As of October 2025, Asian markets have shown resilience amid global economic uncertainties, with Japan and China experiencing notable gains in their stock indices. Despite challenges such as fluctuating domestic demand in China and political shifts in Japan, the region's small-cap stocks present intriguing opportunities for investors seeking growth potential. Identifying promising stocks often involves looking for companies that can navigate current market dynamics effectively while capitalizing on regional strengths and emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wuxi Chemical Equipment | NA | 11.18% | 1.78% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | 1.64% | 15.30% | ★★★★★★ |

| Center International GroupLtd | 17.61% | 0.53% | -25.53% | ★★★★★★ |

| Wan Hwa Enterprise | NA | 7.79% | 10.01% | ★★★★★★ |

| CHANGE HoldingsInc | 63.47% | 29.29% | 14.76% | ★★★★★☆ |

| Nacity Property Service GroupLtd | 6.90% | 6.11% | -8.48% | ★★★★★☆ |

| BIOBIJOULtd | 0.07% | 45.63% | 49.17% | ★★★★★☆ |

| SBS Philippines | 29.71% | 3.10% | -49.78% | ★★★★★☆ |

| Li Ming Development Construction | 170.96% | 14.13% | 22.83% | ★★★★☆☆ |

| Nippon Care Supply | 16.37% | 10.41% | 0.50% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

PhiChem (SZSE:300398)

Simply Wall St Value Rating: ★★★★★★

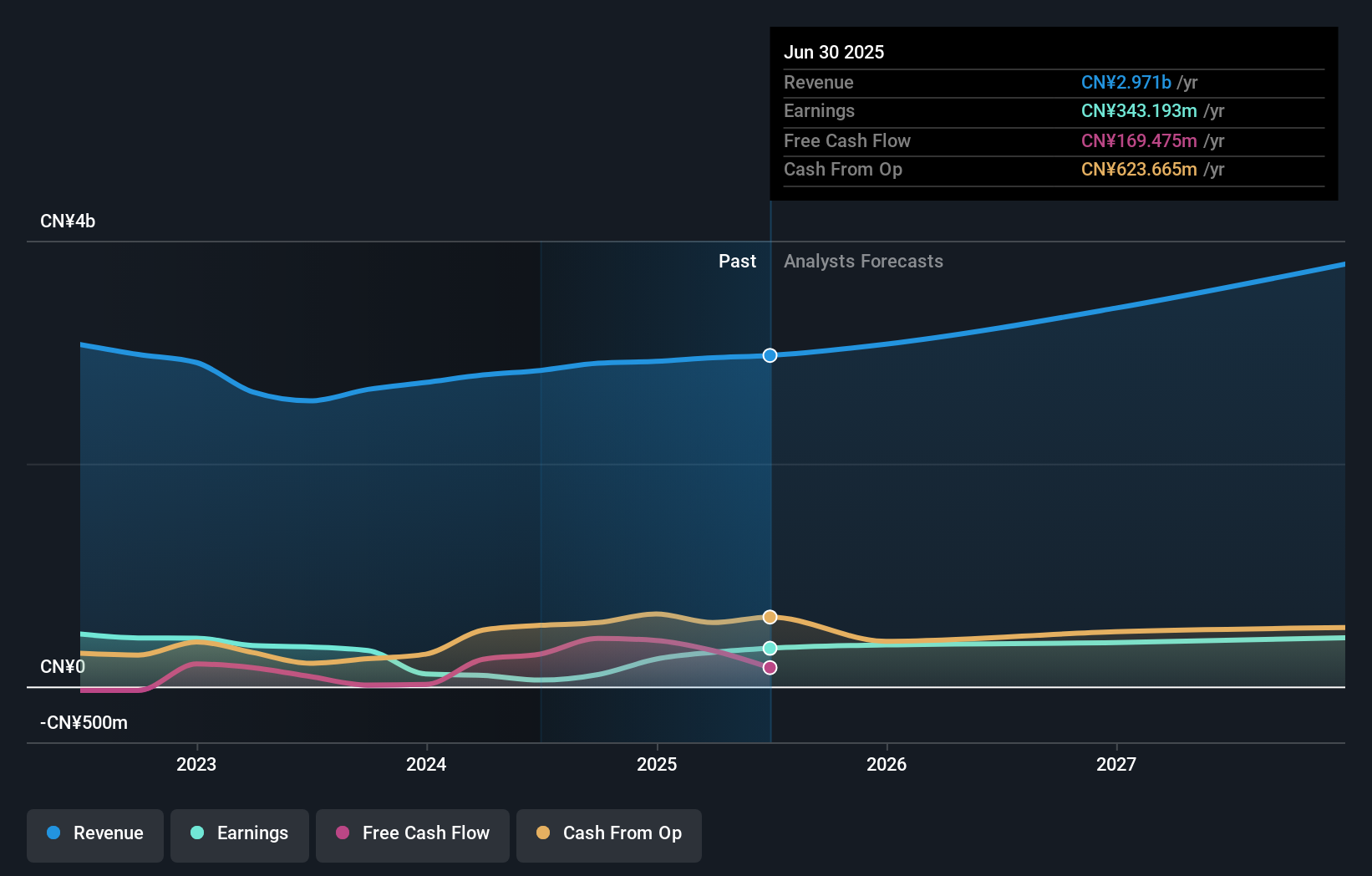

Overview: PhiChem Corporation provides high-performance materials solutions and has a market cap of CN¥13.87 billion.

Operations: PhiChem's primary revenue stream comes from its manufacturing segment, generating CN¥2.97 billion.

PhiChem, a promising name in the Asian market, has shown impressive earnings growth of 488.3% over the past year, significantly outpacing the Chemicals industry's 3.6%. Its debt to equity ratio improved from 35.5% to 19.9% over five years, signaling better financial health with more cash than total debt. The company recently affirmed an interim dividend of CNY 0.40 per 10 shares for 2025 and reported a net income increase to CNY 216.82 million from CNY 120.15 million last year, highlighting its robust performance despite a volatile share price in recent months.

- Dive into the specifics of PhiChem here with our thorough health report.

Gain insights into PhiChem's past trends and performance with our Past report.

Hubei DOTI Micro Technology (SZSE:301183)

Simply Wall St Value Rating: ★★★★★★

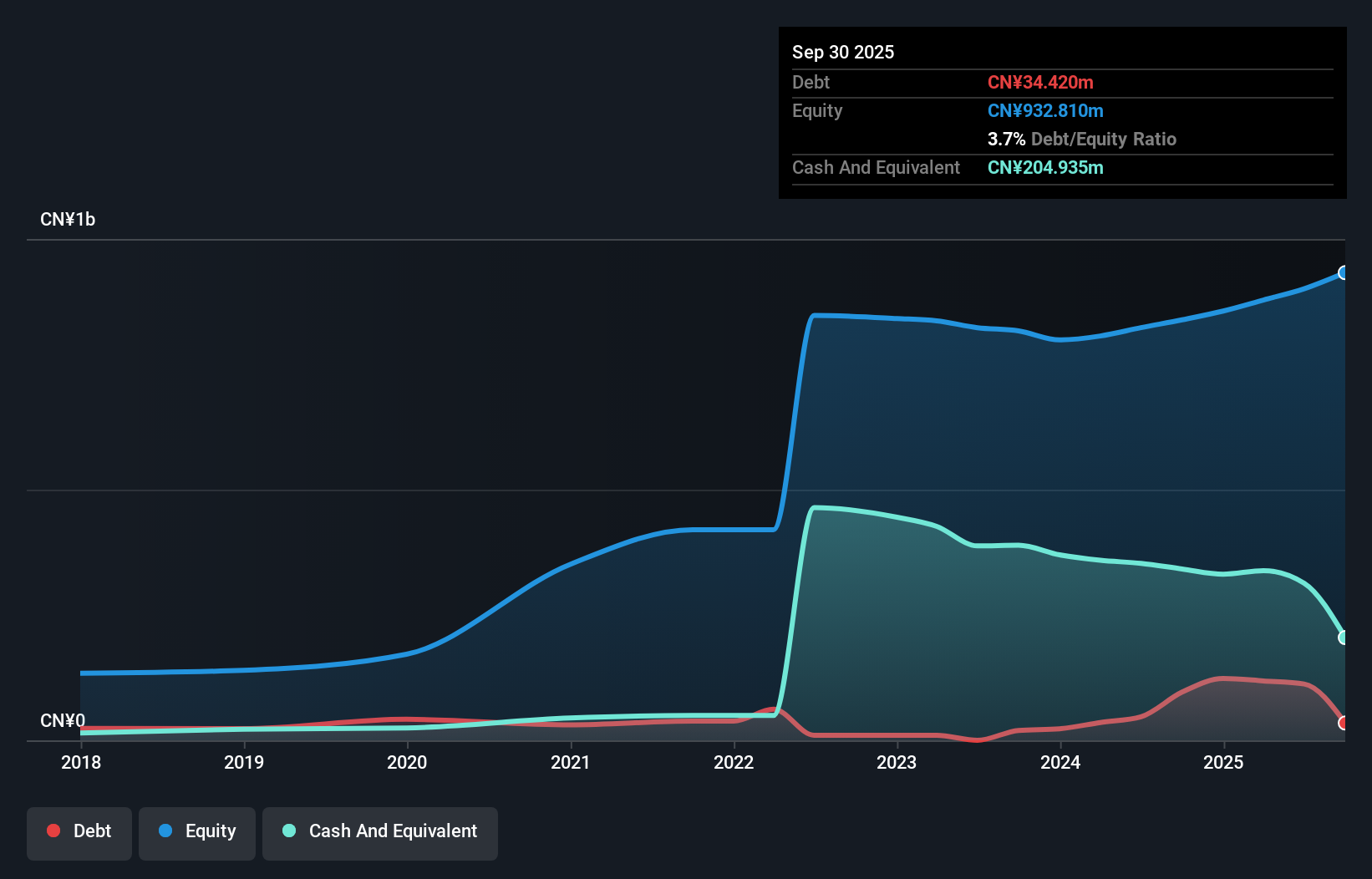

Overview: Hubei DOTI Micro Technology Co., Ltd. focuses on the research, development, production, and sales of precision optoelectronic thin film components in China, with a market cap of CN¥9.12 billion.

Operations: Hubei DOTI Micro Technology generates revenue primarily from the sale of precision optoelectronic thin film components. The company's financials reveal a market capitalization of CN¥9.12 billion.

Hubei DOTI Micro Technology, a smaller player in the electronics sector, has shown impressive growth with earnings surging by 336% over the past year, outpacing the industry's 5.7%. The company reported sales of CNY 636.54 million for the first nine months of 2025, up from CNY 413.59 million a year prior, and net income doubled to CNY 80.03 million during this period. Despite its volatile share price recently, it holds more cash than debt and has reduced its debt-to-equity ratio from 7.8 to 3.7 over five years, indicating improved financial health amidst ongoing expansion efforts.

CAC Nantong Chemical (SZSE:301665)

Simply Wall St Value Rating: ★★★★★☆

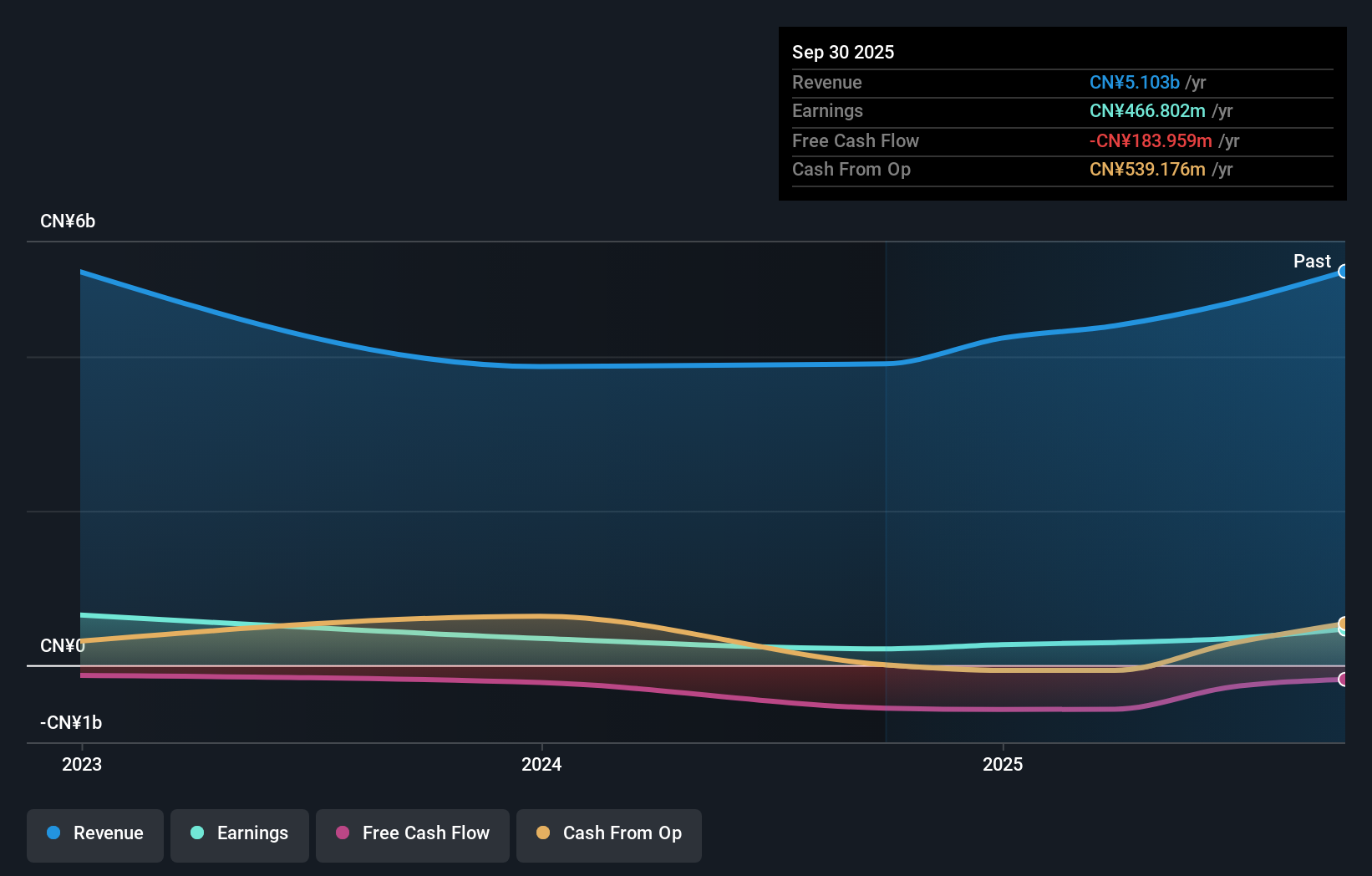

Overview: CAC Nantong Chemical Co., Ltd. specializes in the R&D, production, and sale of pesticide products and functional chemicals for crop protection across various global markets, with a market cap of CN¥13.71 billion.

Operations: The company generates revenue primarily from the sale of pesticide products and functional chemicals for crop protection across multiple regions, including China, North America, South America, Europe, and Southeast Asia.

CAC Nantong Chemical, a smaller player in the chemicals sector, has shown impressive earnings growth of 121.1% over the past year, outpacing the industry average of 3.6%. Despite a net debt to equity ratio rising slightly from 35.3% to 37.5% over five years, it remains satisfactory at 18.5%, indicating manageable leverage levels. The company's recent nine-month results highlight strong sales of CNY 3.89 billion and net income reaching CNY 367 million compared to last year's figures of CNY 3.02 billion and CNY 167 million respectively, reflecting robust operational performance amidst market challenges and strategic adjustments in governance and dividends policies.

- Unlock comprehensive insights into our analysis of CAC Nantong Chemical stock in this health report.

Key Takeaways

- Unlock our comprehensive list of 2393 Asian Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301665

CAC Nantong Chemical

Engages in the research and development, production, and sale of pesticide products and functional chemicals for crop protection in China, North America, South America, Europe, and Southeast Asia.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives