Chinese Universe Publishing and Media Group Among Three Key Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate through varying economic signals, China's equity landscape reflects cautious investor sentiment amid deflationary pressures and a sluggish property sector. In this context, dividend stocks like Chinese Universe Publishing and Media Group become particularly noteworthy for their potential to offer investors steady income streams in uncertain times.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Shandong Wit Dyne HealthLtd (SZSE:000915) | 6.17% | ★★★★★★ |

| Midea Group (SZSE:000333) | 4.63% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.49% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 3.46% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 7.13% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.55% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 5.59% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.08% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.43% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.52% | ★★★★★★ |

Click here to see the full list of 216 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

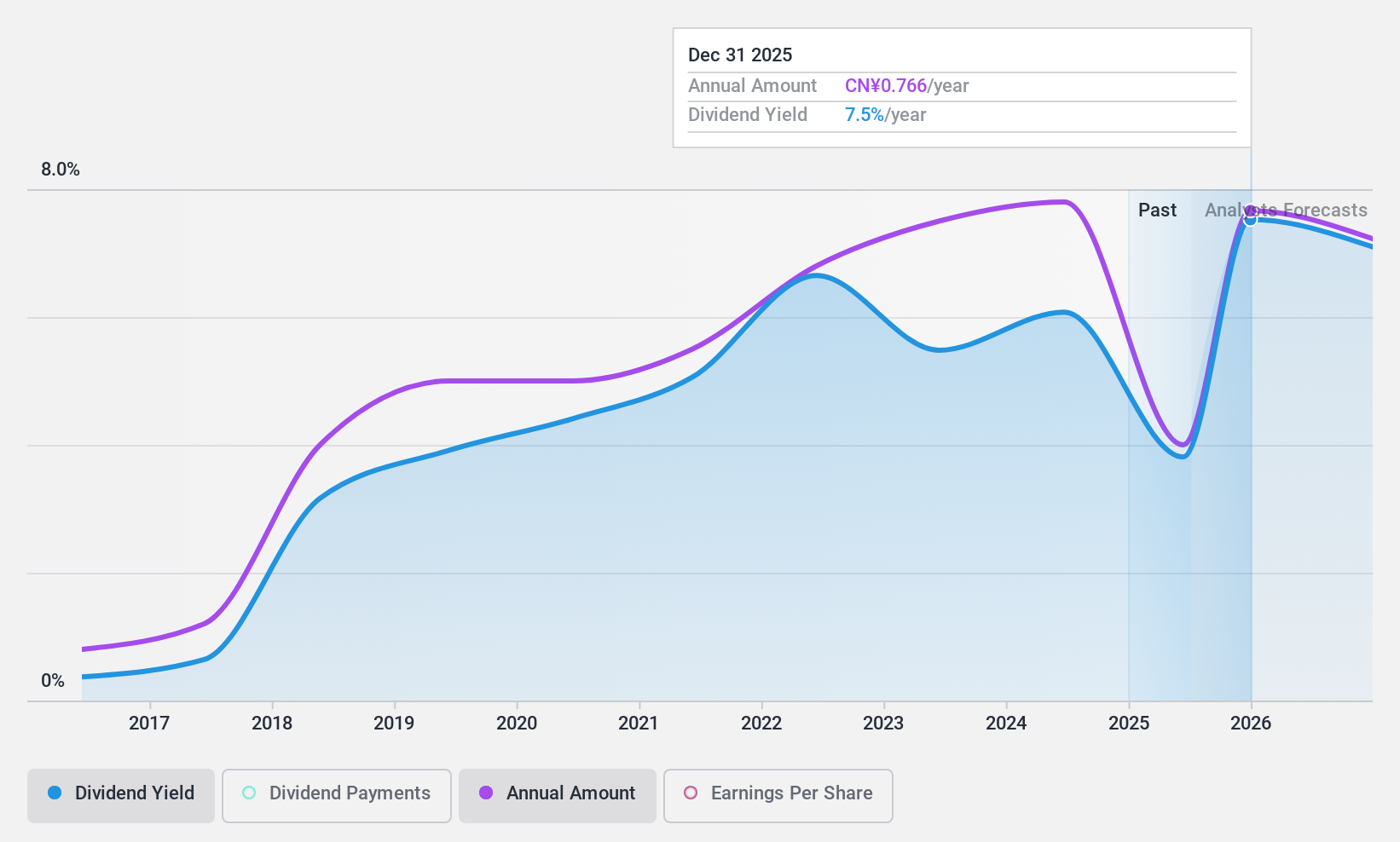

Chinese Universe Publishing and Media Group (SHSE:600373)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chinese Universe Publishing and Media Group Co., Ltd. is a company engaged in publishing and distributing books and media materials, with a market capitalization of approximately CN¥21.48 billion.

Operations: Unfortunately, the provided text does not include specific details about the revenue segments of Chinese Universe Publishing and Media Group Co., Ltd., so I am unable to summarize this information.

Dividend Yield: 4.7%

Chinese Universe Publishing and Media Group has experienced volatility in its dividend payments over the past decade, with a significant annual drop exceeding 20%. Despite this, the company's dividends are well-covered by both earnings and cash flows, with a payout ratio of 51.7% and a cash payout ratio of 58.6%. The firm's dividend yield stands at 4.74%, placing it in the top quartile of Chinese dividend payers. Recent financials show a downturn in quarterly revenue and net income as of March 2024, alongside an ongoing share repurchase program aimed at reducing capital through share cancellations funded by internal resources.

- Navigate through the intricacies of Chinese Universe Publishing and Media Group with our comprehensive dividend report here.

- The analysis detailed in our Chinese Universe Publishing and Media Group valuation report hints at an deflated share price compared to its estimated value.

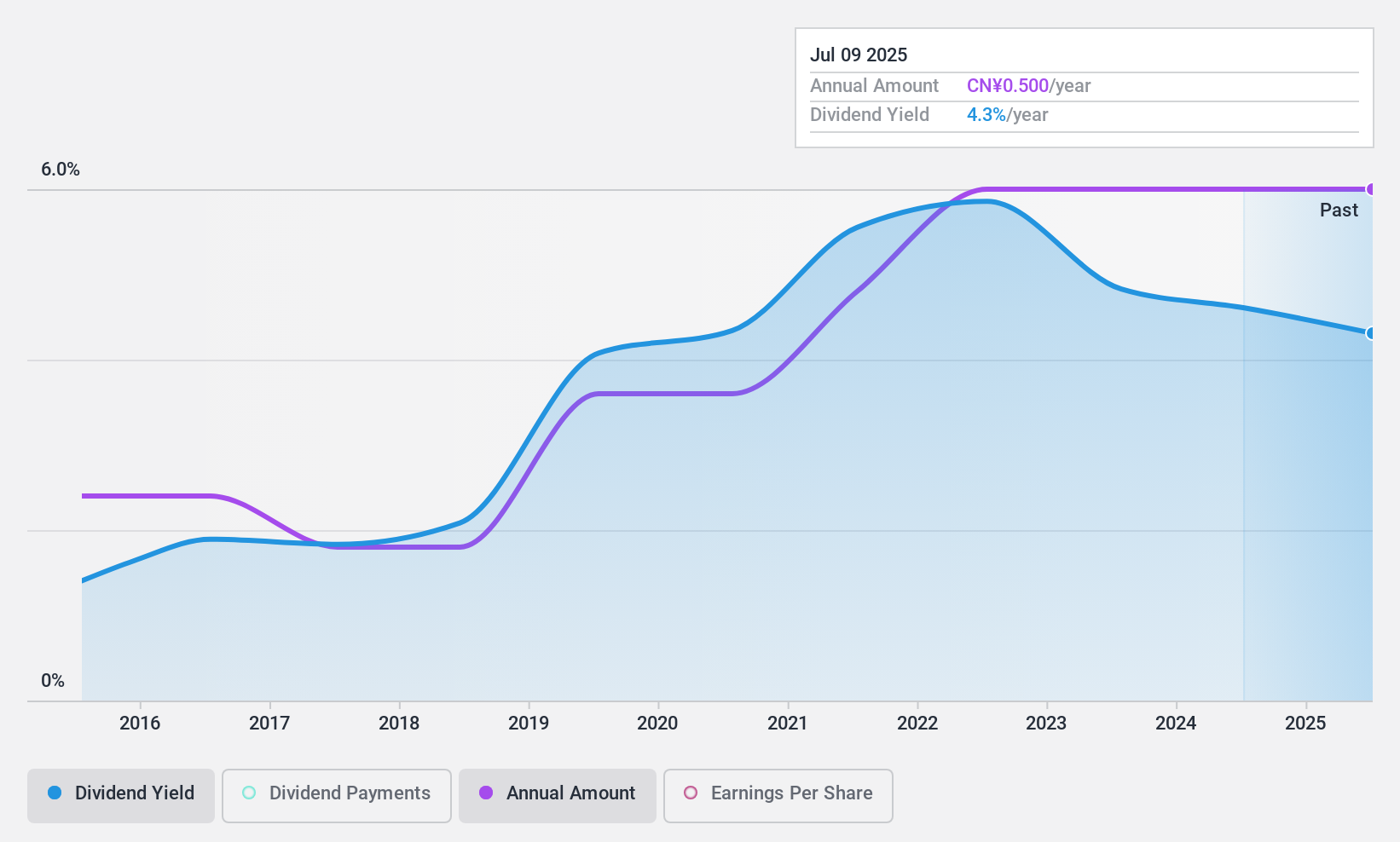

Jiangsu Phoenix Publishing & Media (SHSE:601928)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jiangsu Phoenix Publishing & Media Corporation Limited, based in China, operates in the editing, publishing, and distribution of books, newspapers, electronic publications, and audio-visual products with a market capitalization of CN¥28.50 billion.

Operations: Jiangsu Phoenix Publishing & Media Corporation Limited generates its revenue primarily from the production and sale of books, newspapers, electronic publications, and audio-visual products.

Dividend Yield: 4.5%

Jiangsu Phoenix Publishing & Media has shown a mixed track record in its dividend performance, with an unstable history marked by significant fluctuations exceeding 20% annually. Despite these challenges, the dividends appear reasonably secure, backed by a payout ratio of 45% and a cash payout ratio of 70.5%. The company's recent financials indicate a decline in net income to CNY 356.11 million from CNY 482.96 million year-over-year as of Q1 2024, reflecting potential pressures on future dividend sustainability amidst forecasted earnings declines averaging 10.9% annually over the next three years.

- Click to explore a detailed breakdown of our findings in Jiangsu Phoenix Publishing & Media's dividend report.

- Our valuation report here indicates Jiangsu Phoenix Publishing & Media may be undervalued.

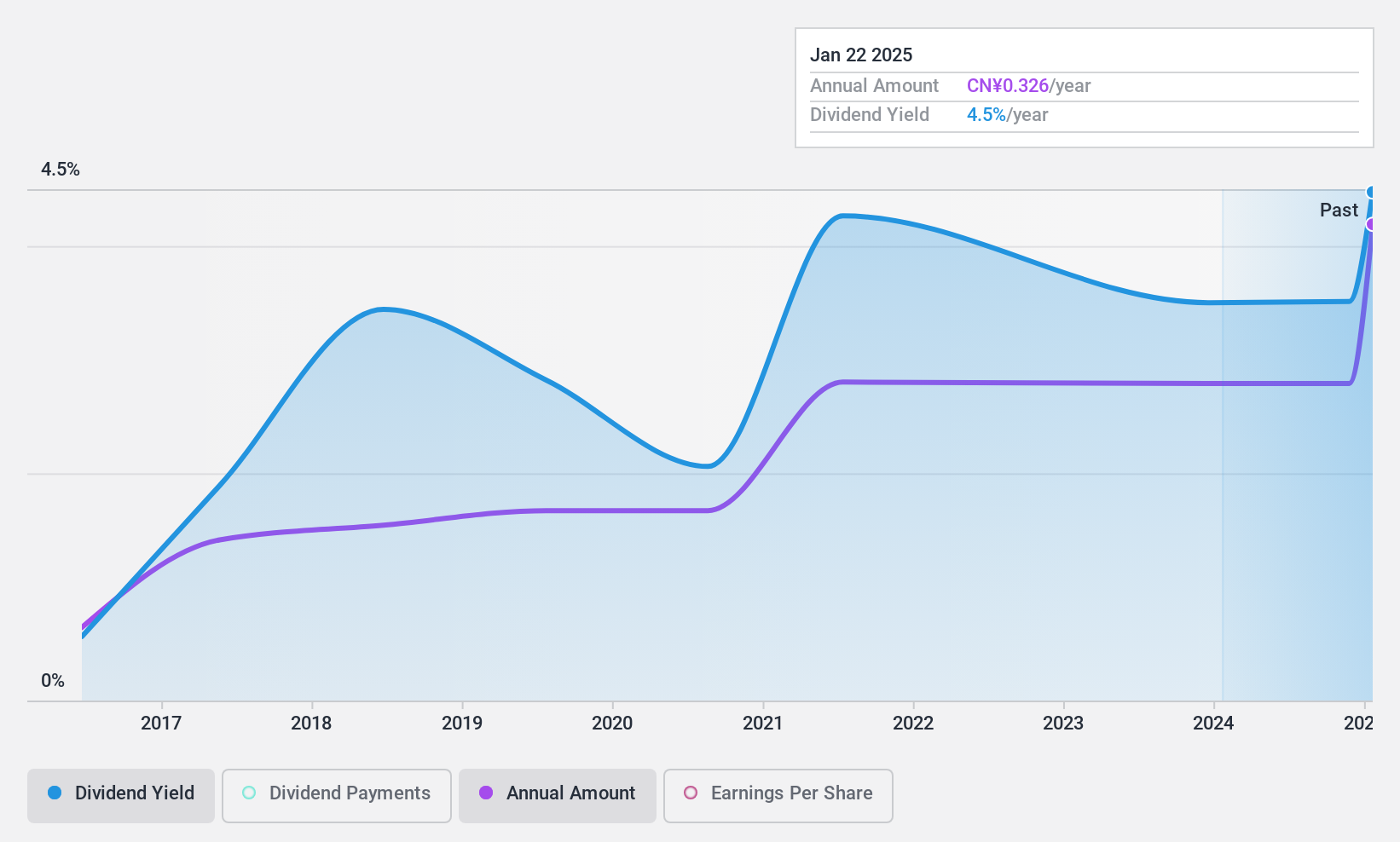

Jiangnan Mould & Plastic Technology (SZSE:000700)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jiangnan Mould & Plastic Technology Co., Ltd. specializes in the manufacturing of plastic parts for the automotive industry, with a market capitalization of approximately CN¥5.14 billion.

Operations: Jiangnan Mould & Plastic Technology Co., Ltd. primarily generates its revenue from the manufacturing of plastic parts for the automotive industry.

Dividend Yield: 3.9%

Jiangnan Mould & Plastic Technology has demonstrated a robust increase in its quarterly and annual earnings, with notable growth in net income and revenue. The company's dividend yield of 3.88% ranks well above the market average, supported by a sustainable payout ratio of 37.8% and a cash payout ratio of 22.6%. However, despite these positive indicators, the dividend track record over the past decade has been marked by volatility, suggesting potential uncertainty for long-term stability in dividend payments.

- Click here and access our complete dividend analysis report to understand the dynamics of Jiangnan Mould & Plastic Technology.

- Our comprehensive valuation report raises the possibility that Jiangnan Mould & Plastic Technology is priced lower than what may be justified by its financials.

Where To Now?

- Discover the full array of 216 Top Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601928

Jiangsu Phoenix Publishing & Media

Engages in the editing, publishing, and distribution of books, newspapers, electronic publications, and audio-visual products in China.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives