Earnings growth of 11% over 1 year hasn't been enough to translate into positive returns for Xinhuanet (SHSE:603888) shareholders

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. But if you buy individual stocks, you can do both better or worse than that. Investors in Xinhuanet Co., Ltd. (SHSE:603888) have tasted that bitter downside in the last year, as the share price dropped 26%. That contrasts poorly with the market decline of 10%. However, the longer term returns haven't been so bad, with the stock down 6.6% in the last three years. Furthermore, it's down 15% in about a quarter. That's not much fun for holders.

After losing 5.8% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Xinhuanet

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Even though the Xinhuanet share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped.

The divergence between the EPS and the share price is quite notable, during the year. But we might find some different metrics explain the share price movements better.

Given the yield is quite low, at 1.0%, we doubt the dividend can shed much light on the share price. Xinhuanet's revenue is actually up 6.5% over the last year. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

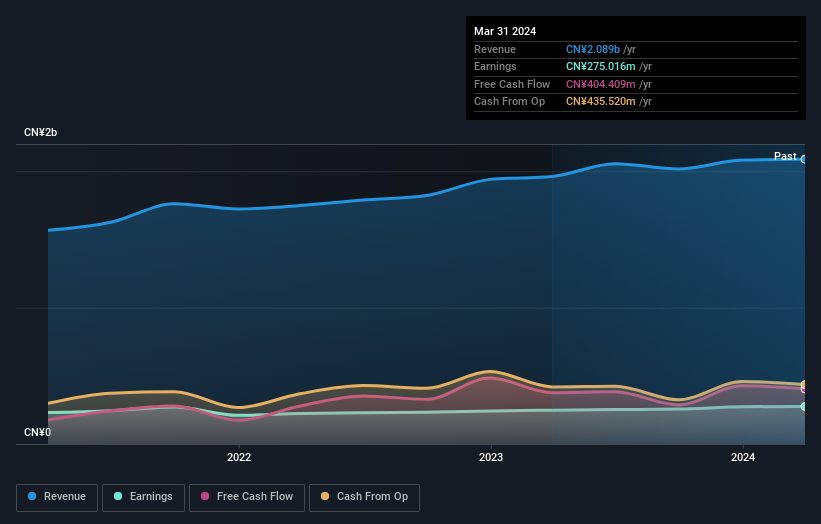

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Xinhuanet's earnings, revenue and cash flow.

A Different Perspective

We regret to report that Xinhuanet shareholders are down 25% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 10%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 3% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Xinhuanet that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603888

Flawless balance sheet with solid track record.