The Market Lifts Ganzhou Tengyuan Cobalt New Material Co., Ltd. (SZSE:301219) Shares 41% But It Can Do More

Ganzhou Tengyuan Cobalt New Material Co., Ltd. (SZSE:301219) shareholders have had their patience rewarded with a 41% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 44% in the last year.

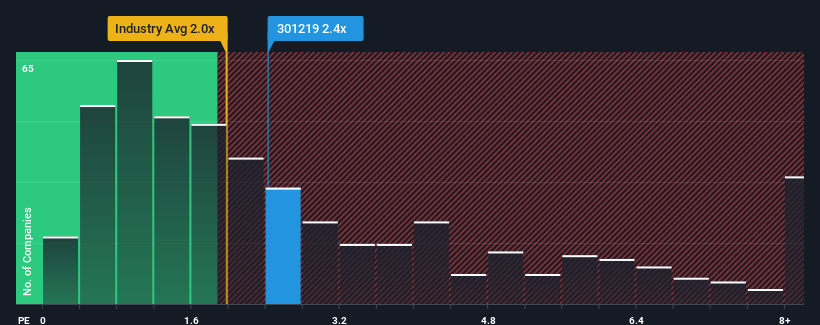

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Ganzhou Tengyuan Cobalt New Material's P/S ratio of 2.4x, since the median price-to-sales (or "P/S") ratio for the Chemicals industry in China is also close to 2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Ganzhou Tengyuan Cobalt New Material

How Ganzhou Tengyuan Cobalt New Material Has Been Performing

Ganzhou Tengyuan Cobalt New Material certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Ganzhou Tengyuan Cobalt New Material will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

Ganzhou Tengyuan Cobalt New Material's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 38%. The latest three year period has also seen an excellent 85% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 25% as estimated by the dual analysts watching the company. That's shaping up to be materially higher than the 23% growth forecast for the broader industry.

With this information, we find it interesting that Ganzhou Tengyuan Cobalt New Material is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Its shares have lifted substantially and now Ganzhou Tengyuan Cobalt New Material's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at Ganzhou Tengyuan Cobalt New Material's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

It is also worth noting that we have found 2 warning signs for Ganzhou Tengyuan Cobalt New Material (1 is a bit unpleasant!) that you need to take into consideration.

If you're unsure about the strength of Ganzhou Tengyuan Cobalt New Material's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301219

Ganzhou Tengyuan Cobalt New Material

Engages in the research, development, production, and sale of cobalt and copper products in China and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026