Investors Still Aren't Entirely Convinced By Inmyshow Digital Technology(Group)Co.,Ltd.'s (SHSE:600556) Revenues Despite 25% Price Jump

Despite an already strong run, Inmyshow Digital Technology(Group)Co.,Ltd. (SHSE:600556) shares have been powering on, with a gain of 25% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 14% over that time.

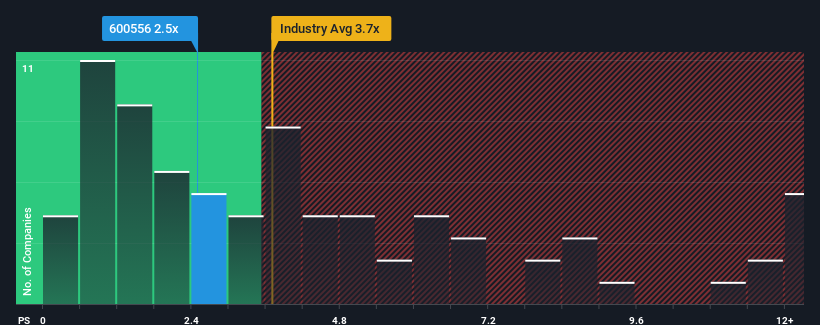

Even after such a large jump in price, Inmyshow Digital Technology(Group)Co.Ltd may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 2.5x, considering almost half of all companies in the Media industry in China have P/S ratios greater than 3.7x and even P/S higher than 7x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Inmyshow Digital Technology(Group)Co.Ltd

How Inmyshow Digital Technology(Group)Co.Ltd Has Been Performing

Inmyshow Digital Technology(Group)Co.Ltd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Inmyshow Digital Technology(Group)Co.Ltd.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Inmyshow Digital Technology(Group)Co.Ltd's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.7%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should generate growth of 17% as estimated by the two analysts watching the company. With the industry only predicted to deliver 14%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Inmyshow Digital Technology(Group)Co.Ltd's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Inmyshow Digital Technology(Group)Co.Ltd's stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A look at Inmyshow Digital Technology(Group)Co.Ltd's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Having said that, be aware Inmyshow Digital Technology(Group)Co.Ltd is showing 1 warning sign in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600556

Inmyshow Digital Technology(Group)Co.Ltd

Inmyshow Digital Technology(Group)Co.,Ltd.

Excellent balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success