- China

- /

- Entertainment

- /

- SHSE:600576

Is Now The Time To Put Zhejiang Sunriver CultureLtd (SHSE:600576) On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Zhejiang Sunriver CultureLtd (SHSE:600576). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Zhejiang Sunriver CultureLtd

How Fast Is Zhejiang Sunriver CultureLtd Growing Its Earnings Per Share?

Zhejiang Sunriver CultureLtd has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Impressively, Zhejiang Sunriver CultureLtd's EPS catapulted from CN¥0.041 to CN¥0.11, over the last year. It's not often a company can achieve year-on-year growth of 160%.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The previous 12 months are something that Zhejiang Sunriver CultureLtd will want to put behind them after seeing a drop in EBIT margin and revenue for the period. Shareholders will be hoping for a change in fortunes if they're looking for profit growth.

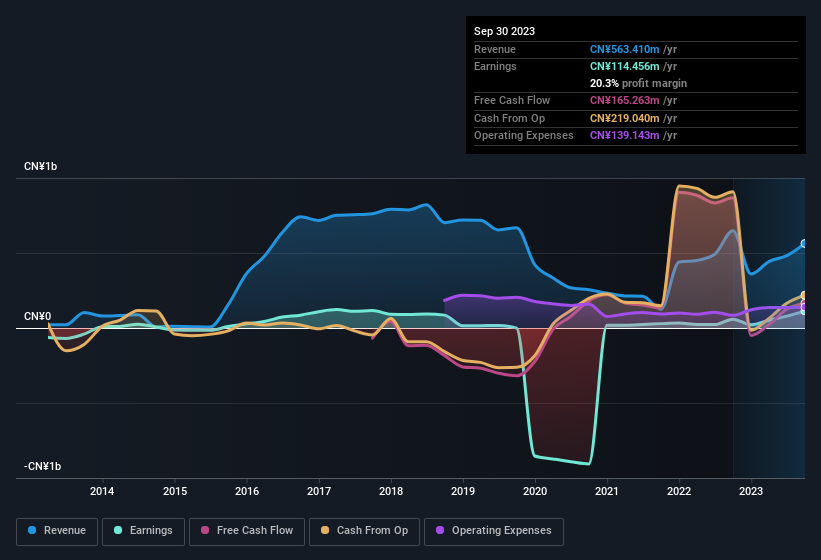

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Zhejiang Sunriver CultureLtd Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. So it is good to see that Zhejiang Sunriver CultureLtd insiders have a significant amount of capital invested in the stock. Indeed, they hold CN¥175m worth of its stock. That's a lot of money, and no small incentive to work hard. While their ownership only accounts for 2.5%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Our quick analysis into CEO remuneration would seem to indicate they are. Our analysis has discovered that the median total compensation for the CEOs of companies like Zhejiang Sunriver CultureLtd with market caps between CN¥2.9b and CN¥12b is about CN¥914k.

The Zhejiang Sunriver CultureLtd CEO received total compensation of only CN¥42k in the year to December 2022. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does Zhejiang Sunriver CultureLtd Deserve A Spot On Your Watchlist?

Zhejiang Sunriver CultureLtd's earnings per share have been soaring, with growth rates sky high. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The drastic earnings growth indicates the business is going from strength to strength. Hopefully a trend that continues well into the future. Zhejiang Sunriver CultureLtd certainly ticks a few boxes, so we think it's probably well worth further consideration. It is worth noting though that we have found 1 warning sign for Zhejiang Sunriver CultureLtd that you need to take into consideration.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Chinese companies which have demonstrated growth backed by recent insider purchases.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Sunriver Culture TourismLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600576

Zhejiang Sunriver Culture TourismLtd

Zhejiang Sunriver Culture Tourism Co.,Ltd.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives