- China

- /

- Semiconductors

- /

- SHSE:688536

Growth Companies Insiders Are Backing In February 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of trade tensions and fluctuating economic indicators, investors are keenly observing how these factors influence stock performance. Despite recent tariff uncertainties and mixed economic data, growth companies with substantial insider ownership continue to attract attention for their potential resilience and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 111.4% |

Here's a peek at a few of the choices from the screener.

3Peak (SHSE:688536)

Simply Wall St Growth Rating: ★★★★★☆

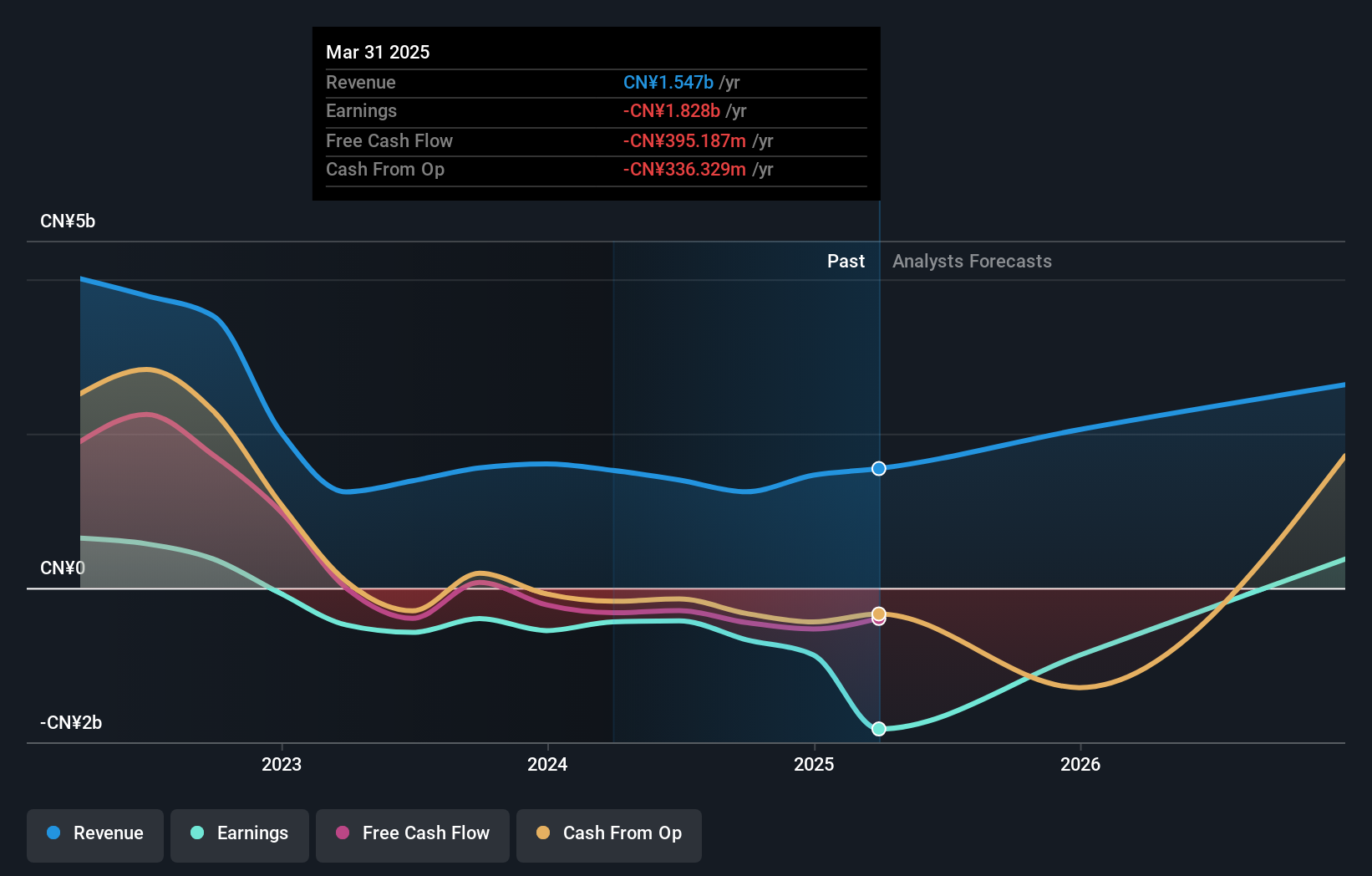

Overview: 3Peak Incorporated focuses on the research, development, and sale of analog integrated circuit products in China and internationally, with a market cap of CN¥13.75 billion.

Operations: The company's revenue is derived from the Integrated Circuit Industry, amounting to CN¥1.13 billion.

Insider Ownership: 14.8%

3Peak is poised for significant growth, with its revenue expected to rise 29.5% annually, outpacing the CN market's 13.5%. Analysts agree on a potential stock price increase of 20.7%. Earnings are forecasted to grow at an impressive rate of 85.54% per year, and profitability is anticipated within three years, surpassing average market growth expectations. No recent insider trading activity has been reported in the past three months.

- Click here to discover the nuances of 3Peak with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that 3Peak is priced higher than what may be justified by its financials.

Bona Film Group (SZSE:001330)

Simply Wall St Growth Rating: ★★★★★☆

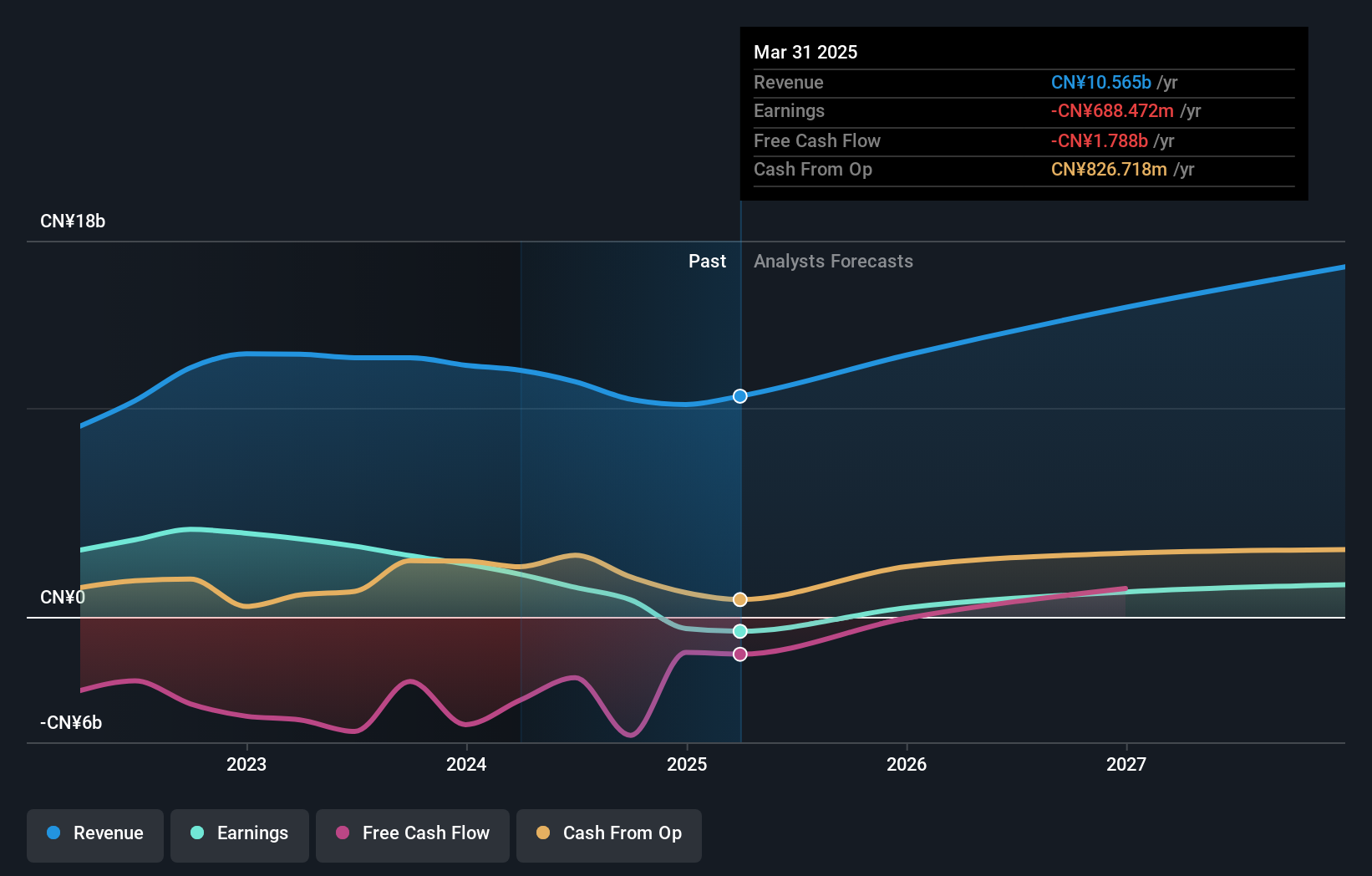

Overview: Bona Film Group Co., Ltd. is involved in film production and distribution in China, with a market cap of CN¥7.48 billion.

Operations: Revenue Segments (in millions of CN¥): Film production and distribution: 2,500; Cinema operations: 1,200; Talent management: 750. Bona Film Group Co., Ltd.'s revenue primarily comes from film production and distribution (CN¥2.5 billion), supplemented by cinema operations (CN¥1.2 billion) and talent management (CN¥750 million).

Insider Ownership: 20.6%

Bona Film Group is positioned for substantial growth, with revenue projected to increase by 50.7% annually, significantly outpacing the CN market's 13.5%. Earnings are expected to grow at an impressive rate of 108.59% per year, with profitability anticipated within three years, exceeding average market growth forecasts. Despite a highly volatile share price recently and no insider trading activity reported in the past three months, its buyback plan was concluded in November 2024 without additional repurchases.

- Click to explore a detailed breakdown of our findings in Bona Film Group's earnings growth report.

- In light of our recent valuation report, it seems possible that Bona Film Group is trading beyond its estimated value.

Yunnan Energy New Material (SZSE:002812)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Yunnan Energy New Material Co., Ltd., along with its subsidiaries, produces and sells film products both in China and internationally, with a market cap of CN¥30.04 billion.

Operations: I'm sorry, but it seems there is no specific revenue segment information provided in the text you shared. If you have additional details on their revenue segments, I can help summarize them for you.

Insider Ownership: 30.7%

Yunnan Energy New Material's earnings are forecast to grow significantly at 39.47% annually, surpassing the Chinese market's average growth of 25.4%. However, its profit margins have decreased from last year, and debt coverage by operating cash flow is inadequate. The stock trades at a discount of 25.4% below estimated fair value but faces challenges with a low projected return on equity of 5.7%. Recent shareholder meetings addressed capital structure adjustments and stock repurchases.

- Get an in-depth perspective on Yunnan Energy New Material's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Yunnan Energy New Material's share price might be on the cheaper side.

Summing It All Up

- Gain an insight into the universe of 1453 Fast Growing Companies With High Insider Ownership by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if 3Peak might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688536

3Peak

Engages in the research and development, and sale of analog integrated circuit products in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives