DHO/MHO5000 Oscilloscopes bolster its innovation credentials. However, insider trading activity remains minimal over three months, and return on equity forecasts are modest at 6.6% in three years.

- Take a closer look at Rigol Technologies' potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Rigol Technologies shares in the market.

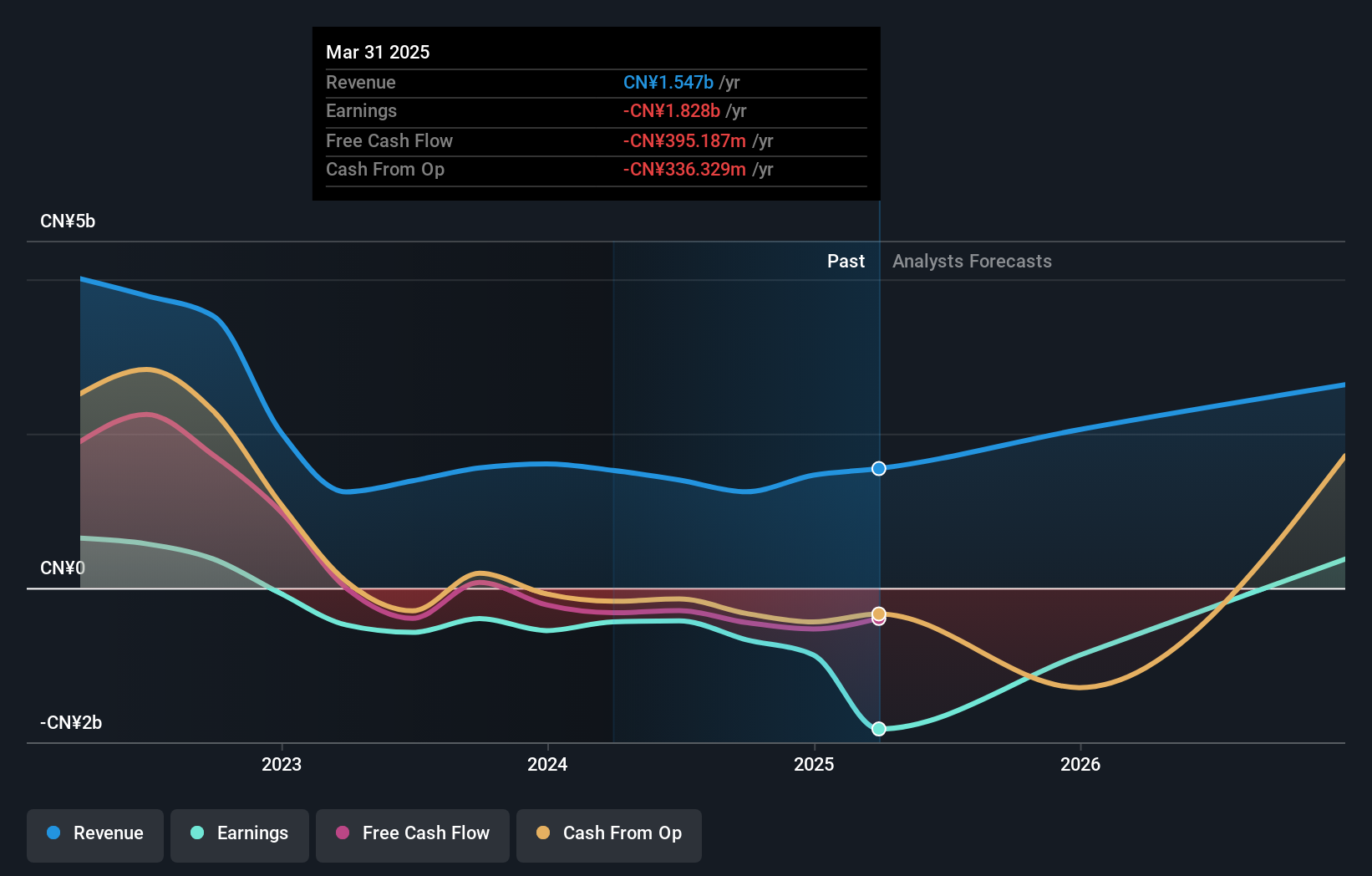

Bona Film Group (SZSE:001330)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bona Film Group Co., Ltd. is involved in film production and distribution in China, with a market cap of CN¥8.07 billion.

Operations: The company's revenue primarily comes from its film production and distribution activities within China.

Insider Ownership: 20.6%

Revenue Growth Forecast: 50.6% p.a.

Bona Film Group's revenue is forecast to grow rapidly at 50.6% annually, surpassing the Chinese market average. Despite a current net loss of CNY 354.36 million for the first nine months of 2024, profitability is anticipated within three years, indicating significant growth potential. Insider ownership remains high with no recent substantial trading activity, though share price volatility persists. The company completed a buyback plan totaling CNY 47 million in November 2024.

- Click here to discover the nuances of Bona Film Group with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Bona Film Group's current price could be inflated.

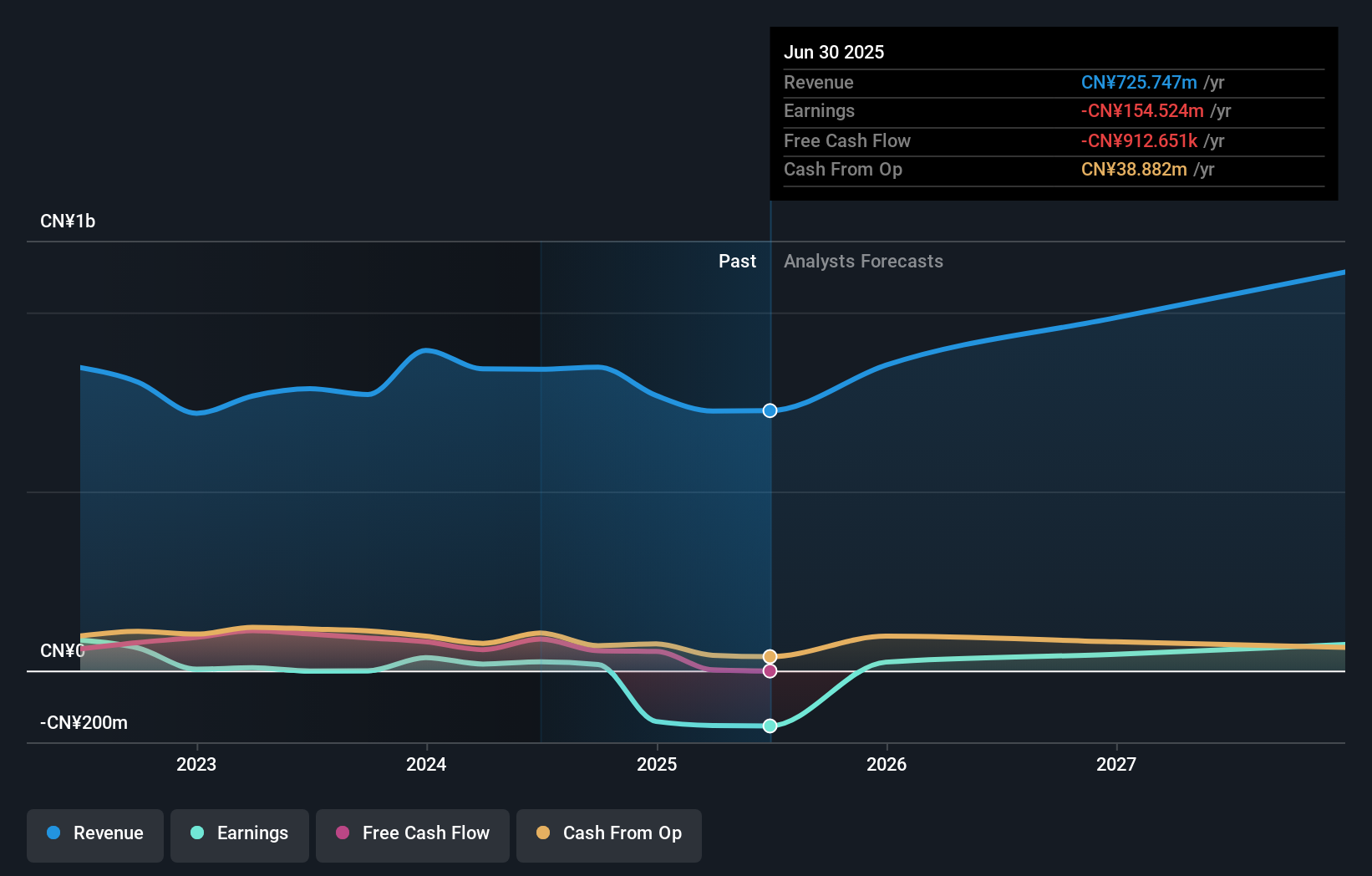

Beijing Beetech (SZSE:300667)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Beetech Inc. produces and sells smart sensors and optoelectronic instrument products, with a market cap of CN¥3.21 billion.

Operations: Revenue Segments (in millions of CN¥): Smart sensors and optoelectronic instrument products.

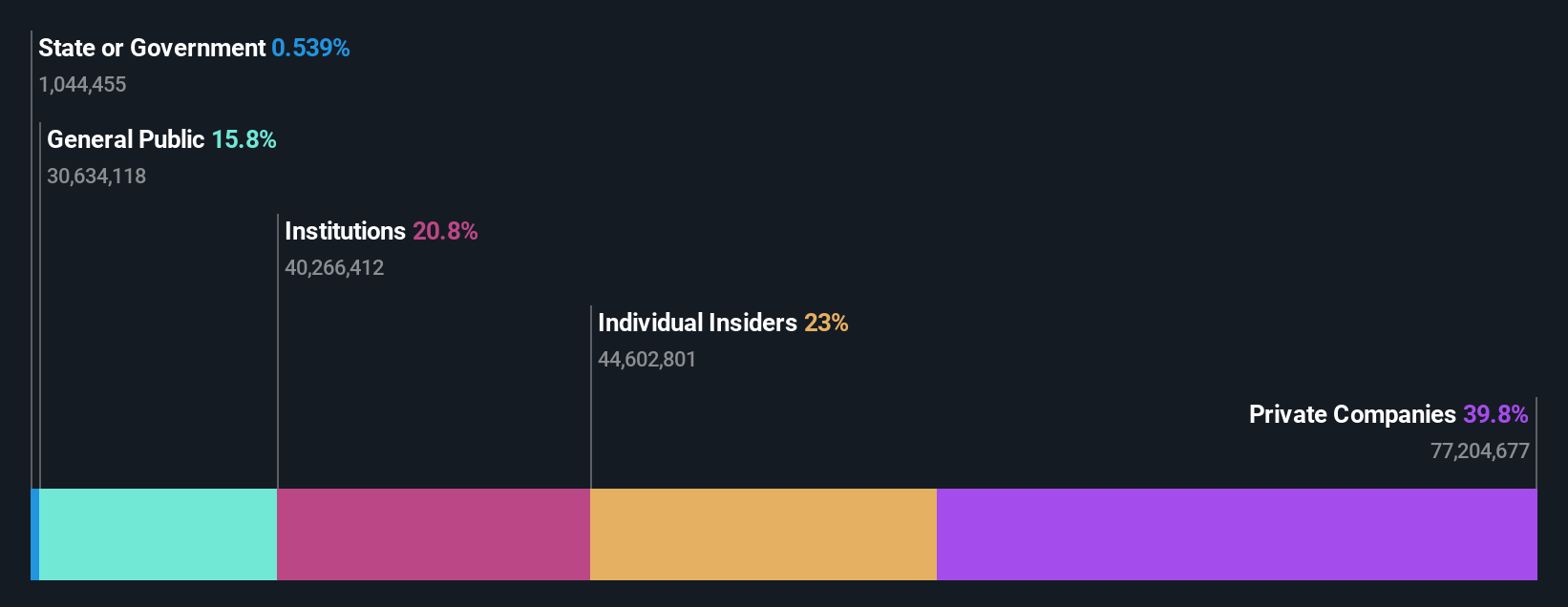

Insider Ownership: 29.8%

Revenue Growth Forecast: 19.3% p.a.

Beijing Beetech's earnings are projected to grow significantly at 55.3% annually, outpacing the Chinese market average, despite a recent net loss of CNY 3.76 million for the first nine months of 2024. Revenue is expected to increase by 19.3% per year, faster than the market but below high-growth benchmarks. No substantial insider trading has been reported recently, and share price volatility remains high. The company is undergoing an audit firm change following a special shareholders meeting in December 2024.

- Unlock comprehensive insights into our analysis of Beijing Beetech stock in this growth report.

- In light of our recent valuation report, it seems possible that Beijing Beetech is trading beyond its estimated value.

Seize The Opportunity

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1481 more companies for you to explore.Click here to unveil our expertly curated list of 1484 Fast Growing Companies With High Insider Ownership.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Beetech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300667

Beijing Beetech

Produces and sells smart sensors and optoelectronic instrument products.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives