Unpleasant Surprises Could Be In Store For Beijing Gehua Catv Network Co.,Ltd.'s (SHSE:600037) Shares

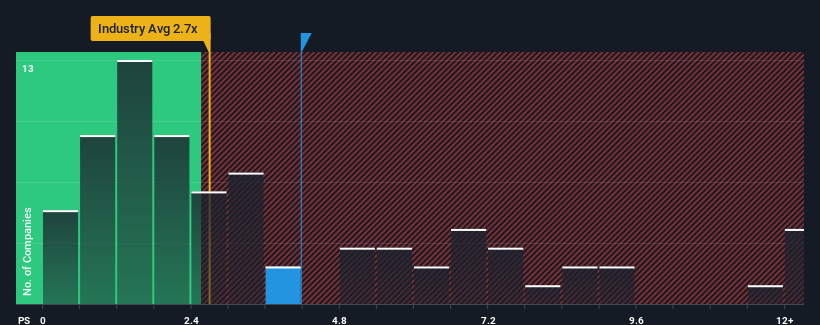

When close to half the companies in the Media industry in China have price-to-sales ratios (or "P/S") below 2.7x, you may consider Beijing Gehua Catv Network Co.,Ltd. (SHSE:600037) as a stock to potentially avoid with its 4.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Beijing Gehua Catv NetworkLtd

How Beijing Gehua Catv NetworkLtd Has Been Performing

Beijing Gehua Catv NetworkLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Beijing Gehua Catv NetworkLtd's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Beijing Gehua Catv NetworkLtd would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.9%. The last three years don't look nice either as the company has shrunk revenue by 9.5% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 4.3% as estimated by the one analyst watching the company. That's shaping up to be materially lower than the 21% growth forecast for the broader industry.

With this information, we find it concerning that Beijing Gehua Catv NetworkLtd is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Beijing Gehua Catv NetworkLtd's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Beijing Gehua Catv NetworkLtd, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Having said that, be aware Beijing Gehua Catv NetworkLtd is showing 1 warning sign in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Gehua Catv NetworkLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600037

Beijing Gehua Catv NetworkLtd

Engages in the construction, management, operation, and maintenance of cable radio and television networks in China.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives