- China

- /

- Entertainment

- /

- SHSE:601595

Exploring Three High Growth Tech Stocks in China

Reviewed by Simply Wall St

Amidst a backdrop of economic growth that has surprised to the upside but still lags behind government targets, Chinese equities have experienced a rise as the central bank implements more support measures to counter deflationary pressures. In this dynamic environment, identifying high-growth tech stocks involves looking for companies that not only leverage technological advancements but also demonstrate resilience and adaptability in response to shifting economic conditions.

Top 10 High Growth Tech Companies In China

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Xi'an NovaStar Tech | 27.95% | 31.01% | ★★★★★★ |

| Zhejiang Meorient Commerce Exhibition | 26.41% | 32.59% | ★★★★★★ |

| Suzhou TFC Optical Communication | 32.62% | 32.32% | ★★★★★★ |

| Zhongji Innolight | 32.50% | 31.62% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 23.53% | 29.96% | ★★★★★★ |

| Shanghai BOCHU Electronic Technology | 27.82% | 28.62% | ★★★★★★ |

| Cubic Sensor and InstrumentLtd | 24.87% | 38.87% | ★★★★★★ |

| Eoptolink Technology | 43.31% | 44.06% | ★★★★★★ |

| Bio-Thera Solutions | 26.85% | 117.16% | ★★★★★★ |

| Huayi Brothers Media | 37.55% | 103.97% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Shanghai Film (SHSE:601595)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Film Co., Ltd. is involved in film distribution and screening activities in China, with a market cap of CN¥12.11 billion.

Operations: Shanghai Film Co., Ltd. generates revenue primarily through its film distribution and screening operations across China. The company focuses on leveraging its market presence to enhance its distribution network and cinema offerings, contributing to its financial performance within the entertainment industry.

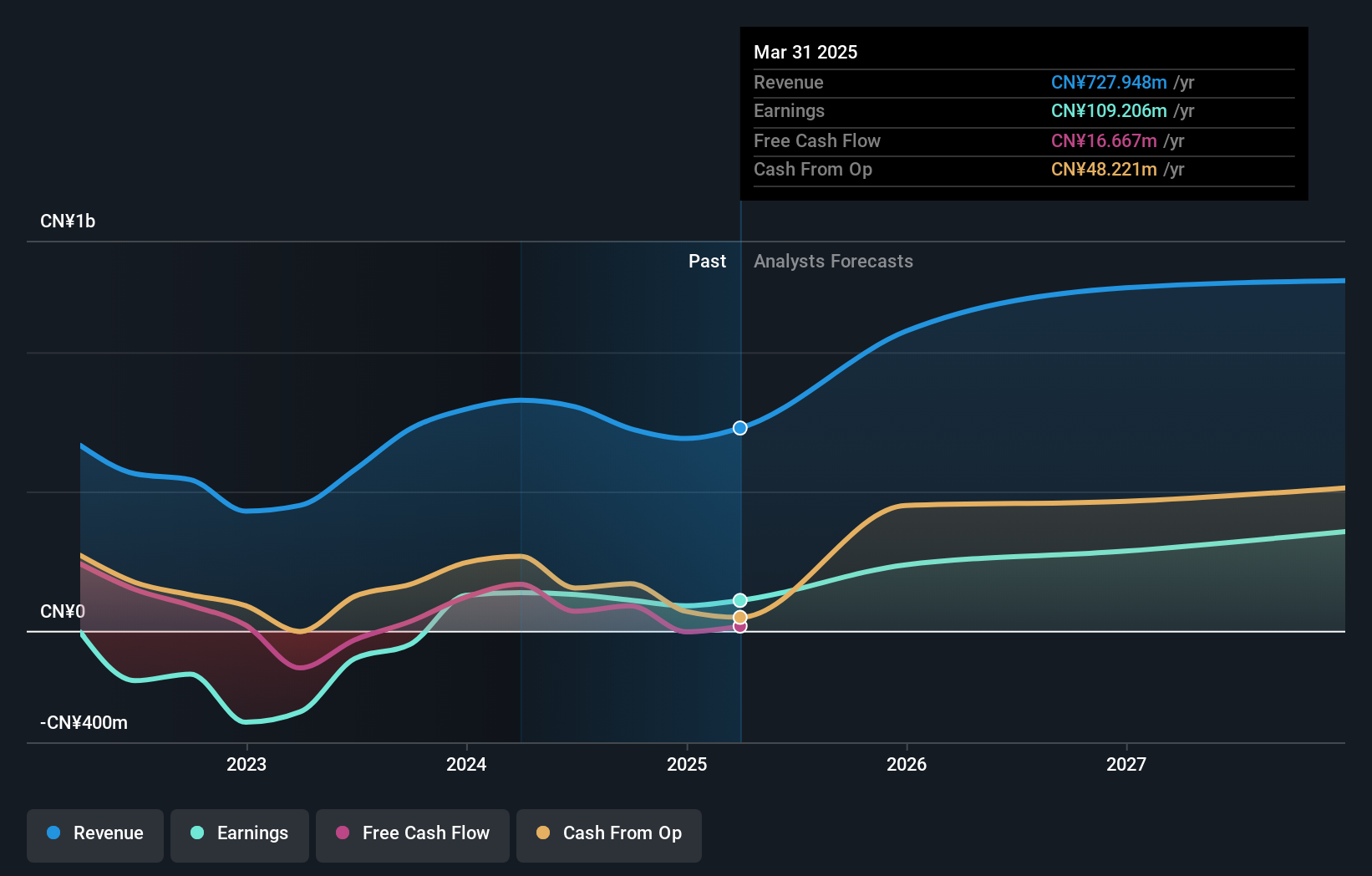

Shanghai Film has demonstrated a robust financial performance with a reported net income increase to CN¥69.08 million from CN¥65.84 million year-over-year, alongside revenue growth from CN¥371.96 million to CN¥380.86 million in the first half of 2024. This upward trajectory is underpinned by significant projected annual earnings growth of 42.6% and revenue growth forecasts at an impressive 27.9%, outpacing the broader Chinese market's average of 13.5%. Despite these strong indicators, it's crucial to note that Shanghai Film's return on equity is expected to remain modest at 15.5% over the next three years, suggesting potential challenges in sustaining higher profitability relative to its capital base.

- Click here to discover the nuances of Shanghai Film with our detailed analytical health report.

Explore historical data to track Shanghai Film's performance over time in our Past section.

China Transinfo Technology (SZSE:002373)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Transinfo Technology Co., Ltd. operates in the transportation and Internet of Things (IoT) sectors with a market capitalization of approximately CN¥16.18 billion.

Operations: The company generates revenue primarily from its Intelligent Internet of Things segment, which accounts for CN¥4.88 billion, and its Intelligent Transportation segment, contributing CN¥3.12 billion. The focus on these sectors highlights their strategic emphasis on leveraging technology in transportation and IoT solutions.

China Transinfo Technology has demonstrated resilience and adaptability in a competitive tech landscape, with its revenue climbing to CN¥3.57 billion, up from CN¥3.36 billion year-over-year as of mid-2024. This growth is underscored by an aggressive R&D commitment, crucial for maintaining technological edge and innovation in high-growth markets. Despite a significant dip in net income to CN¥12.24 million from CN¥285.09 million, the company's strategic share repurchases totaling 8,475,000 shares for CN¥79.77 million reflect confidence in its future trajectory and shareholder value enhancement strategies. The firm’s projected annual earnings growth stands at an impressive 45.7%, notably outpacing the broader Chinese market forecast of 23.8%, signaling robust potential despite current profitability challenges.

- Click to explore a detailed breakdown of our findings in China Transinfo Technology's health report.

Wondershare Technology Group (SZSE:300624)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wondershare Technology Group Co., Ltd. develops application software products both in China and internationally, with a market cap of CN¥12.97 billion.

Operations: Wondershare Technology Group Co., Ltd. specializes in developing application software products for both domestic and international markets. The company generates revenue primarily through its diverse software offerings, catering to various consumer and professional needs.

Wondershare Technology Group is capitalizing on the burgeoning AI-driven video editing market, evidenced by its recent launch of Filmora 14, which integrates advanced AI tools to enhance productivity and quality. This innovation aligns with industry trends where software firms are increasingly adopting SaaS models for steady revenue streams. The company's commitment to R&D is robust, with a significant 15.3% of its revenue reinvested in development, fostering a rapid annual revenue growth forecast at 31.8%. Additionally, Wondershare has demonstrated confidence in its trajectory through the repurchase of shares worth CNY 25 million between August and September 2024, underlining its strategic approach to shareholder value amidst dynamic market conditions.

- Navigate through the intricacies of Wondershare Technology Group with our comprehensive health report here.

Understand Wondershare Technology Group's track record by examining our Past report.

Turning Ideas Into Actions

- Discover the full array of 257 Chinese High Growth Tech and AI Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601595

Shanghai Film

Engages in film distribution and screening activities in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives