- China

- /

- Metals and Mining

- /

- SZSE:301040

Zhangjiagang Zhonghuan Hailu High-End Equipment Co., Ltd.'s (SZSE:301040) Shares Climb 41% But Its Business Is Yet to Catch Up

Despite an already strong run, Zhangjiagang Zhonghuan Hailu High-End Equipment Co., Ltd. (SZSE:301040) shares have been powering on, with a gain of 41% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 22% in the last twelve months.

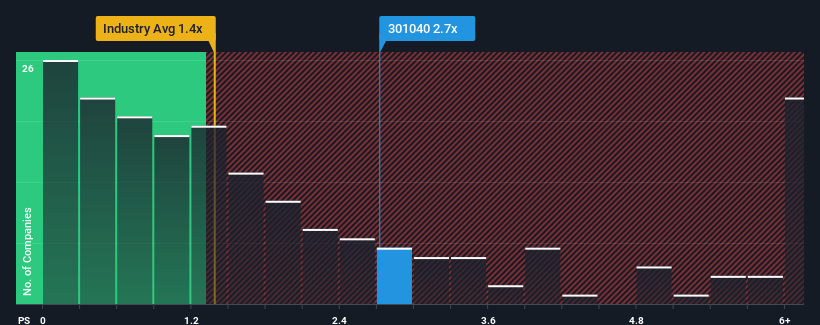

After such a large jump in price, you could be forgiven for thinking Zhangjiagang Zhonghuan Hailu High-End Equipment is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.7x, considering almost half the companies in China's Metals and Mining industry have P/S ratios below 1.4x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Zhangjiagang Zhonghuan Hailu High-End Equipment

What Does Zhangjiagang Zhonghuan Hailu High-End Equipment's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Zhangjiagang Zhonghuan Hailu High-End Equipment over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Zhangjiagang Zhonghuan Hailu High-End Equipment's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Zhangjiagang Zhonghuan Hailu High-End Equipment's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 38%. As a result, revenue from three years ago have also fallen 52% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 13% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's alarming that Zhangjiagang Zhonghuan Hailu High-End Equipment's P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Zhangjiagang Zhonghuan Hailu High-End Equipment's P/S?

Zhangjiagang Zhonghuan Hailu High-End Equipment's P/S is on the rise since its shares have risen strongly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Zhangjiagang Zhonghuan Hailu High-End Equipment revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Plus, you should also learn about these 2 warning signs we've spotted with Zhangjiagang Zhonghuan Hailu High-End Equipment (including 1 which doesn't sit too well with us).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Zhangjiagang Zhonghuan Hailu High-End Equipment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301040

Zhangjiagang Zhonghuan Hailu High-End Equipment

Zhangjiagang Zhonghuan Hailu High-End Equipment Co., Ltd.

Mediocre balance sheet with very low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026