As global markets continue to navigate a landscape of mixed economic signals, the S&P 500 and Nasdaq Composite have reached new highs, buoyed by robust corporate earnings. Amid this backdrop, the term 'penny stocks' may seem outdated, yet these low-priced shares still hold significant potential for growth. Typically representing smaller or emerging companies, penny stocks can offer attractive opportunities when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.09 | A$101.42M | ✅ 4 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.41 | HK$889.64M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.455 | SGD184.41M | ✅ 4 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.396 | £42.74M | ✅ 5 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.45 | SGD9.64B | ✅ 5 ⚠️ 0 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ✅ 5 ⚠️ 0 View Analysis > |

| Zetrix AI Berhad (KLSE:ZETRIX) | MYR0.935 | MYR7.2B | ✅ 5 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.255 | £198.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.986 | €32.91M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,816 stocks from our Global Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Bona Film Group (SZSE:001330)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bona Film Group Co., Ltd. is involved in film production and distribution in China, with a market cap of CN¥6.53 billion.

Operations: Bona Film Group Co., Ltd. does not report specific revenue segments.

Market Cap: CN¥6.53B

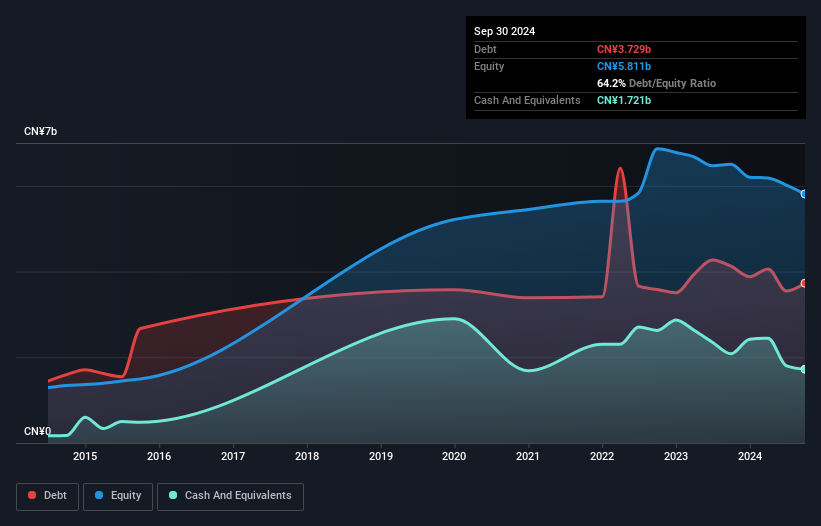

Bona Film Group, with a market cap of CN¥6.53 billion, is currently unprofitable and not expected to achieve profitability in the next three years. The company's net debt to equity ratio is high at 44.3%, and its return on equity is negative at -42.57%. Despite these challenges, Bona's short-term assets exceed both its short-term and long-term liabilities, offering some financial stability. Revenue is forecasted to grow significantly by 29.78% annually, though past losses have increased substantially over five years. Recent earnings showed a net loss of CN¥955.17 million for Q1 2025 despite increased revenue compared to the previous year.

- Unlock comprehensive insights into our analysis of Bona Film Group stock in this financial health report.

- Understand Bona Film Group's earnings outlook by examining our growth report.

Yotrio Group (SZSE:002489)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yotrio Group Co., Ltd. is engaged in the research, development, manufacturing, and sale of outdoor furniture products across China and various international markets, with a market cap of CN¥8.11 billion.

Operations: No specific revenue segments are reported for Yotrio Group.

Market Cap: CN¥8.11B

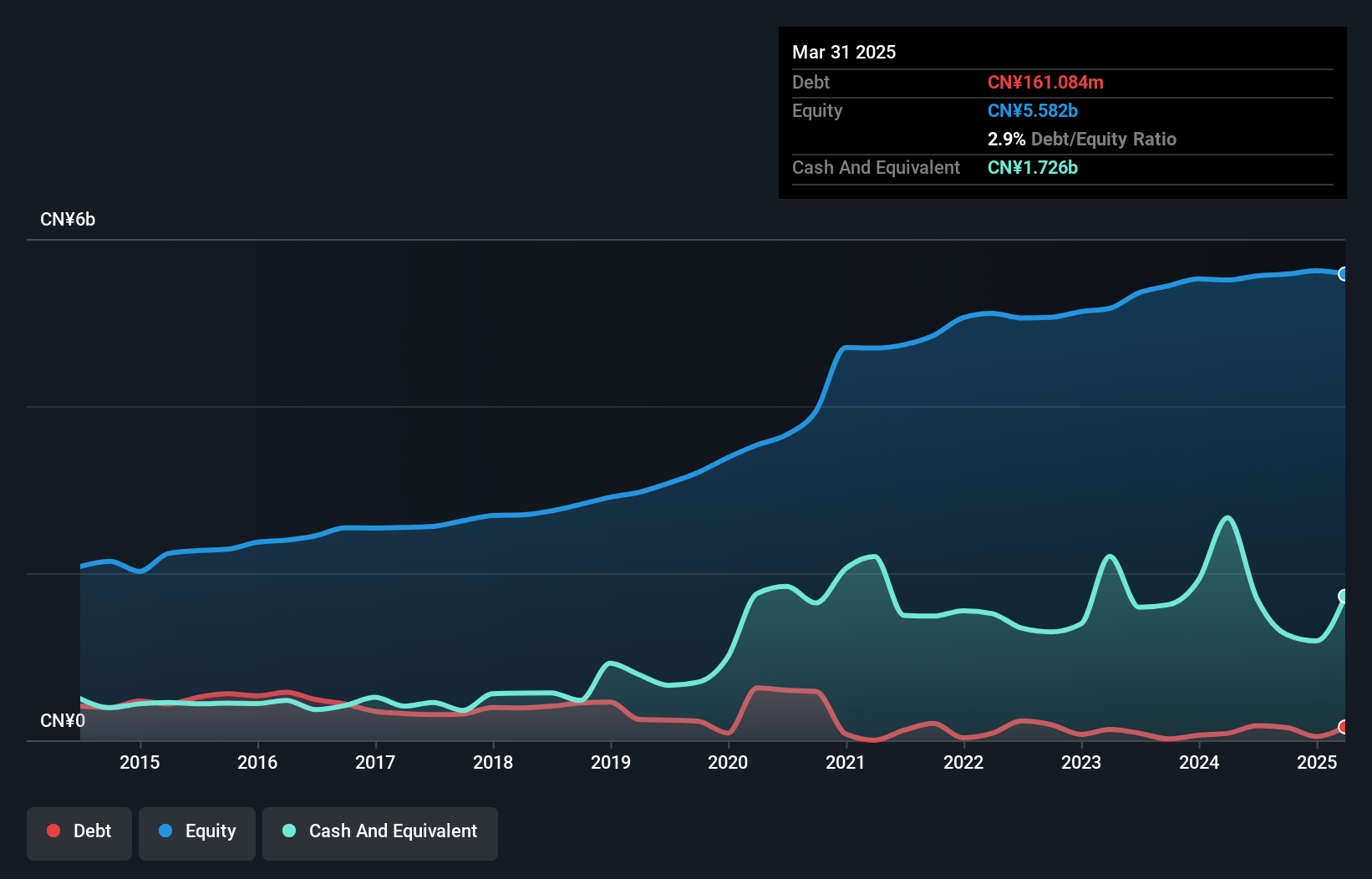

Yotrio Group, with a market cap of CN¥8.11 billion, has shown profitability in recent periods despite previous earnings declines. Its short-term assets of CN¥5.9 billion comfortably cover both its short-term and long-term liabilities, indicating solid liquidity management. The company reported Q1 2025 revenue of CN¥2.54 billion and net income of CN¥371.57 million, reflecting growth from the previous year. While its price-to-earnings ratio is relatively low at 14.2x compared to the broader market, a significant one-off gain impacted recent results, and dividend stability remains uncertain due to an unstable track record.

- Take a closer look at Yotrio Group's potential here in our financial health report.

- Explore historical data to track Yotrio Group's performance over time in our past results report.

Era (SZSE:002641)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Era Co., Ltd. engages in the research, development, production, and sale of plastic pipe products in China with a market cap of CN¥5.28 billion.

Operations: The company generates revenue primarily from its manufacturing industry segment, which accounts for CN¥6.19 billion.

Market Cap: CN¥5.28B

Era Co., Ltd., with a market cap of CN¥5.28 billion, has experienced a challenging financial period, reporting a net loss of CN¥38.34 million for Q1 2025 compared to net income the previous year. Despite negative earnings growth and declining profit margins from 4.2% to 2.1%, the company maintains strong liquidity with short-term assets exceeding liabilities and reduced debt-to-equity ratio over five years. The management team is seasoned, yet operating cash flow remains negative, impacting debt coverage and dividend sustainability at 1.14%. Forecasts suggest potential earnings growth of 23.46% annually despite current challenges in profitability and revenue generation.

- Click here to discover the nuances of Era with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Era's future.

Where To Now?

- Discover the full array of 3,816 Global Penny Stocks right here.

- Ready To Venture Into Other Investment Styles? Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002489

Yotrio Group

Researches, develops, manufactures, and sells outdoor furniture products in China, Europe, North and South America, Australia, Africa, and internationally.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives