As global markets navigate the complexities of the incoming Trump administration's policies, investors are witnessing significant movements across various sectors, with financials and energy stocks benefiting from deregulation hopes while health care and EV shares face headwinds. In this dynamic environment, identifying high-growth tech stocks involves looking for companies that can adapt to regulatory changes and leverage technological advancements to drive innovation and expansion.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Seojin SystemLtd | 33.54% | 52.43% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1309 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Happiest Minds Technologies (NSEI:HAPPSTMNDS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Happiest Minds Technologies Limited offers IT solutions and services across various regions including India, the United States, and several other countries, with a market cap of ₹110 billion.

Operations: Happiest Minds Technologies Limited operates in the IT solutions and services sector, catering to clients across regions such as India, the United States, Canada, and several others. The company generates revenue through its diverse service offerings in digital business solutions, product engineering services, and infrastructure management.

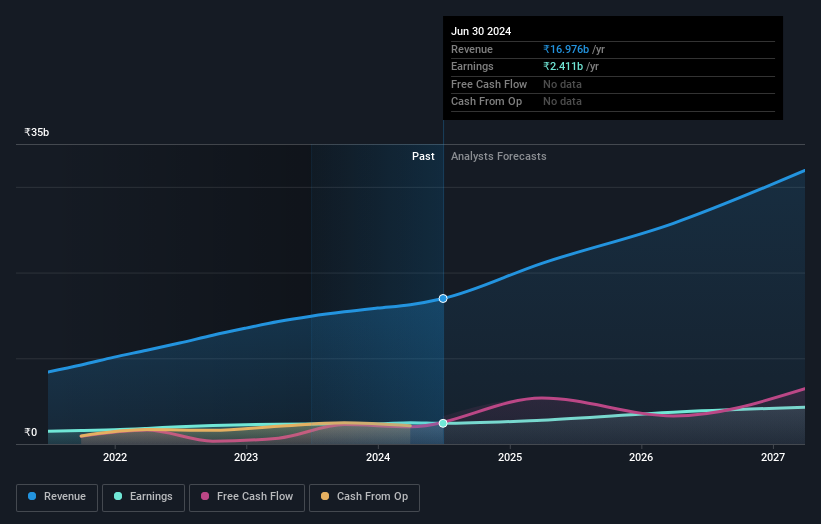

Happiest Minds Technologies has demonstrated robust financial performance with a significant 21% yearly revenue growth, outpacing the Indian market average of 10.6%. This growth is complemented by an impressive forecast of 24.8% annual earnings expansion over the next three years, highlighting its potential in a competitive tech landscape. Notably, the company's recent launch of Happiest Minds' Secureline360, an AI-driven security solution, underscores its commitment to innovation and sector leadership in cybersecurity solutions. This strategic focus not only enhances its service offerings but also positions it well for sustained growth amidst evolving digital threats.

- Get an in-depth perspective on Happiest Minds Technologies' performance by reading our health report here.

Learn about Happiest Minds Technologies' historical performance.

Shanghai Film (SHSE:601595)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Film Co., Ltd. operates in film distribution and screening in China with a market cap of CN¥12.37 billion.

Operations: The company focuses on film distribution and screening within China. Its operations are primarily centered around generating revenue from these activities.

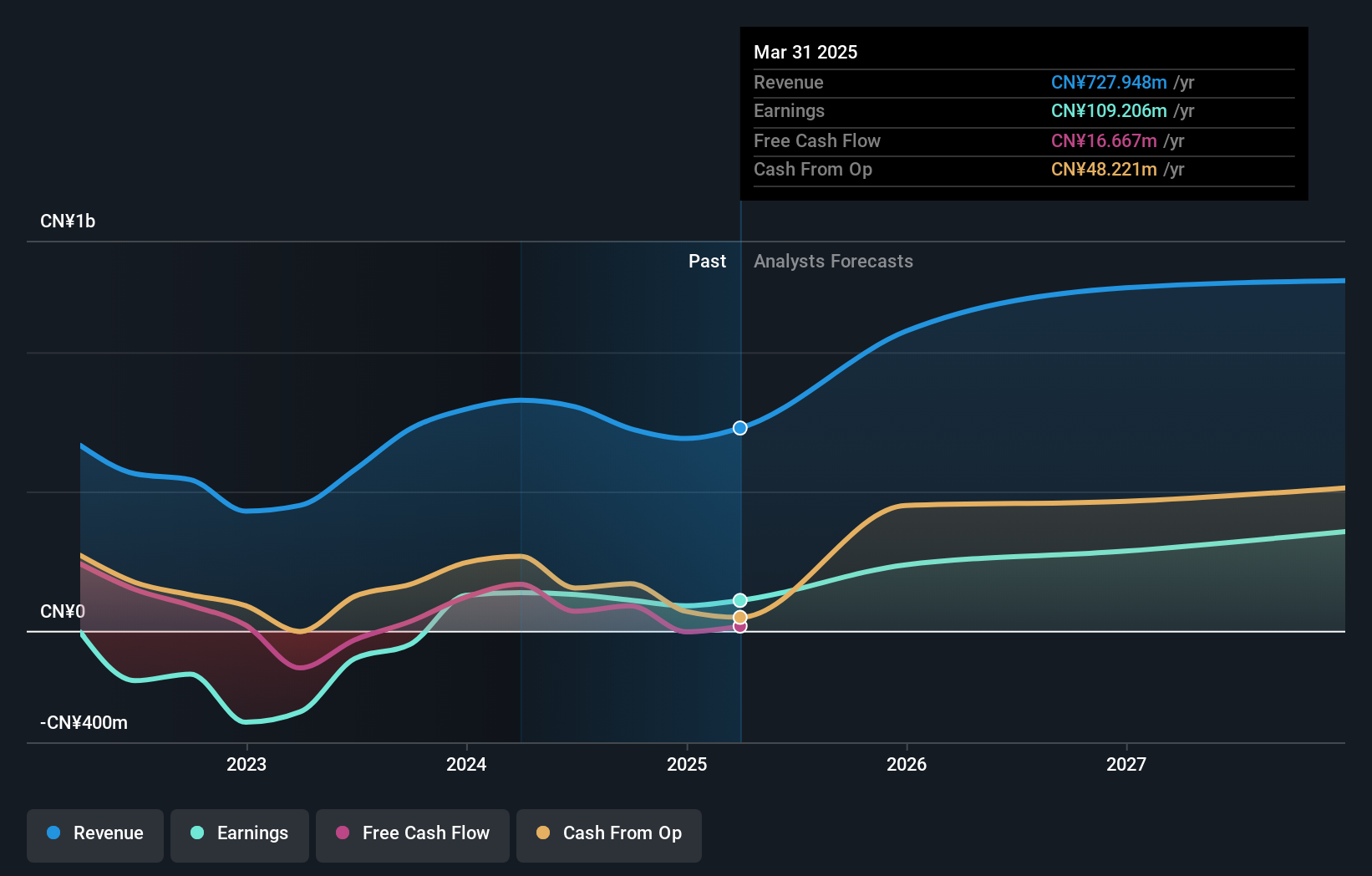

Shanghai Film has recently showcased a downturn in revenue and net income, with sales dropping from CNY 629.42 million to CNY 559.75 million year-over-year, and net income decreasing from CNY 124.52 million to CNY 107.41 million. Despite these challenges, the company is positioned for significant growth with expected annual earnings increases of 53.8%. This potential is underpinned by an aggressive R&D strategy that aligns well with industry demands for innovative media solutions, ensuring Shanghai Film remains competitive in a rapidly evolving entertainment landscape.

- Click to explore a detailed breakdown of our findings in Shanghai Film's health report.

Assess Shanghai Film's past performance with our detailed historical performance reports.

Wondershare Technology Group (SZSE:300624)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wondershare Technology Group Co., Ltd. develops application software products in China and internationally, with a market cap of CN¥11.45 billion.

Operations: Wondershare Technology Group Co., Ltd. specializes in developing application software products for both domestic and international markets. The company generates revenue through its diverse range of software solutions, catering to various consumer and professional needs.

Wondershare Technology Group has demonstrated a robust commitment to innovation, particularly in its AI-driven product offerings like SelfyzAI 3.0 and DemoCreator V8.0, which have significantly enhanced user experience and broadened market reach. Despite a challenging financial period with a reported net loss of CNY 5.5 million for the nine months ending September 2024, the company's aggressive R&D strategy—evidenced by an R&D expense ratio that surged to 16.2% of revenue—underscores its potential for recovery and growth. This focus on R&D is integral as it fuels Wondershare's earnings forecast to grow at an impressive rate of 74.5% annually, positioning it well within the competitive tech landscape where continuous innovation is key to retaining relevance and expanding consumer base.

- Delve into the full analysis health report here for a deeper understanding of Wondershare Technology Group.

Understand Wondershare Technology Group's track record by examining our Past report.

Summing It All Up

- Access the full spectrum of 1309 High Growth Tech and AI Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Happiest Minds Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:HAPPSTMNDS

Happiest Minds Technologies

Provides IT solutions and services in India, the United States, Canada, the United Kingdom, Australia, the Netherlands, Singapore, Malaysia, New Zealand, Mexico, Africa, and the Middle East.

Flawless balance sheet with high growth potential.