- Saudi Arabia

- /

- Professional Services

- /

- SASE:1831

October 2024's Top Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

As global markets navigate fluctuating economic indicators, the U.S. indices have shown resilience with notable gains in sectors like utilities and real estate, while European markets respond positively to monetary easing from the ECB. Amidst these developments, identifying growth companies with strong insider ownership can be a strategic approach, as such stocks often reflect confidence from those closest to the business and may offer potential stability in uncertain times.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

We're going to check out a few of the best picks from our screener tool.

Maharah for Human Resources (SASE:1831)

Simply Wall St Growth Rating: ★★★★☆☆

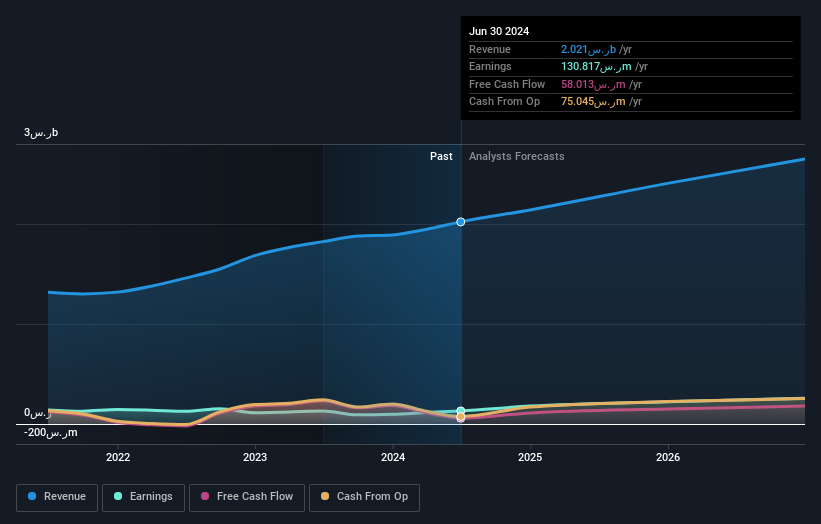

Overview: Maharah for Human Resources Company offers manpower services to both public and private sectors in Saudi Arabia and the United Arab Emirates, with a market cap of SAR3.29 billion.

Operations: The company's revenue segments include Corporate services at SAR1.46 billion, Individual services at SAR433.68 million, and Facility Management at SAR116.65 million.

Insider Ownership: 26.3%

Maharah for Human Resources shows promising growth potential, with recent earnings reflecting a net income increase to SAR 51.11 million in Q2 2024 from SAR 35.1 million the previous year. Its revenue and earnings are projected to grow faster than the Saudi Arabian market, at rates of 10.2% and 15.6% annually, respectively. Despite these positives, interest payments are not well covered by earnings, and its dividend yield of 1.99% is unsustainable through free cash flow alone.

- Dive into the specifics of Maharah for Human Resources here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Maharah for Human Resources' share price might be too optimistic.

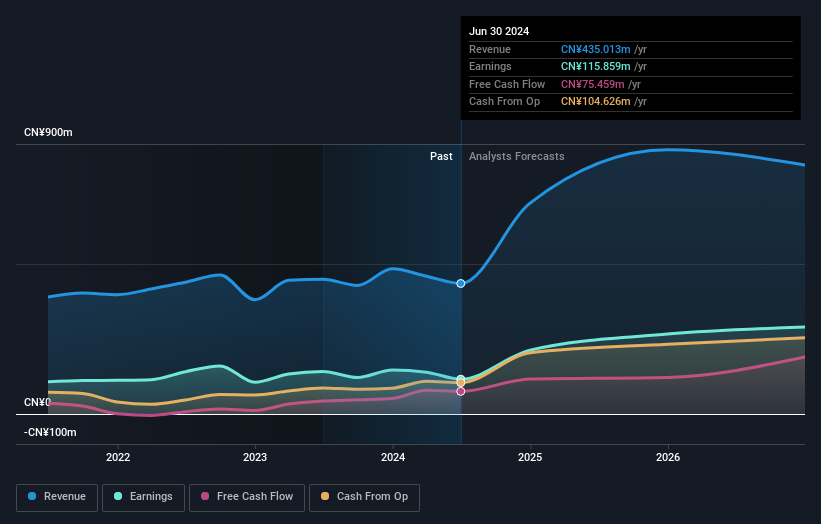

Chison Medical Technologies (SHSE:688358)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chison Medical Technologies Co., Ltd. manufactures and sells diagnostic ultrasound systems both in China and internationally, with a market cap of CN¥2.74 billion.

Operations: The company's revenue is primarily derived from its Ultrasound Medical Imaging Equipment Business, which generated CN¥435.01 million.

Insider Ownership: 23.6%

Chison Medical Technologies is trading significantly below its estimated fair value, offering a good relative value compared to peers. The company's earnings and revenue are expected to grow substantially at 31.4% and 24.2% annually, outpacing the Chinese market averages. However, recent financial results show a decline in sales and net income for the half year ending June 2024, with net income dropping to CNY 81.34 million from CNY 111.96 million previously.

- Get an in-depth perspective on Chison Medical Technologies' performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Chison Medical Technologies' share price might be too pessimistic.

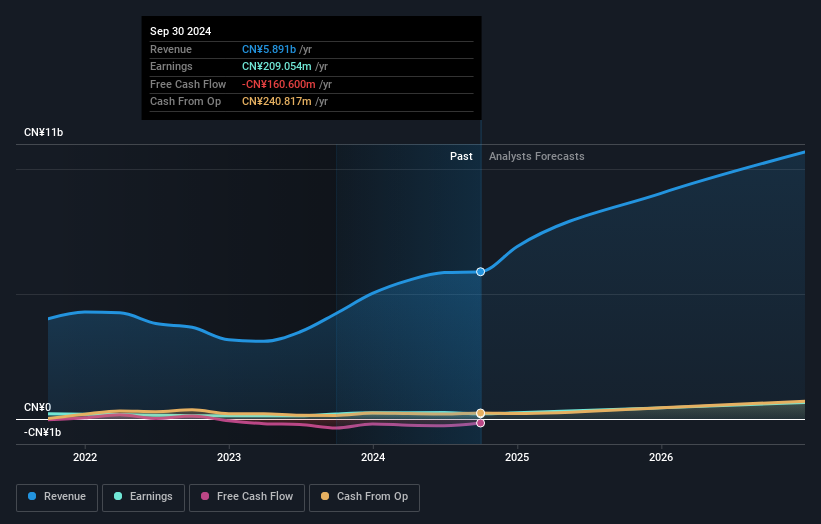

Shandong Longhua New Material (SZSE:301149)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shandong Longhua New Material Co., Ltd. focuses on the research, development, production, and sale of polyether polyols and polymer polyols in China, with a market cap of CN¥4.24 billion.

Operations: The company generates revenue primarily through its production and sale of polyether polyols and polymer polyols products in China.

Insider Ownership: 34.4%

Shandong Longhua New Material shows promising growth potential with earnings forecasted to rise significantly at 51.8% annually, surpassing the Chinese market average. The company's revenue is also expected to grow robustly at 25.5% per year. Despite a recent dip in net income for the nine months ending September 2024, sales increased to CNY 4.33 billion from CNY 3.46 billion year-on-year, highlighting strong revenue performance amidst volatile share prices and modest dividend coverage concerns.

- Click here to discover the nuances of Shandong Longhua New Material with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential undervaluation of Shandong Longhua New Material shares in the market.

Key Takeaways

- Reveal the 1487 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:1831

Maharah for Human Resources

Provides manpower services to public and private sectors in Saudi Arabia and the United Arab Emirates.

Reasonable growth potential with proven track record.