- China

- /

- Auto Components

- /

- SZSE:002715

Undiscovered Gems Three Promising Stocks for November 2024

Reviewed by Simply Wall St

In the wake of a "red sweep" in the U.S. elections, global markets have experienced significant shifts, with small-cap stocks like those in the Russell 2000 Index showing notable gains but still trailing their historical highs. As investors navigate these dynamic conditions marked by potential regulatory changes and economic policies, identifying promising stocks that can thrive amidst such fluctuations becomes crucial.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Bank Ganesha | NA | 25.03% | 70.72% | ★★★★★★ |

| Suraj | 37.84% | 15.84% | 63.29% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Network People Services Technologies | 0.11% | 84.31% | 84.48% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| S J Logistics (India) | 34.96% | 59.89% | 51.25% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Fanli Digital TechnologyLtd (SHSE:600228)

Simply Wall St Value Rating: ★★★★★★

Overview: Fanli Digital Technology Co., Ltd operates Fanli.com, an e-commerce shopping guide platform in China, with a market cap of CN¥2.68 billion.

Operations: Fanli Digital Technology generates revenue primarily through its e-commerce shopping guide platform, Fanli.com. The company focuses on leveraging its digital platform to drive sales and commissions. It has a market cap of approximately CN¥2.68 billion, reflecting its position in the Chinese e-commerce sector.

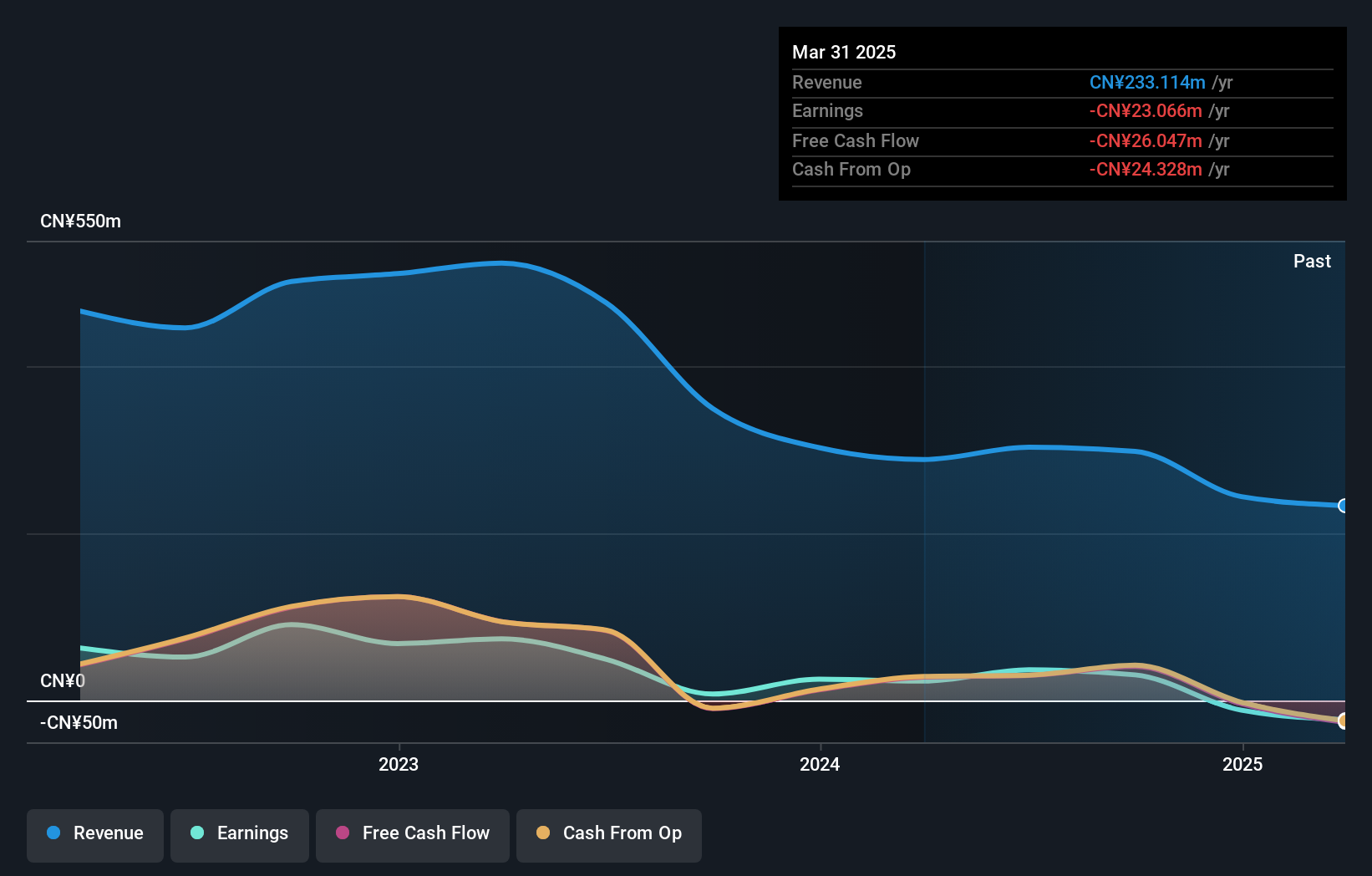

Fanli Digital Technology, a smaller player in the tech space, has shown impressive earnings growth of 356% over the past year, outpacing its industry peers. Despite this recent surge, its earnings have seen a 41.9% per year reduction over the past five years. The company reported sales of CNY 192.75 million for nine months ending September 2024, with a reduced net loss of CNY 3.28 million compared to CNY 12.72 million last year. Fanli's debt-to-equity ratio improved significantly from 4.8 to just 0.7 over five years, suggesting prudent financial management and better positioning for future growth opportunities.

Huaiji Dengyun Auto-parts (Holding)Ltd (SZSE:002715)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Huaiji Dengyun Auto-parts (Holding) Co., Ltd. is engaged in the manufacturing and sale of automotive parts, with a market capitalization of CN¥2.49 billion.

Operations: Huaiji Dengyun Auto-parts generates revenue primarily from the sale of automotive parts. The company's financial performance includes a notable trend in its gross profit margin, which has shown variation over recent periods.

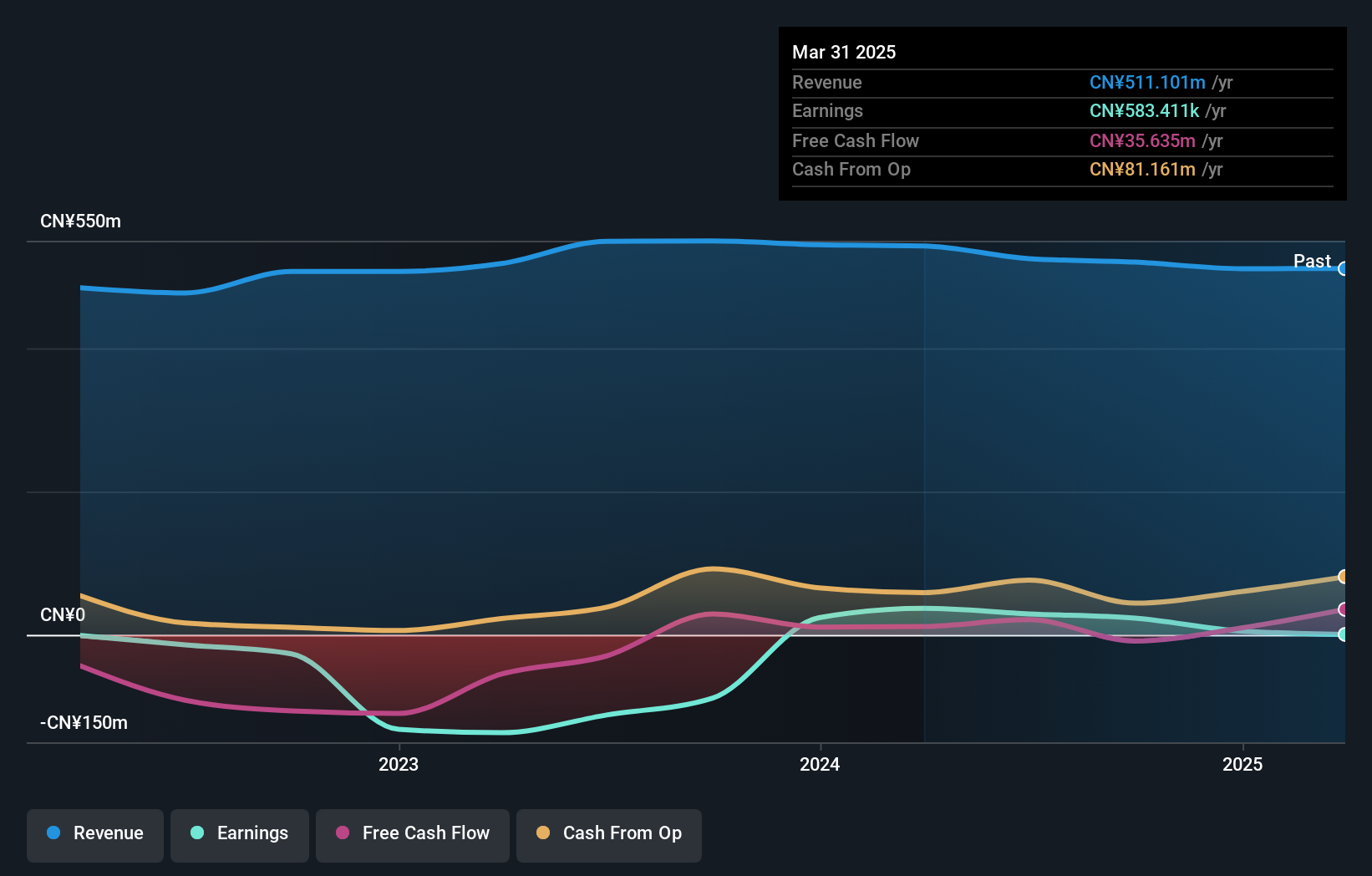

Huaiji Dengyun Auto-parts, a smaller player in the auto components sector, has shown resilience despite challenges. Over the past five years, its debt to equity ratio increased from 33.9% to 49.6%, yet it maintains a satisfactory net debt to equity ratio of 37.6%. The company turned profitable this year but struggles with interest coverage, with EBIT covering only 2.7 times its interest payments. Recent earnings reported sales of CNY 376.6 million for the nine months ending September 2024, slightly down from CNY 400.77 million last year, while net income was CNY 11.25 million compared to CNY 11.76 million previously.

- Click here and access our complete health analysis report to understand the dynamics of Huaiji Dengyun Auto-parts (Holding)Ltd.

Understand Huaiji Dengyun Auto-parts (Holding)Ltd's track record by examining our Past report.

Maruha Nichiro (TSE:1333)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Maruha Nichiro Corporation operates in the fishing, fish farming, food processing, trading, meat products, and distribution sectors both in Japan and internationally with a market cap of ¥149.56 billion.

Operations: Maruha Nichiro generates revenue primarily from its diverse operations in fishing, fish farming, food processing, trading, and meat products. The company has a market cap of ¥149.56 billion.

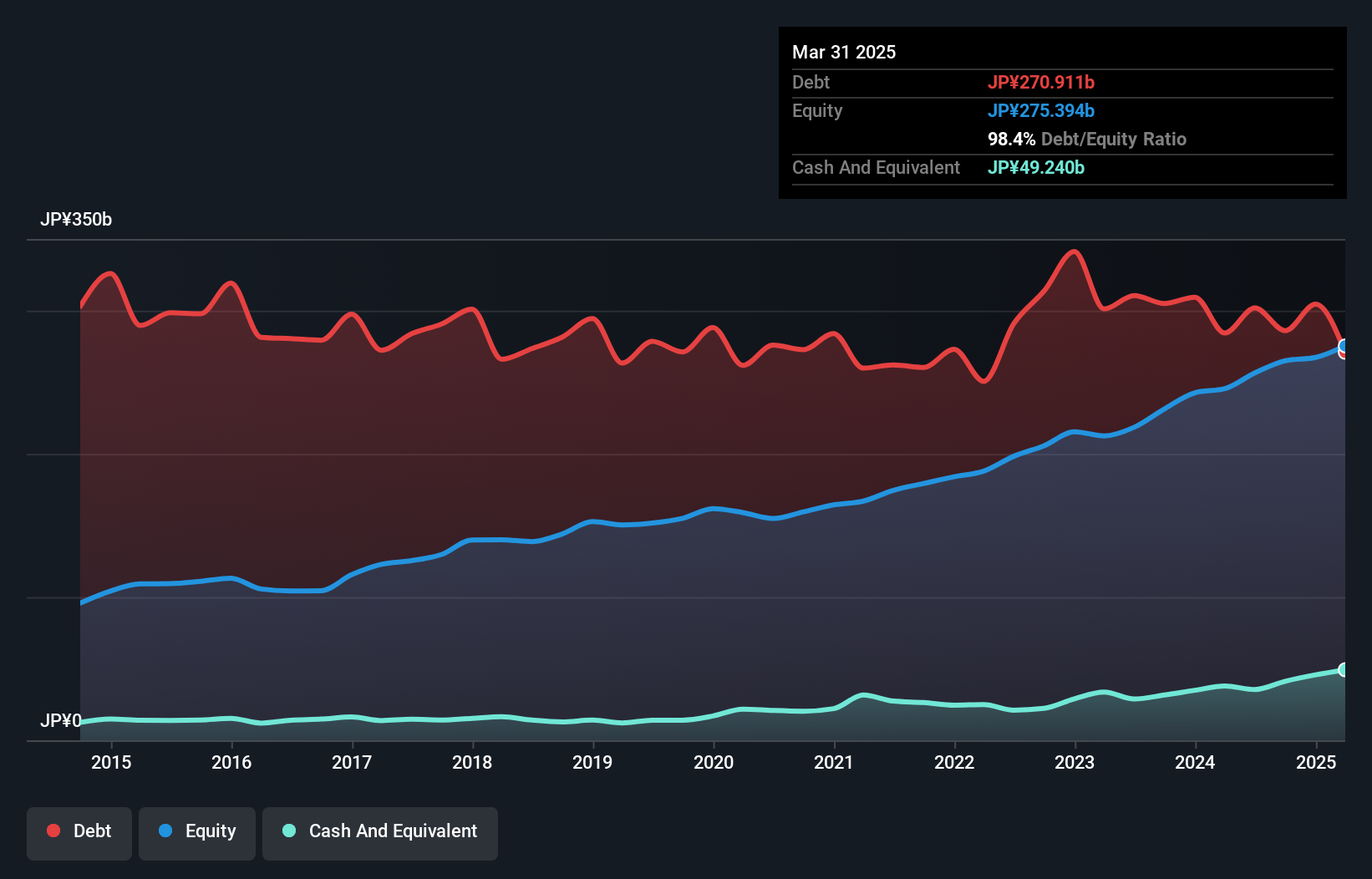

Maruha Nichiro, a notable player in the food sector, has shown promising financial metrics. Its earnings have grown at an impressive 16.8% annually over the past five years, highlighting robust performance despite not outpacing industry growth of 24.2%. The company's interest payments are well covered by EBIT at 11.7 times coverage, indicating sound financial management. Although its net debt to equity ratio remains high at 103.9%, it has improved from a much higher level of 183.7% five years ago, suggesting effective debt reduction efforts. Additionally, Maruha is trading significantly below estimated fair value by about 78%, presenting potential investment appeal for those seeking undervalued opportunities in this space.

- Click to explore a detailed breakdown of our findings in Maruha Nichiro's health report.

Review our historical performance report to gain insights into Maruha Nichiro's's past performance.

Key Takeaways

- Discover the full array of 4667 Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huaiji Dengyun Auto-parts (Holding)Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002715

Huaiji Dengyun Auto-parts (Holding)Ltd

Huaiji Dengyun Auto-parts (Holding) Co.,Ltd.

Slight with mediocre balance sheet.

Market Insights

Community Narratives