- China

- /

- Entertainment

- /

- SHSE:601595

Shanghai Film Co., Ltd.'s (SHSE:601595) 26% Cheaper Price Remains In Tune With Revenues

To the annoyance of some shareholders, Shanghai Film Co., Ltd. (SHSE:601595) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 33% in that time.

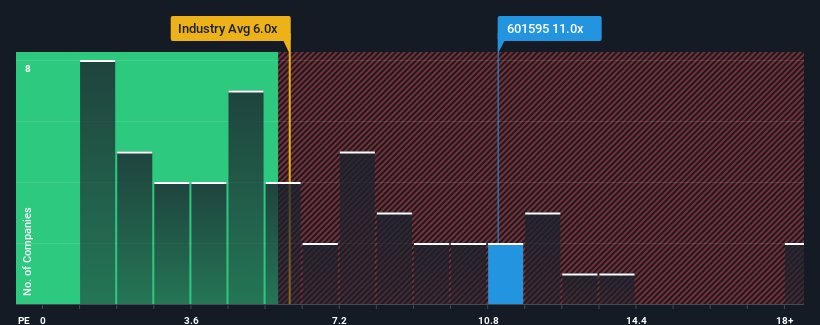

Although its price has dipped substantially, when almost half of the companies in China's Entertainment industry have price-to-sales ratios (or "P/S") below 6x, you may still consider Shanghai Film as a stock not worth researching with its 11x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Shanghai Film

How Shanghai Film Has Been Performing

With revenue growth that's superior to most other companies of late, Shanghai Film has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Shanghai Film will help you uncover what's on the horizon.How Is Shanghai Film's Revenue Growth Trending?

In order to justify its P/S ratio, Shanghai Film would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 84% gain to the company's top line. Pleasingly, revenue has also lifted 70% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 40% during the coming year according to the five analysts following the company. With the industry only predicted to deliver 26%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Shanghai Film's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Shanghai Film's P/S?

Shanghai Film's shares may have suffered, but its P/S remains high. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Shanghai Film's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You always need to take note of risks, for example - Shanghai Film has 1 warning sign we think you should be aware of.

If you're unsure about the strength of Shanghai Film's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Shanghai Film, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601595

Shanghai Film

Engages in film distribution and screening activities in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives