- China

- /

- Entertainment

- /

- SHSE:600576

Zhejiang Sunriver Culture Tourism Co.,Ltd.'s (SHSE:600576) P/E Is Still On The Mark Following 27% Share Price Bounce

Zhejiang Sunriver Culture Tourism Co.,Ltd. (SHSE:600576) shareholders have had their patience rewarded with a 27% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 20% over that time.

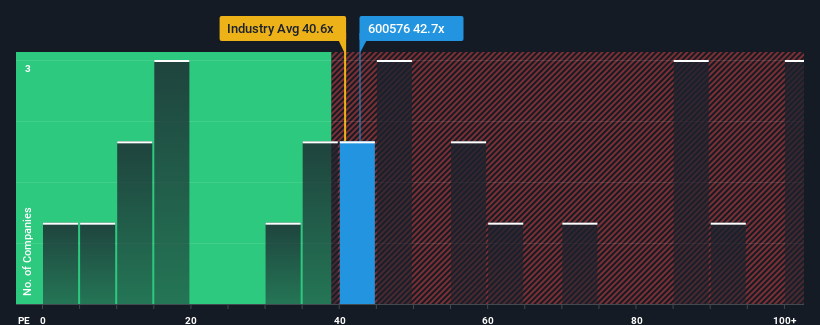

Following the firm bounce in price, Zhejiang Sunriver Culture TourismLtd's price-to-earnings (or "P/E") ratio of 42.7x might make it look like a sell right now compared to the market in China, where around half of the companies have P/E ratios below 29x and even P/E's below 18x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Zhejiang Sunriver Culture TourismLtd has been doing quite well of late. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Zhejiang Sunriver Culture TourismLtd

Does Growth Match The High P/E?

In order to justify its P/E ratio, Zhejiang Sunriver Culture TourismLtd would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered an exceptional 69% gain to the company's bottom line. The latest three year period has also seen an excellent 286% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 26% each year during the coming three years according to the one analyst following the company. That's shaping up to be materially higher than the 19% per annum growth forecast for the broader market.

With this information, we can see why Zhejiang Sunriver Culture TourismLtd is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Zhejiang Sunriver Culture TourismLtd shares have received a push in the right direction, but its P/E is elevated too. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Zhejiang Sunriver Culture TourismLtd's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You always need to take note of risks, for example - Zhejiang Sunriver Culture TourismLtd has 1 warning sign we think you should be aware of.

You might be able to find a better investment than Zhejiang Sunriver Culture TourismLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Sunriver Culture TourismLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600576

Zhejiang Sunriver Culture TourismLtd

Zhejiang Sunriver Culture Tourism Co.,Ltd.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives