Earnings Working Against Zhejiang Publishing & Media Co., Ltd.'s (SHSE:601921) Share Price Following 27% Dive

Zhejiang Publishing & Media Co., Ltd. (SHSE:601921) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Longer-term shareholders would now have taken a real hit with the stock declining 3.9% in the last year.

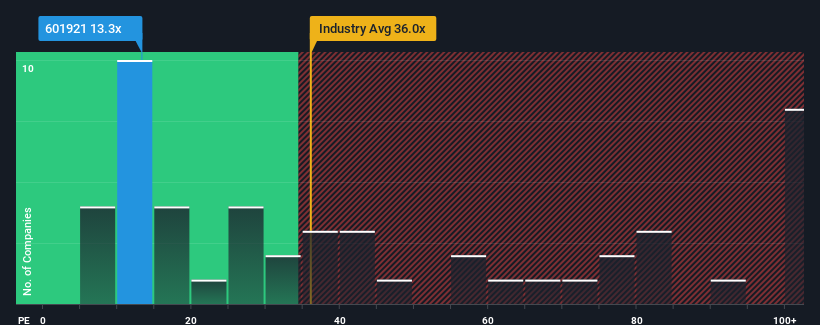

Following the heavy fall in price, Zhejiang Publishing & Media's price-to-earnings (or "P/E") ratio of 13.3x might make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 27x and even P/E's above 51x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for Zhejiang Publishing & Media as its earnings have been falling quicker than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for Zhejiang Publishing & Media

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Zhejiang Publishing & Media's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 12% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 2.4% per year as estimated by the dual analysts watching the company. That's not great when the rest of the market is expected to grow by 19% per annum.

With this information, we are not surprised that Zhejiang Publishing & Media is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Having almost fallen off a cliff, Zhejiang Publishing & Media's share price has pulled its P/E way down as well. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Zhejiang Publishing & Media's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You need to take note of risks, for example - Zhejiang Publishing & Media has 4 warning signs (and 2 which don't sit too well with us) we think you should know about.

You might be able to find a better investment than Zhejiang Publishing & Media. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Publishing & Media might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601921

Zhejiang Publishing & Media

Engages in publishing, distribution, and printing activities in China.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.