- China

- /

- Metals and Mining

- /

- SZSE:300881

Undiscovered Gems On None Exchange To Watch In February 2025

Reviewed by Simply Wall St

As global markets grapple with geopolitical tensions and consumer spending concerns, major indices have experienced volatility, with the S&P 500 reaching record highs before ending lower due to sharp losses later in the week. Amid this backdrop of uncertainty and cautious investor sentiment, identifying promising small-cap stocks can be particularly rewarding for those seeking opportunities that may not yet be fully recognized by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Natural Food International Holding | NA | 2.49% | 20.35% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Bengal & Assam | 4.72% | -3.69% | 46.32% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 263.90% | 20.29% | 37.81% | ★★★★☆☆ |

| Monarch Networth Capital | 8.98% | 32.34% | 49.29% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Beijing Balance Medical TechnologyLtd (SHSE:688198)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing Balance Medical Technology Co., Ltd. operates in the medical technology sector with a market cap of CN¥14.43 billion.

Operations: Balance Medical generates revenue primarily from its medical technology products. The company's net profit margin stands at 15.2%, reflecting its profitability in the sector.

Beijing Balance Medical Technology, a nimble player in the medical equipment sector, has shown impressive growth with earnings rising 26% over the past year, outpacing the industry average of -9%. The company reported sales of CNY 502.83 million and net income of CNY 145.46 million for 2024, reflecting its robust financial health. Despite not having free cash flow positivity recently, it remains debt-free for five years and boasts high-quality earnings. With projected annual earnings growth of over 35%, this entity seems poised for continued expansion in its field.

Shengtak New Material (SZSE:300881)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shengtak New Material Co., Ltd specializes in the R&D, production, and sale of seamless steel pipes for industrial energy equipment in China with a market cap of CN¥3.37 billion.

Operations: Shengtak New Material primarily generates revenue through the sale of seamless steel pipes. The company’s financial performance is influenced by its cost structure, which includes expenses related to production and R&D activities. Gross profit margin trends provide insight into its operational efficiency over time.

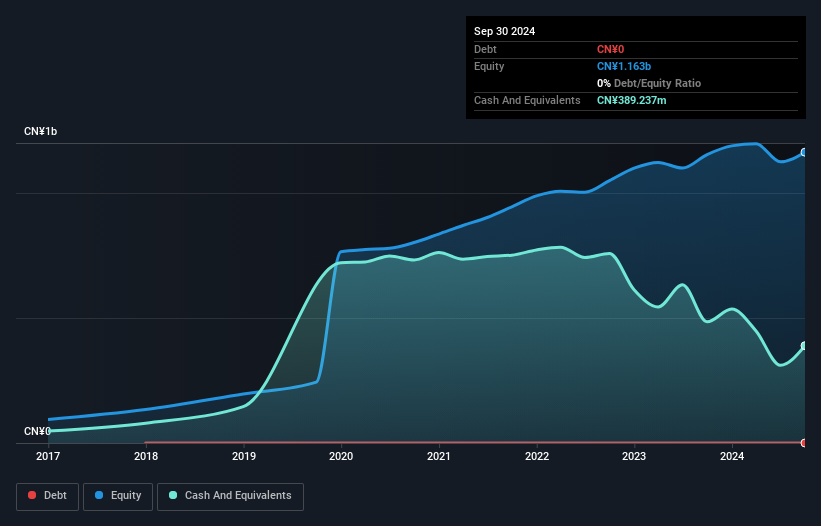

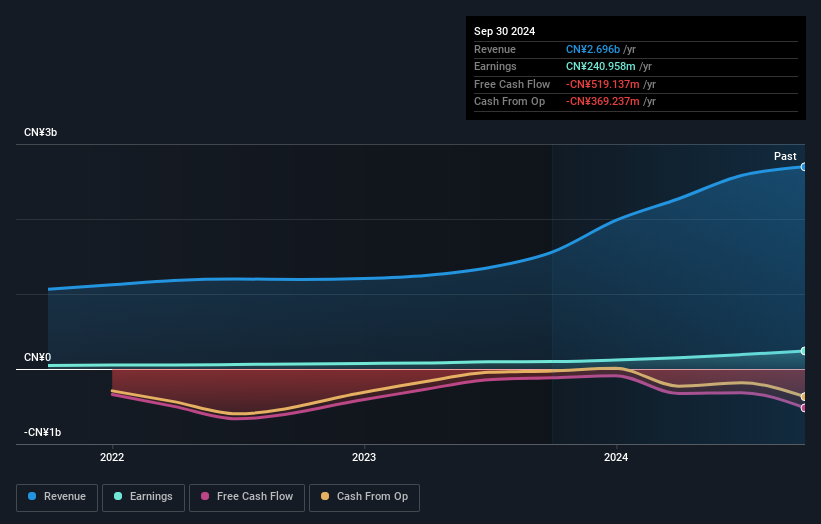

Shengtak New Material, a smaller player in the industry, has shown impressive earnings growth of 144% over the past year, outpacing the broader Metals and Mining sector's -1.1%. With a price-to-earnings ratio of 16.3x, it trades below the CN market average of 38x, suggesting potential value. The company's interest payments are comfortably covered by EBIT at 21.3 times, indicating strong financial health despite an increased debt to equity ratio from 28.9% to 50.6% over five years. Recent share repurchases totaling CNY 15.1 million for about 0.63% of shares reflect confidence in its prospects moving forward.

- Delve into the full analysis health report here for a deeper understanding of Shengtak New Material.

Jiangsu Boiln Plastics (SZSE:301003)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Boiln Plastics Co., Ltd. is engaged in the research, development, production, and sale of modified plastic products across various regions including China, Hong Kong, Taiwan, Southeast Asia, North America, South America, and Europe with a market cap of CN¥2.28 billion.

Operations: Jiangsu Boiln Plastics generates revenue through the sale of modified plastic products across multiple international markets. The company's cost structure primarily involves production expenses related to these products. Notably, the net profit margin has shown a significant trend over recent periods, reflecting its financial performance dynamics.

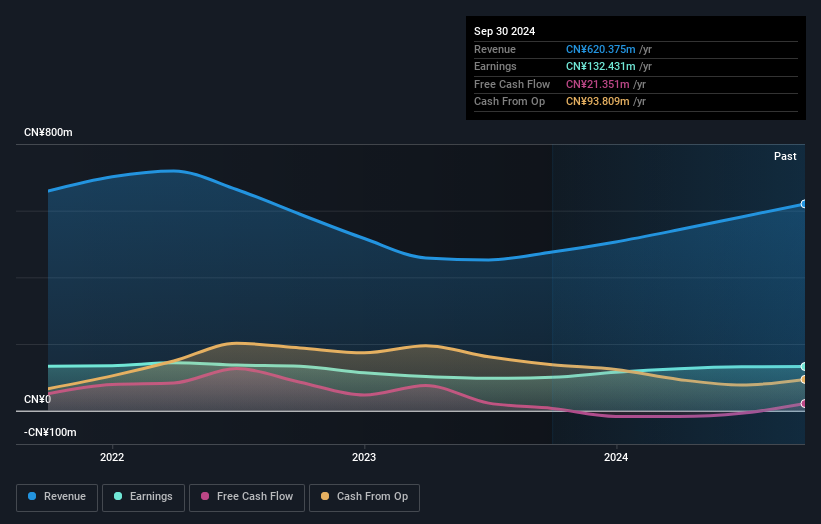

Jiangsu Boiln Plastics, a nimble player in the chemicals sector, has shown impressive earnings growth of 31.9% over the past year, outpacing the industry’s -5.4%. This debt-free company boasts a price-to-earnings ratio of 20.6x, offering value below the CN market average of 38x. With high-quality non-cash earnings and no debt since its previous debt to equity ratio was 21.4% five years ago, it seems well-positioned financially. Recent changes include updates to its articles of association and board elections at an extraordinary general meeting held in January 2025, indicating strategic governance adjustments for future endeavors.

Key Takeaways

- Unlock our comprehensive list of 4759 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300881

Shengtak New Material

Engages in the research and development, production, and sale of seamless steel pipes for use in industrial energy equipment in China.

Mediocre balance sheet second-rate dividend payer.

Market Insights

Community Narratives