- China

- /

- Entertainment

- /

- SZSE:001330

Bona Film Group Co., Ltd. (SZSE:001330) Soars 30% But It's A Story Of Risk Vs Reward

Bona Film Group Co., Ltd. (SZSE:001330) shares have continued their recent momentum with a 30% gain in the last month alone. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 8.6% over the last year.

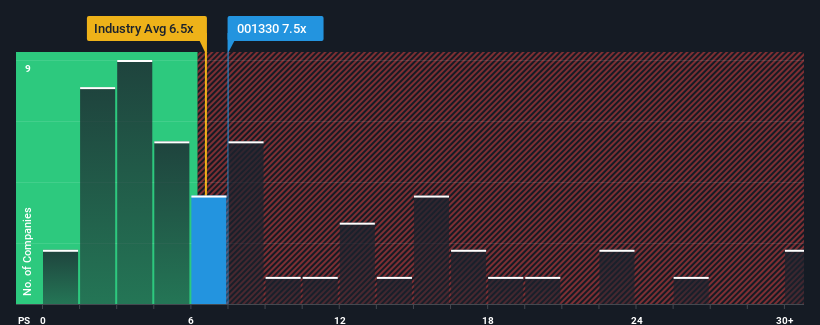

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Bona Film Group's P/S ratio of 7.5x, since the median price-to-sales (or "P/S") ratio for the Entertainment industry in China is also close to 6.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Bona Film Group

What Does Bona Film Group's P/S Mean For Shareholders?

Bona Film Group could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bona Film Group.Is There Some Revenue Growth Forecasted For Bona Film Group?

The only time you'd be comfortable seeing a P/S like Bona Film Group's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. This means it has also seen a slide in revenue over the longer-term as revenue is down 60% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 117% during the coming year according to the three analysts following the company. With the industry only predicted to deliver 33%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Bona Film Group is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Bona Film Group's P/S?

Bona Film Group's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, Bona Film Group's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Bona Film Group with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Bona Film Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:001330

Bona Film Group

Primarily engages in the film production and distribution business in China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives