Beijing Gehua Catv NetworkLtd (SHSE:600037) Has Announced That Its Dividend Will Be Reduced To CN¥0.027

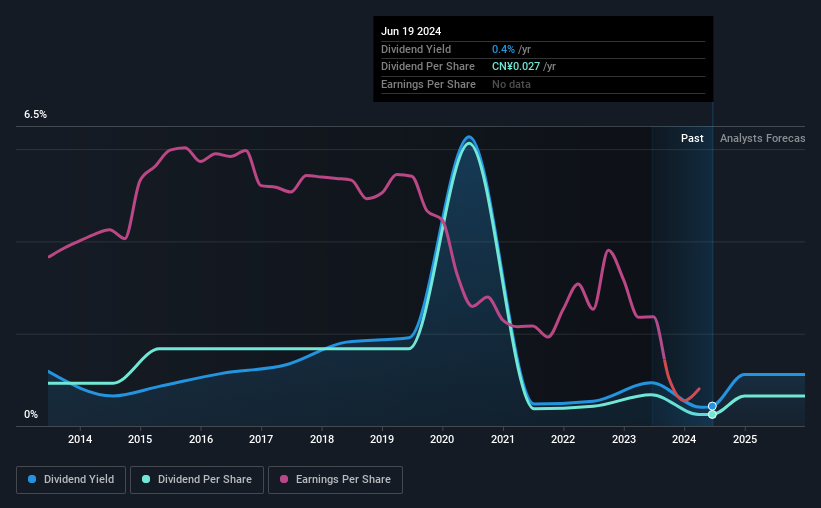

Beijing Gehua Catv Network Co.,Ltd.'s (SHSE:600037) dividend is being reduced from last year's payment covering the same period to CN¥0.027 on the 21st of June. Based on this payment, the dividend yield will be 0.4%, which is lower than the average for the industry.

See our latest analysis for Beijing Gehua Catv NetworkLtd

Beijing Gehua Catv NetworkLtd's Distributions May Be Difficult To Sustain

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. Even though Beijing Gehua Catv NetworkLtd isn't generating a profit, it is generating healthy free cash flows that easily cover the dividend. This gives us some comfort about the level of the dividend payments.

Analysts are expecting EPS to grow by 95.2% over the next 12 months. We like to see the company moving towards profitability, but this probably won't be enough for it to post positive net income this year. The positive free cash flows give us some comfort, however, that the dividend could continue to be sustained.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The annual payment during the last 10 years was CN¥0.10 in 2014, and the most recent fiscal year payment was CN¥0.027. The dividend has fallen 73% over that period. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

Dividend Growth Potential Is Shaky

Given that the track record hasn't been stellar, we really want to see earnings per share growing over time. Beijing Gehua Catv NetworkLtd's EPS has fallen by approximately 43% per year during the past five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this becomes a long term trend.

The Dividend Could Prove To Be Unreliable

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. See if management have their own wealth at stake, by checking insider shareholdings in Beijing Gehua Catv NetworkLtd stock. Is Beijing Gehua Catv NetworkLtd not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Gehua Catv NetworkLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600037

Beijing Gehua Catv NetworkLtd

Engages in the construction, management, operation, and maintenance of cable radio and television networks in China.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives