- China

- /

- Consumer Durables

- /

- SZSE:301479

Undiscovered Gems in Asia to Watch This March 2025

Reviewed by Simply Wall St

Amidst global economic uncertainties and shifting trade policies, Asian markets have shown resilience, with China's stimulus hopes and Japan's wage growth trends capturing investor attention. As we navigate these dynamic conditions, identifying promising opportunities in the region requires a keen eye for companies that demonstrate robust fundamentals and adaptability to changing market landscapes.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 5.93% | 20.71% | ★★★★★★ |

| Shangri-La Hotel | NA | 15.26% | 23.20% | ★★★★★★ |

| TCM Biotech International | 10.23% | 9.33% | -1.73% | ★★★★★★ |

| Savior Lifetec | NA | -7.74% | -0.77% | ★★★★★★ |

| Wuhan Guide Technology | 10.56% | 10.17% | 21.41% | ★★★★★☆ |

| Keli Motor Group | 21.66% | 9.99% | -12.19% | ★★★★★☆ |

| Nippon Ski Resort DevelopmentLtd | 40.39% | 10.24% | 42.77% | ★★★★★☆ |

| Unitech Computer | 47.89% | 3.09% | 2.82% | ★★★★☆☆ |

| Zhejiang Jinghua Laser TechnologyLtd | 31.04% | 4.49% | -1.72% | ★★★★☆☆ |

| CNSIG Anhui Hongsifang Fertilizer | 27.44% | -7.07% | 9.49% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Guangdong Hongjing Optoelectronic Technology (SZSE:301479)

Simply Wall St Value Rating: ★★★★★★

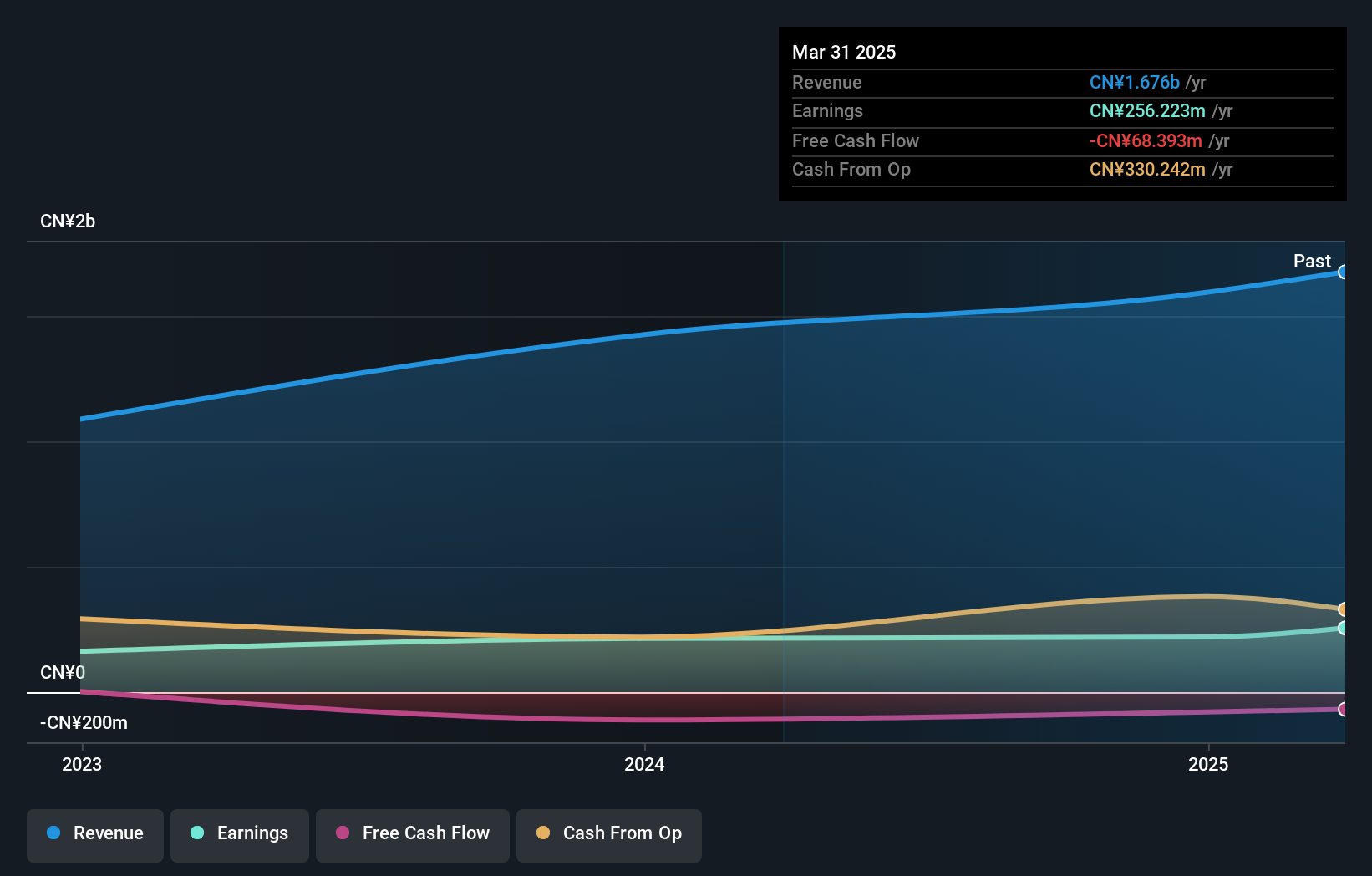

Overview: Guangdong Hongjing Optoelectronic Technology Inc. operates in the optoelectronics industry, focusing on the production and development of electronic components and parts, with a market capitalization of approximately CN¥10.17 billion.

Operations: Hongjing Optoelectronic generates revenue primarily from its Electronic Components & Parts segment, amounting to CN¥1.09 billion. The company's gross profit margin is 34.5%.

Guangdong Hongjing Optoelectronic Technology, a promising player in the optoelectronics sector, recently completed an IPO raising CNY 665.65 million. The company's earnings growth of 41.9% outpaced the industry average of 10.2%, showcasing its competitive edge. With a debt to equity ratio reduced from 48.6% to 21.7% over five years and interest payments covered by EBIT at a strong 52x, financial stability seems robust despite illiquid shares. Net income rose to CNY 165.22 million from last year's CNY 116.43 million, indicating solid profitability and positioning it well for future opportunities in its niche market.

Hefei Hengxin Life Science and Technology (SZSE:301501)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hefei Hengxin Life Science and Technology Co., Ltd. is a company involved in the life sciences sector, with a market capitalization of CN¥4.07 billion.

Operations: Hefei Hengxin Life Science and Technology generates revenue primarily from its Plastics & Rubber segment, contributing CN¥1.59 billion.

Hefei Hengxin Life Science and Technology recently completed a CNY 1.02 billion IPO, reflecting its growing market presence. The company reported annual sales of CNY 1.59 billion, up from CNY 1.43 billion the previous year, with net income reaching CNY 219.89 million compared to last year's CNY 213.86 million. Despite an increase in debt-to-equity ratio from 17.9% to 34.6% over five years, their interest payments are well-covered by EBIT at a robust coverage of 33 times, indicating financial stability amidst growth initiatives in the competitive chemicals sector where earnings grew by 2.8%, outpacing the industry's -5%.

FuSheng Precision (TWSE:6670)

Simply Wall St Value Rating: ★★★★★☆

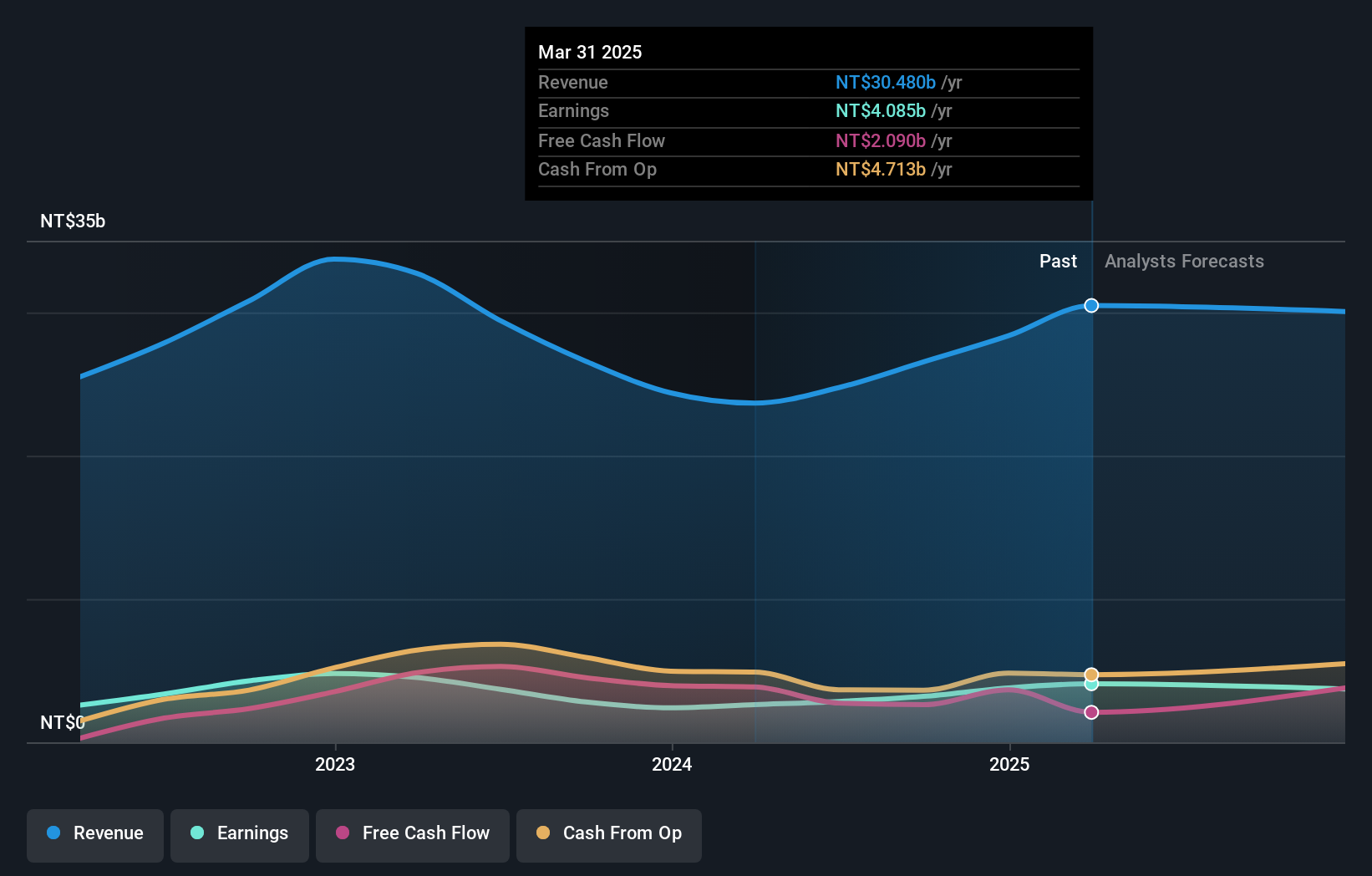

Overview: FuSheng Precision Co., Ltd. operates in the golf and sports equipment sectors across Japan, the United States, and internationally, with a market capitalization of NT$48.51 billion.

Operations: FuSheng Precision generates revenue primarily from its Golf Division, contributing NT$23.09 billion, followed by the Sports Assembly Division at NT$2.44 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability within these sectors.

FuSheng Precision, a promising player in its industry, has shown robust financial health with earnings growth of 14% last year, surpassing the Leisure industry's pace. Trading at 24.3% below estimated fair value suggests potential for appreciation. The company maintains a strong cash position exceeding total debt, indicating prudent financial management. Recent executive changes include appointing Chou Cheng-Chi as Chief Information Security Officer to bolster cybersecurity efforts. Despite a slight increase in the debt-to-equity ratio from 12.5% to 13%, FuSheng's high-quality earnings and positive free cash flow highlight its resilience and strategic positioning for future growth.

- Delve into the full analysis health report here for a deeper understanding of FuSheng Precision.

Assess FuSheng Precision's past performance with our detailed historical performance reports.

Next Steps

- Navigate through the entire inventory of 2613 Asian Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301479

Guangdong Hongjing Optoelectronic Technology

Guangdong Hongjing Optoelectronic Technology Inc.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives