Amidst a backdrop of mixed economic signals from global markets, Asian indices have shown resilience with notable performances in China and Japan. As investors navigate these evolving conditions, growth companies with strong insider ownership can offer unique insights into potential opportunities, as insiders often have a vested interest in the company's success.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 26.9% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Samyang Foods (KOSE:A003230) | 11.7% | 25.7% |

| Novoray (SHSE:688300) | 23.6% | 27.1% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Laopu Gold (SEHK:6181) | 35.5% | 41.8% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

We'll examine a selection from our screener results.

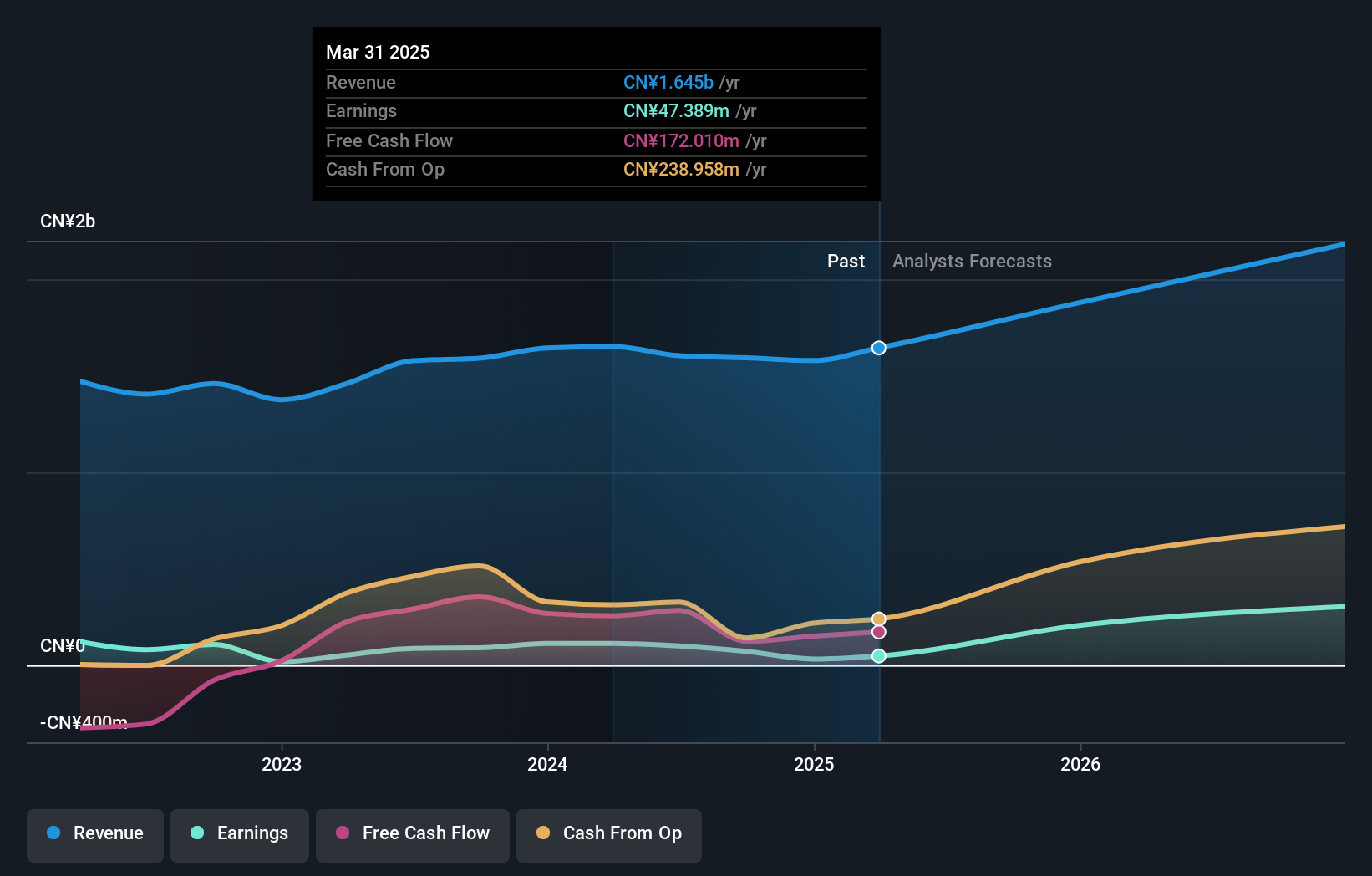

Shenzhen Jieshun Science and Technology IndustryLtd (SZSE:002609)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Jieshun Science and Technology Industry Co., Ltd. operates in the field of intelligent transportation and parking solutions, with a market cap of CN¥7.70 billion.

Operations: Unfortunately, the provided text does not include specific revenue segment data for Shenzhen Jieshun Science and Technology Industry Co., Ltd.

Insider Ownership: 38.1%

Earnings Growth Forecast: 77.3% p.a.

Shenzhen Jieshun Science and Technology Industry Ltd. demonstrates significant growth potential, with earnings forecasted to rise 77.26% annually, outpacing the broader CN market. Despite recent volatility and a reduction in profit margins from 6.8% to 2.9%, the company reported improved first-quarter results with net income of CNY 1.58 million versus a prior loss, highlighting resilience amidst challenges like dividend decreases and executive changes approved at its recent AGM.

- Click here and access our complete growth analysis report to understand the dynamics of Shenzhen Jieshun Science and Technology IndustryLtd.

- The valuation report we've compiled suggests that Shenzhen Jieshun Science and Technology IndustryLtd's current price could be inflated.

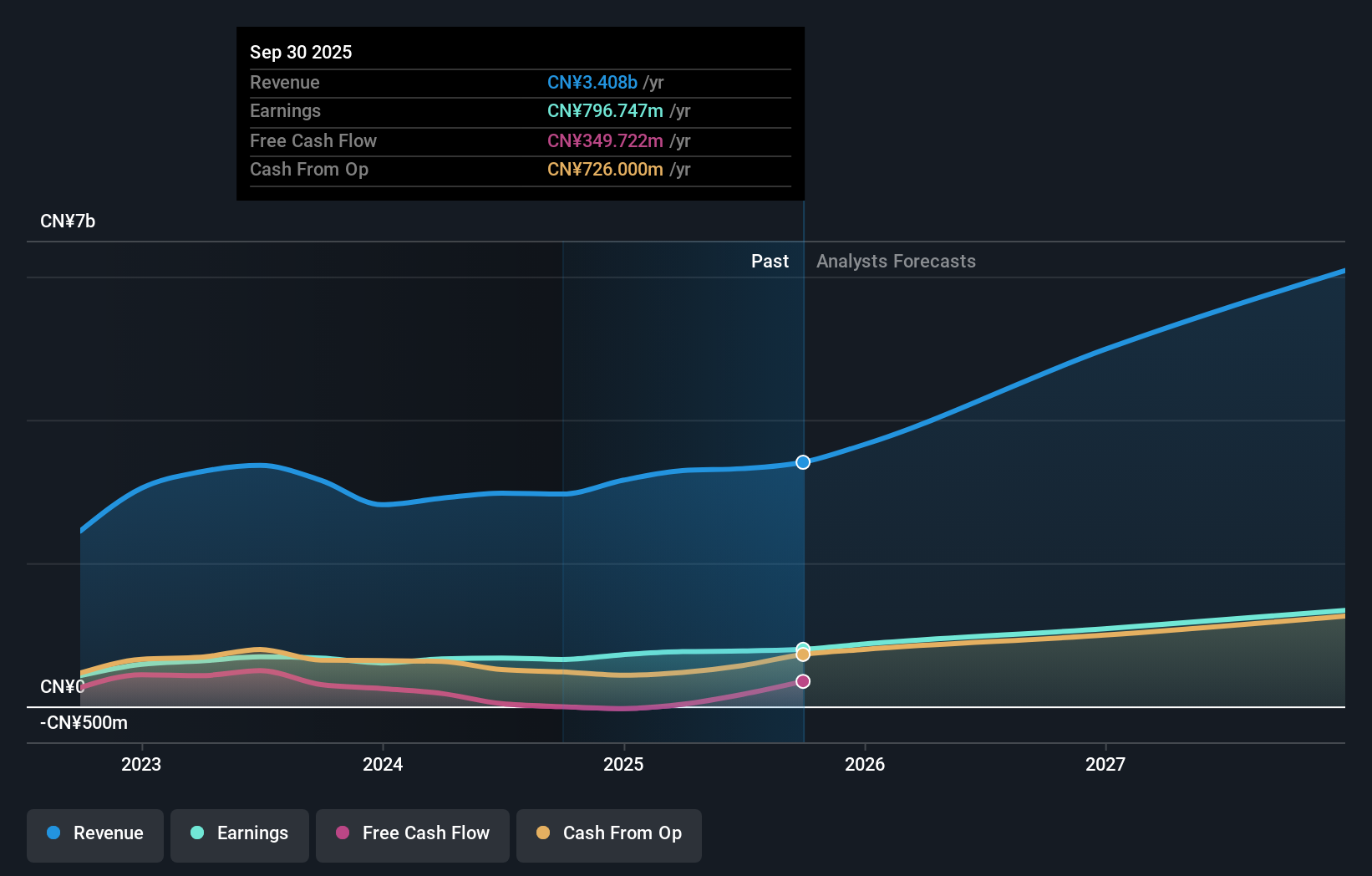

Xinxiang Richful Lube AdditiveLtd (SZSE:300910)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Xinxiang Richful Lube Additive Co., Ltd. is involved in the research, production, and sales of lubricant additive products in China, with a market cap of CN¥17.42 billion.

Operations: Xinxiang Richful Lube Additive Co., Ltd. generates revenue through its core activities in the research, production, and sales of lubricant additive products within China.

Insider Ownership: 40%

Earnings Growth Forecast: 21.1% p.a.

Xinxiang Richful Lube Additive Ltd. is positioned for robust growth, with earnings expected to rise significantly over the next three years and revenue projected to grow 22.6% annually, surpassing market averages. Despite a dividend decrease, recent first-quarter results showed strong performance with net income increasing to CNY 194.93 million from CNY 152.78 million year-over-year. The company trades at a favorable valuation compared to peers, though its dividend sustainability remains questionable due to low free cash flow coverage.

- Dive into the specifics of Xinxiang Richful Lube AdditiveLtd here with our thorough growth forecast report.

- According our valuation report, there's an indication that Xinxiang Richful Lube AdditiveLtd's share price might be on the cheaper side.

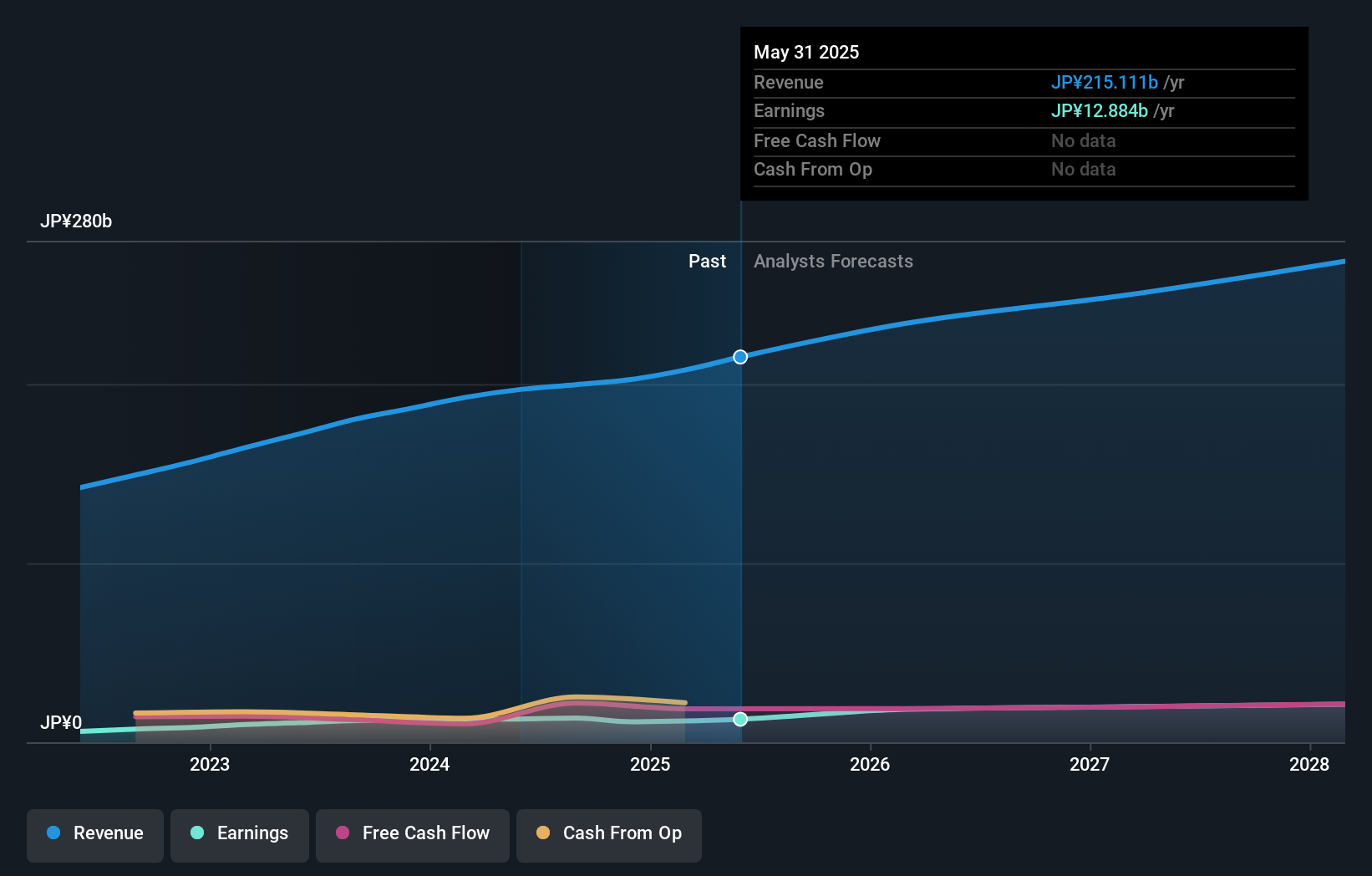

PAL GROUP Holdings (TSE:2726)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PAL GROUP Holdings CO., LTD. operates in Japan, focusing on the planning, manufacture, wholesale, and retail of men's and women's clothing and accessories, with a market cap of ¥362.92 billion.

Operations: The company generates revenue through its activities in the planning, manufacturing, wholesaling, and retailing of men's and women's clothing and accessories within Japan.

Insider Ownership: 10.9%

Earnings Growth Forecast: 15.6% p.a.

PAL GROUP Holdings shows promising growth potential, with earnings projected to increase 15.6% annually, outpacing the Japanese market average. Despite a volatile share price and slower revenue growth at 7.8% per year, it remains above market expectations. Recent corporate guidance indicates robust financial targets for fiscal year-end February 2026, including net sales of ¥231 billion and operating profit of ¥26.4 billion. The company is executing a share repurchase program to enhance shareholder value and capital efficiency.

- Click to explore a detailed breakdown of our findings in PAL GROUP Holdings' earnings growth report.

- Our expertly prepared valuation report PAL GROUP Holdings implies its share price may be too high.

Taking Advantage

- Discover the full array of 601 Fast Growing Asian Companies With High Insider Ownership right here.

- Seeking Other Investments? These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300910

Xinxiang Richful Lube AdditiveLtd

Engages in the sales of lubricant additive products in China and internationally.

High growth potential with solid track record.

Market Insights

Community Narratives