As global markets experience fluctuations, Chinese equities have recently faced challenges, with the Shanghai Composite Index and CSI 300 seeing declines amid wavering optimism about Beijing's stimulus measures. In this context, identifying promising small-cap stocks in China requires a keen eye for companies that demonstrate resilience and potential for growth despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In China

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zhejiang Haisen Pharmaceutical | NA | 2.45% | 10.43% | ★★★★★★ |

| Hubei Three Gorges Tourism Group | 11.57% | -7.07% | 1.90% | ★★★★★★ |

| ShenZhen QiangRui Precision Technology | 2.29% | 24.35% | -0.93% | ★★★★★★ |

| Shenzhen Jdd Tech New Material | NA | 27.24% | 21.39% | ★★★★★★ |

| Tibet Development | 52.25% | -1.03% | 55.10% | ★★★★★★ |

| Xinjiang Torch Gas | 2.26% | 16.26% | 11.21% | ★★★★★☆ |

| Changjiang Publishing & MediaLtd | 3.36% | -3.86% | 3.37% | ★★★★★☆ |

| Jiangsu ChengXing Phosph-Chemicals | 74.90% | 2.41% | 20.41% | ★★★★★☆ |

| Shanghai Feilo AcousticsLtd | 36.01% | -17.85% | 55.43% | ★★★★☆☆ |

| Huaiji Dengyun Auto-parts (Holding)Ltd | 67.58% | 11.72% | -34.21% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Shanghai Hongda New Material (SZSE:002211)

Simply Wall St Value Rating: ★★★★★☆

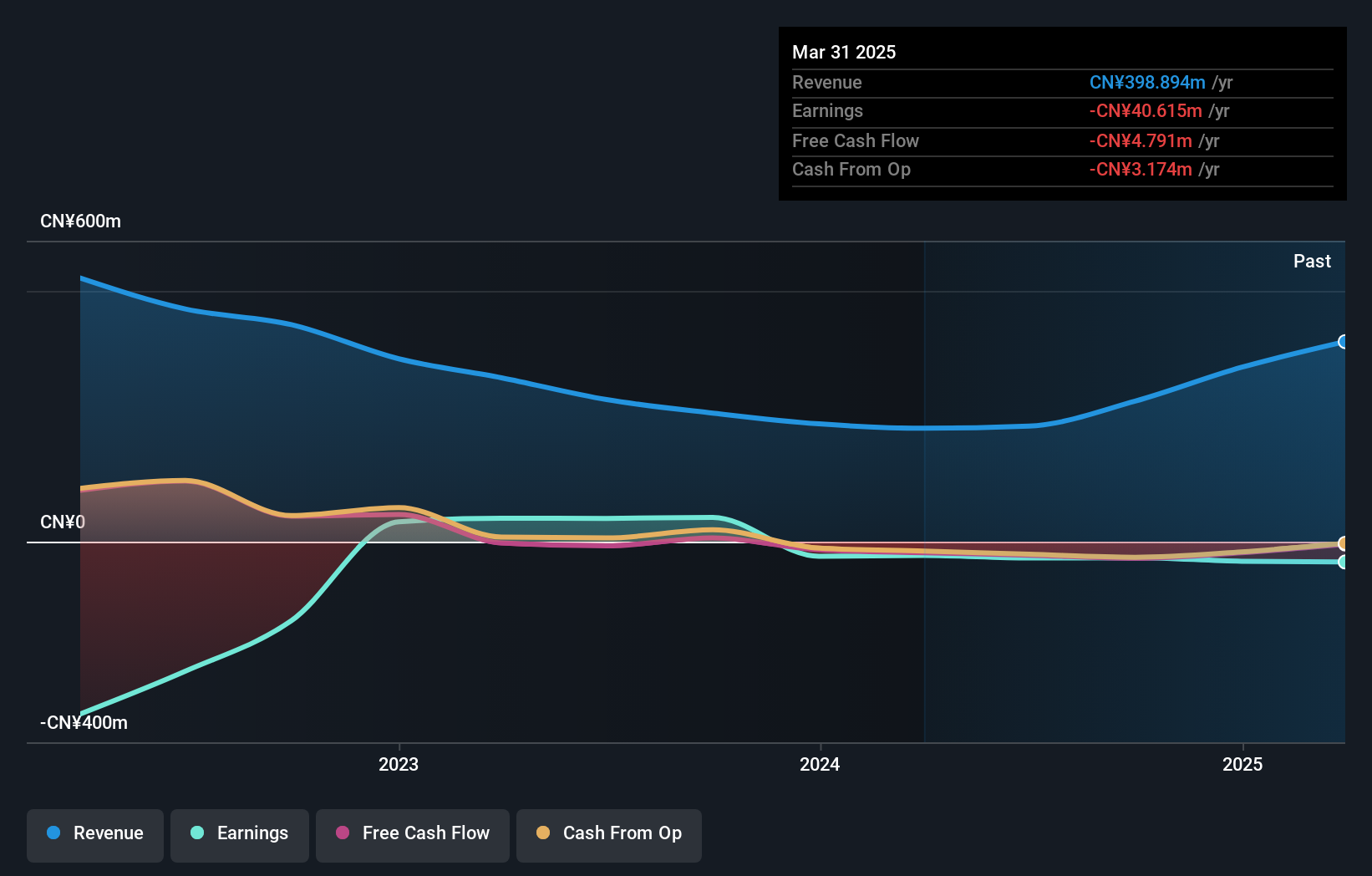

Overview: Shanghai Hongda New Material Co., Ltd. focuses on the processing, production, and sale of silicone rubber and its products primarily in China, with a market capitalization of approximately CN¥1.84 billion.

Operations: The company's revenue is primarily derived from the sale of silicone rubber and related products. It has experienced fluctuations in its net profit margin, which was 5.2% in the most recent period analyzed.

Shanghai Hongda New Material, a small player in the chemicals industry, turned profitable this year despite an industry contraction of 4.7%. The company is debt-free and saw a significant one-off gain of CN¥73.6 million impacting its recent financials. Recent M&A activity includes Zhu Enwei acquiring a 15.77% stake for CN¥150 million and Li Qijun purchasing 6.76% for CN¥64.4 million, reflecting strategic interest in the firm amidst reported losses of CN¥14.78 million for H1 2024 compared to last year's figures.

- Dive into the specifics of Shanghai Hongda New Material here with our thorough health report.

Gain insights into Shanghai Hongda New Material's past trends and performance with our Past report.

Shenzhen Forms Syntron InformationLtd (SZSE:300468)

Simply Wall St Value Rating: ★★★★★★

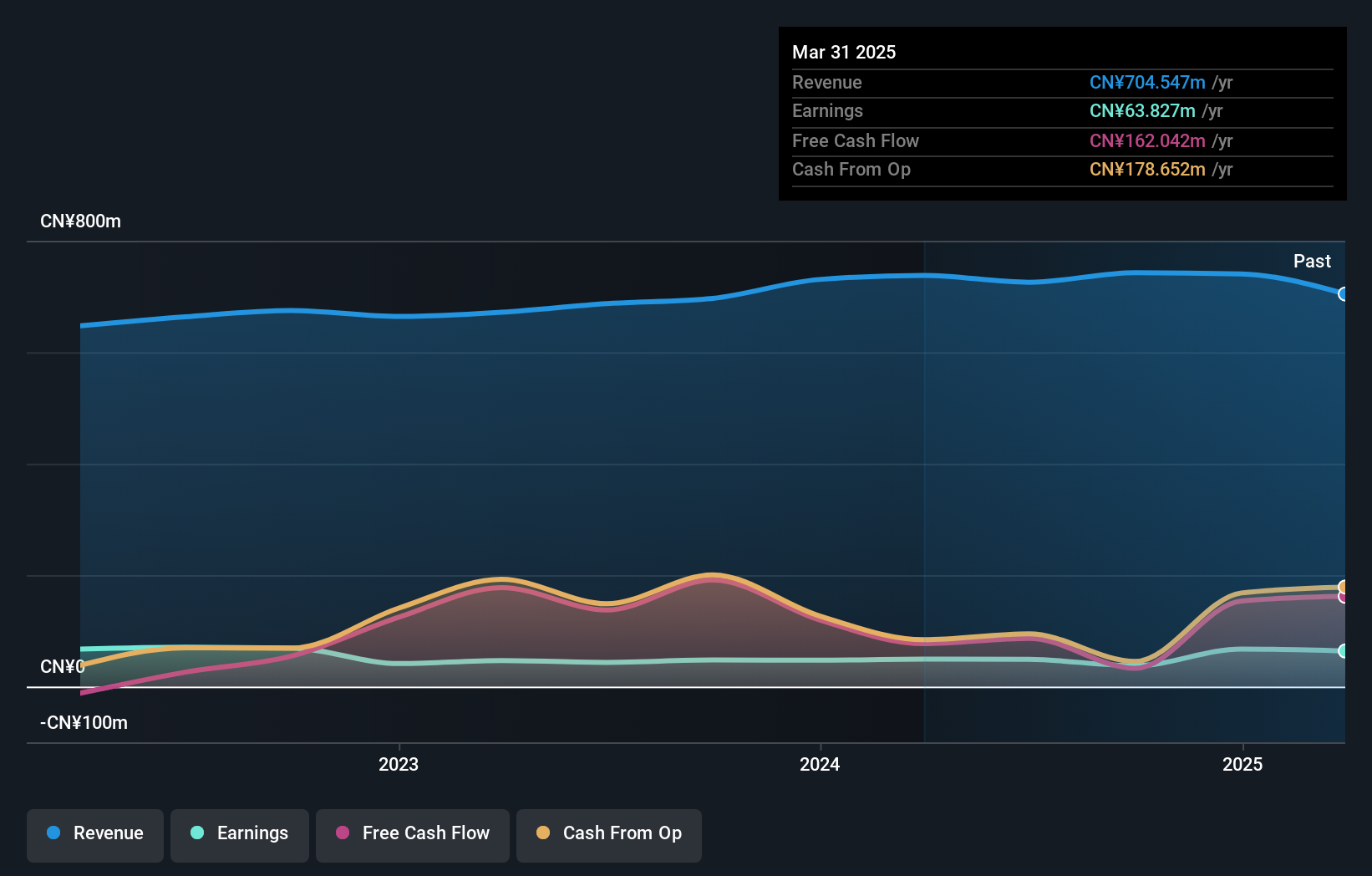

Overview: Shenzhen Forms Syntron Information Co., Ltd. operates in the software and information services industry with a market cap of CN¥10.96 billion.

Operations: Forms Syntron generates revenue primarily from its software and information services segment, amounting to CN¥725.52 million. The company's financial performance is influenced by its cost structure and market dynamics within this sector.

Shenzhen Forms Syntron Information, a nimble player in the tech sector, has shown resilience despite earnings dipping by 13.6% annually over five years. However, it boasts a debt-free balance sheet for the past five years and impressive earnings growth of 12.4% last year, outpacing the IT industry's -11.5%. Recent reports highlight sales at CNY 342 million with net income climbing to CNY 36.8 million from CNY 35 million previously, reflecting its robust financial health amidst market volatility.

Dongguan Changlian New Materials TechnologyLtd (SZSE:301618)

Simply Wall St Value Rating: ★★★★★★

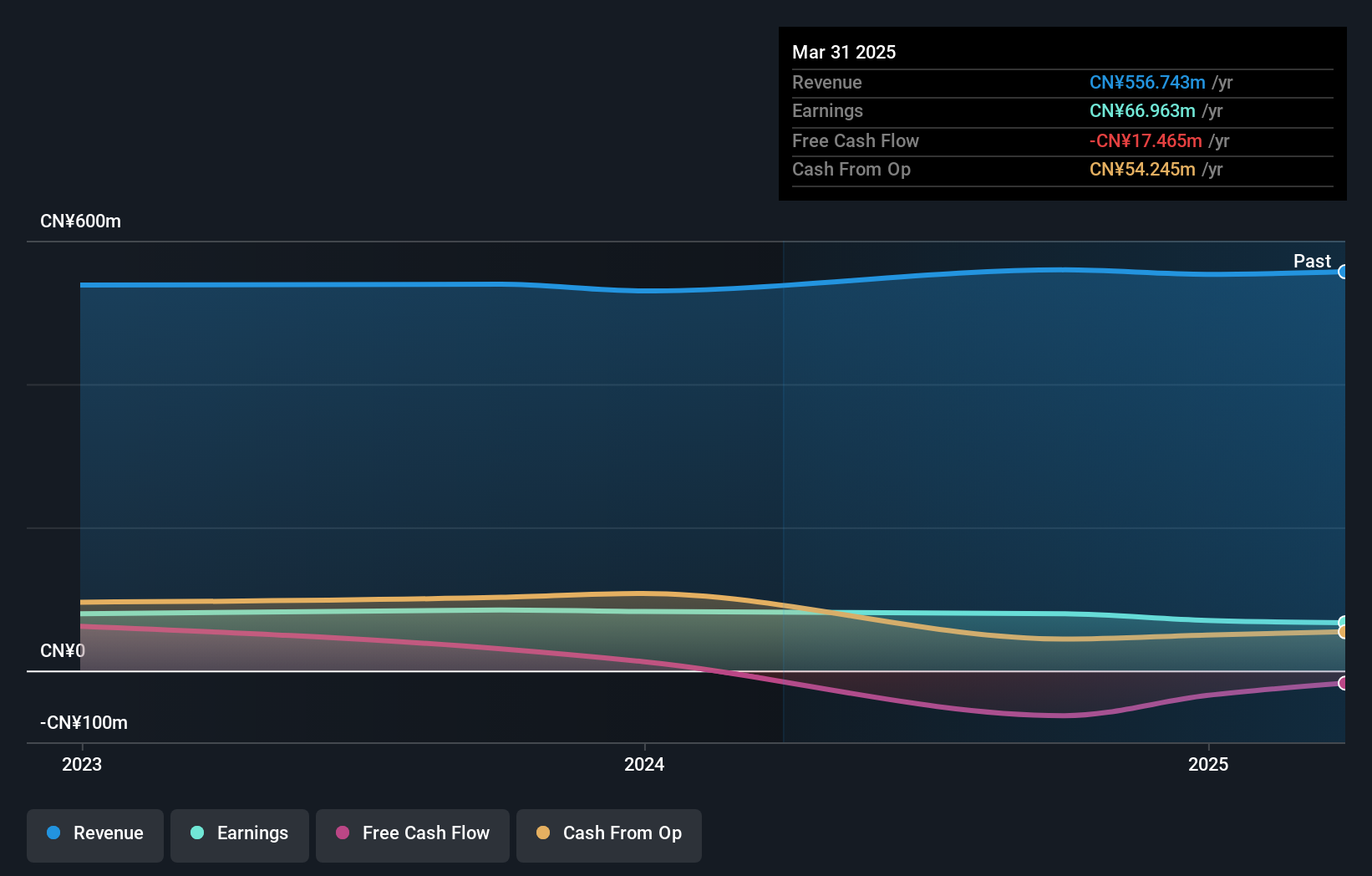

Overview: Dongguan Changlian New Materials Technology Ltd focuses on the development and production of specialty chemicals, with a market capitalization of CN¥8.76 billion.

Operations: Changlian generates revenue primarily from its specialty chemicals segment, amounting to CN¥529.93 million.

Dongguan Changlian New Materials Technology, a relatively small player in the market, recently completed an IPO raising CNY 340.24 million, with shares priced at CNY 21.12 each. The company reported net income of CNY 82.51 million for the year ending December 2023, up from CNY 79.46 million previously, showcasing its ability to grow earnings by 3.8% despite industry challenges. With no debt on its balance sheet and high-quality past earnings, it seems well-positioned within its sector despite highly illiquid shares and slightly lower revenue of CNY 529.93 million compared to the prior year's CNY 538.05 million.

Next Steps

- Embark on your investment journey to our 907 Chinese Undiscovered Gems With Strong Fundamentals selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002211

Shanghai Hongda New Material

Engages in the processing, production, and sale of silicone rubber and its products primarily in China.

Excellent balance sheet and overvalued.

Market Insights

Community Narratives