- China

- /

- Entertainment

- /

- SHSE:601595

Why Investors Shouldn't Be Surprised By Shanghai Film Co., Ltd.'s (SHSE:601595) 30% Share Price Surge

Shanghai Film Co., Ltd. (SHSE:601595) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

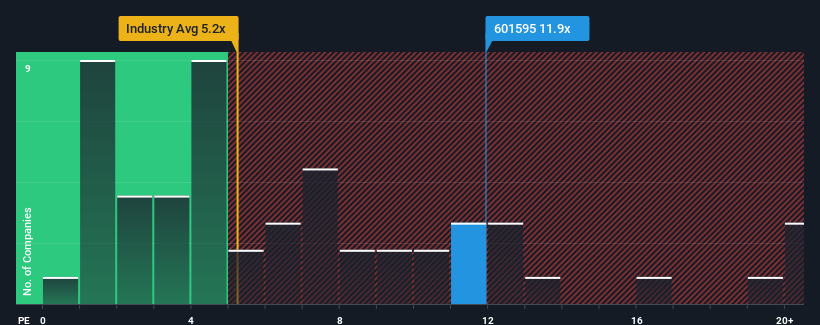

Following the firm bounce in price, when almost half of the companies in China's Entertainment industry have price-to-sales ratios (or "P/S") below 5.2x, you may consider Shanghai Film as a stock not worth researching with its 11.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Shanghai Film

How Shanghai Film Has Been Performing

Recent times have been advantageous for Shanghai Film as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Shanghai Film will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Shanghai Film?

In order to justify its P/S ratio, Shanghai Film would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 39%. As a result, it also grew revenue by 25% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 34% as estimated by the five analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 28%, which is noticeably less attractive.

With this information, we can see why Shanghai Film is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Shares in Shanghai Film have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Shanghai Film maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Entertainment industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Shanghai Film that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601595

Shanghai Film

Engages in film distribution and screening activities in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives