The Market Lifts Shanghai Fengyuzhu Culture Technology Co., Ltd. (SHSE:603466) Shares 32% But It Can Do More

Shanghai Fengyuzhu Culture Technology Co., Ltd. (SHSE:603466) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 8.3% over the last year.

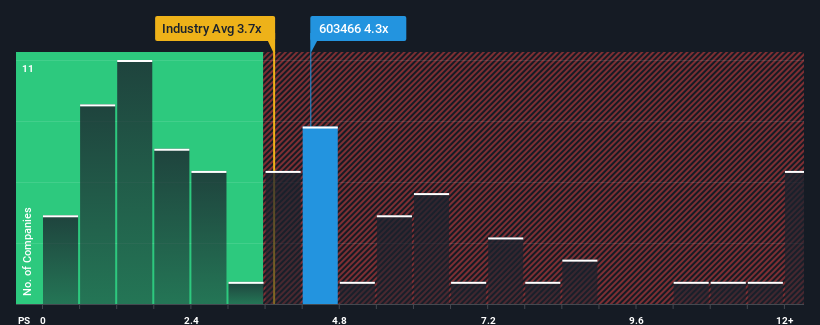

Even after such a large jump in price, it's still not a stretch to say that Shanghai Fengyuzhu Culture Technology's price-to-sales (or "P/S") ratio of 4.3x right now seems quite "middle-of-the-road" compared to the Media industry in China, where the median P/S ratio is around 3.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Shanghai Fengyuzhu Culture Technology

How Has Shanghai Fengyuzhu Culture Technology Performed Recently?

Shanghai Fengyuzhu Culture Technology could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Shanghai Fengyuzhu Culture Technology will help you uncover what's on the horizon.How Is Shanghai Fengyuzhu Culture Technology's Revenue Growth Trending?

Shanghai Fengyuzhu Culture Technology's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 35%. The last three years don't look nice either as the company has shrunk revenue by 49% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 37% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 11%, which is noticeably less attractive.

In light of this, it's curious that Shanghai Fengyuzhu Culture Technology's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Shanghai Fengyuzhu Culture Technology's P/S Mean For Investors?

Shanghai Fengyuzhu Culture Technology's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at Shanghai Fengyuzhu Culture Technology's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you take the next step, you should know about the 2 warning signs for Shanghai Fengyuzhu Culture Technology (1 is potentially serious!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603466

Shanghai Fengyuzhu Culture Technology

Shanghai Fengyuzhu Culture Technology Co., Ltd.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives