Optimistic Investors Push China Satellite Communications Co., Ltd. (SHSE:601698) Shares Up 36% But Growth Is Lacking

China Satellite Communications Co., Ltd. (SHSE:601698) shareholders have had their patience rewarded with a 36% share price jump in the last month. Taking a wider view, although not as strong as the last month, the full year gain of 16% is also fairly reasonable.

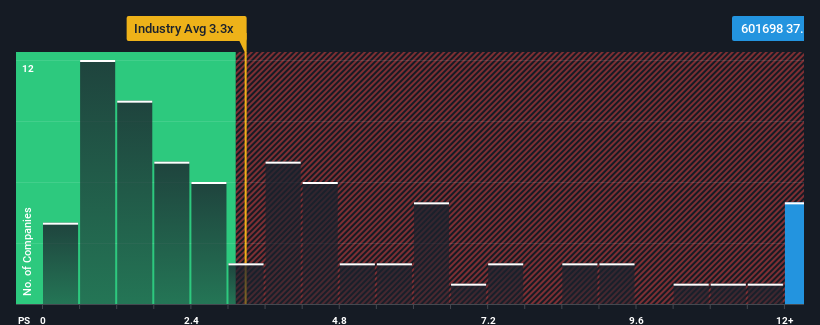

Following the firm bounce in price, given around half the companies in China's Media industry have price-to-sales ratios (or "P/S") below 3.3x, you may consider China Satellite Communications as a stock to avoid entirely with its 37.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for China Satellite Communications

What Does China Satellite Communications' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, China Satellite Communications' revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on China Satellite Communications.How Is China Satellite Communications' Revenue Growth Trending?

China Satellite Communications' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.2%. As a result, revenue from three years ago have also fallen 5.3% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 8.7% as estimated by the only analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 15%, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that China Satellite Communications' P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On China Satellite Communications' P/S

China Satellite Communications' P/S has grown nicely over the last month thanks to a handy boost in the share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see China Satellite Communications trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 1 warning sign for China Satellite Communications you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601698

China Satellite Communications

Provides satellite communications and broadcasting services to broadcast, telecom, corporate, and government customers.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives