- South Korea

- /

- Entertainment

- /

- KOSDAQ:A122870

Exploring None's High Growth Tech Stocks with Promising Potential

Reviewed by Simply Wall St

As global markets continue to navigate through a landscape marked by rising inflation and cautious monetary policies, U.S. stock indexes are climbing toward record highs, with growth stocks outperforming value shares despite small-cap stocks lagging behind major indices. In this environment, identifying high-growth tech stocks with promising potential involves considering factors such as innovation capability, market adaptability, and financial resilience to withstand economic fluctuations and capitalize on emerging opportunities.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 27.11% | 39.37% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| Xspray Pharma | 127.78% | 104.91% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| AVITA Medical | 29.48% | 53.73% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.83% | 59.08% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1208 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

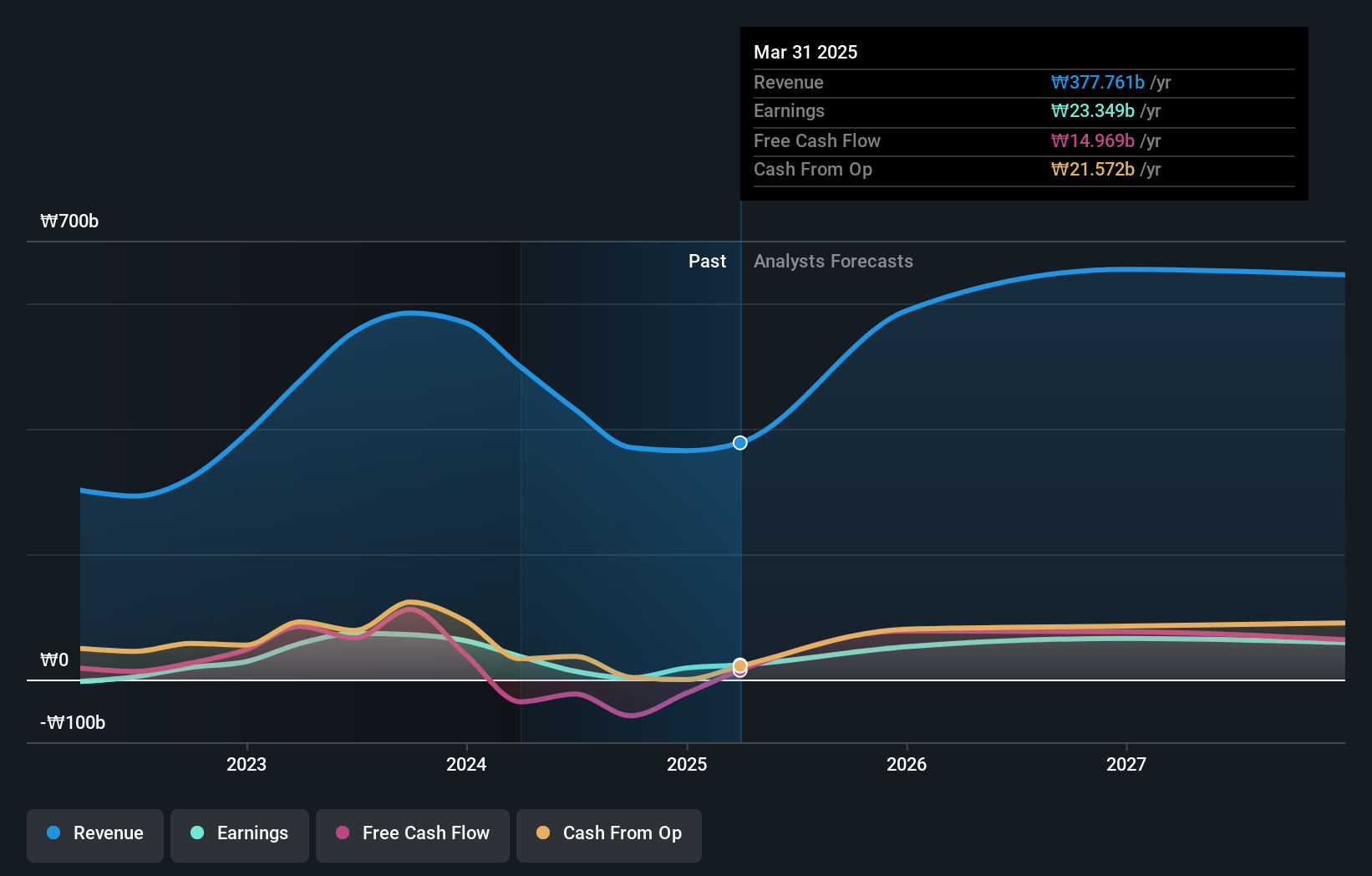

YG Entertainment (KOSDAQ:A122870)

Simply Wall St Growth Rating: ★★★★★☆

Overview: YG Entertainment Inc. is an entertainment company that operates in South Korea, Japan, and internationally with a market capitalization of approximately ₩986.69 billion.

Operations: YG Entertainment generates revenue primarily from its entertainment-related activities, amounting to approximately ₩415.71 billion.

YG Entertainment, despite a challenging past with a 96.5% earnings drop last year, is poised for substantial growth with projected earnings increases of 97.2% annually over the next three years, outpacing the Korean market's 26%. This rebound is supported by an impressive forecasted revenue growth rate of 25.6% per year, significantly higher than the market average of 9%. However, it's crucial to note that past financials were affected by a large one-off gain of ₩9.3 billion, which may skew perceptions of underlying performance. Looking ahead, while YG Entertainment's Return on Equity might seem modest at 10.7%, the firm's aggressive growth metrics in both top-line revenue and bottom-line earnings suggest potential shifts in its industry standing and financial health.

- Get an in-depth perspective on YG Entertainment's performance by reading our health report here.

Evaluate YG Entertainment's historical performance by accessing our past performance report.

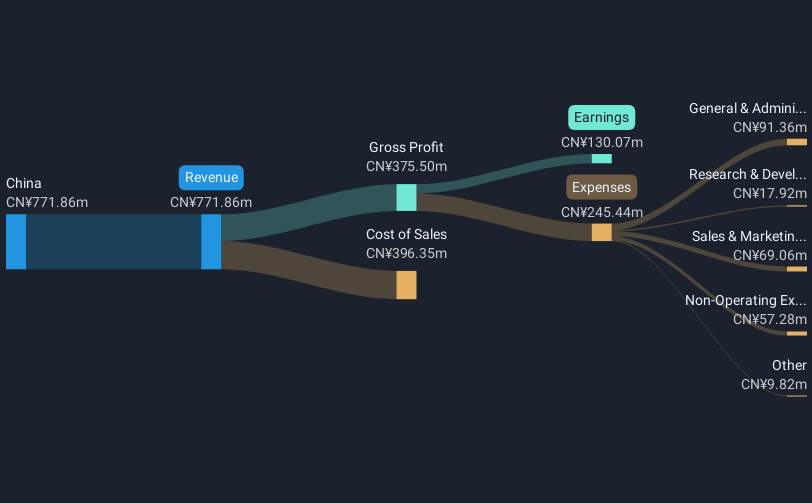

Zhejiang Sunriver Culture TourismLtd (SHSE:600576)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Sunriver Culture Tourism Co., Ltd. operates in the cultural tourism industry with a market capitalization of CN¥8.48 billion.

Operations: Zhejiang Sunriver Culture Tourism Co., Ltd. generates revenue primarily from its cultural tourism operations, leveraging attractions and related services to drive income. The company's market presence is reflected in its significant capitalization of CN¥8.48 billion, indicating its established position within the industry.

Zhejiang Sunriver Culture Tourism Ltd. has demonstrated robust growth, with earnings increasing by 15.9% over the past year and projected to surge by 47.95% annually for the next three years, significantly outpacing the Chinese market's average of 25%. This growth is supported by a revenue increase forecast at an impressive rate of 32.5% per year, well above the industry standard of 13.3%. Despite challenges in maintaining positive free cash flow, the company's strong performance in both revenue and earnings growth positions it as a dynamic player in the entertainment sector. The recent extraordinary shareholders meeting could signal strategic shifts that further influence its market trajectory and operational focus.

- Unlock comprehensive insights into our analysis of Zhejiang Sunriver Culture TourismLtd stock in this health report.

Learn about Zhejiang Sunriver Culture TourismLtd's historical performance.

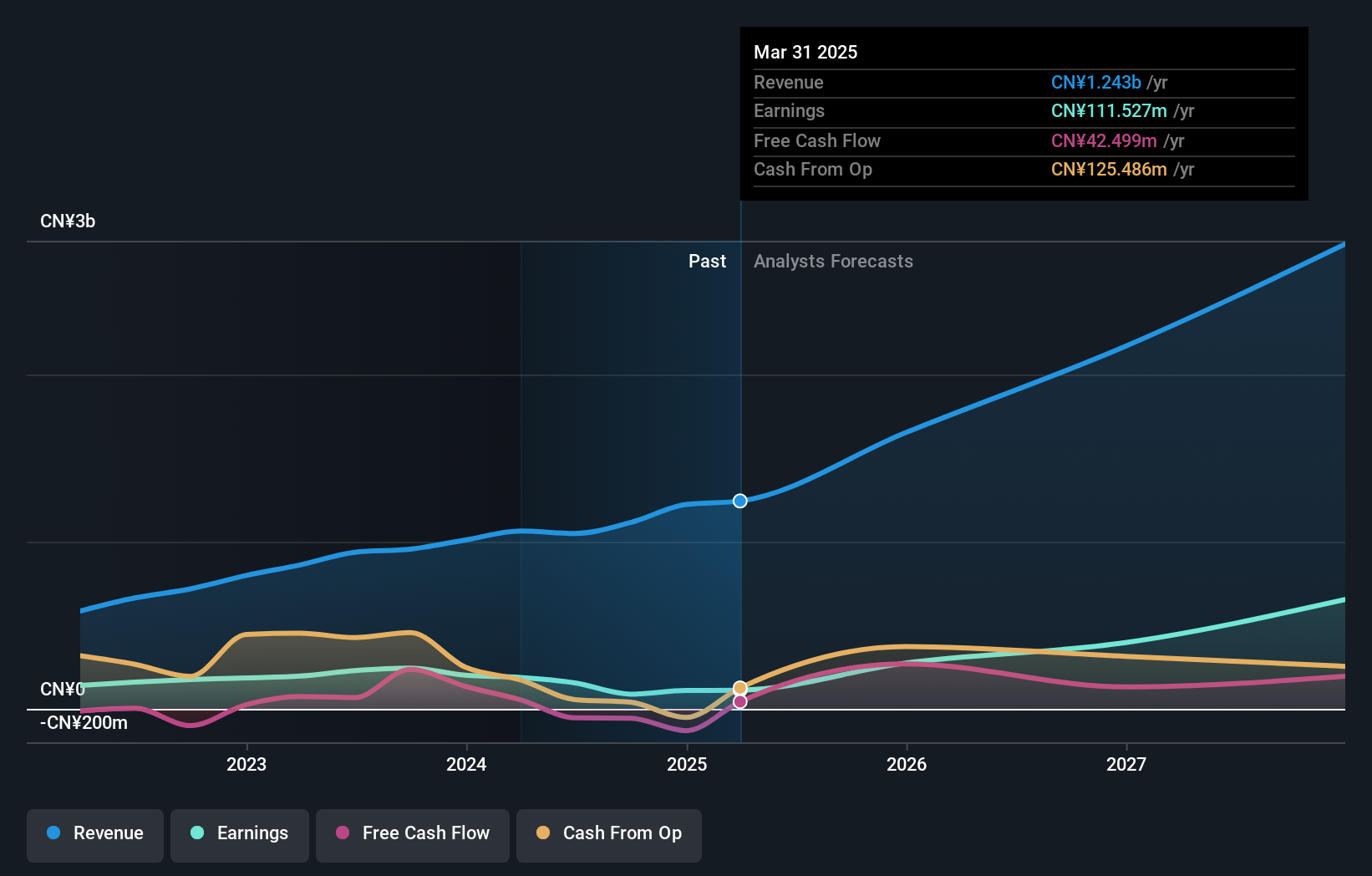

Empyrean Technology (SZSE:301269)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Empyrean Technology Co., Ltd. specializes in the development, sale, and servicing of electronic design automation (EDA) software with a market capitalization of CN¥62.93 billion.

Operations: Empyrean Technology focuses on electronic design automation (EDA) software, offering comprehensive development, sales, and service solutions. The company operates with a market capitalization of CN¥62.93 billion.

Empyrean Technology's recent extraordinary shareholders meeting hints at potential strategic shifts, crucial as the company navigates a challenging landscape with a 64% decline in earnings last year. Despite this, revenue growth remains strong at 27.1% annually, outpacing the Chinese market average of 13.3%. This growth is underpinned by significant R&D investment, aligning with industry trends towards innovative software solutions. Looking ahead, Empyrean is poised for substantial earnings recovery with forecasts suggesting a 50.8% annual increase over the next three years, reflecting both its resilience and potential to capitalize on evolving market demands.

Taking Advantage

- Embark on your investment journey to our 1208 High Growth Tech and AI Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A122870

YG Entertainment

Operates as an entertainment company in South Korea, Japan, and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives