What Poly Plastic Masterbatch (SuZhou) Co.,Ltd's (SZSE:300905) 37% Share Price Gain Is Not Telling You

Poly Plastic Masterbatch (SuZhou) Co.,Ltd (SZSE:300905) shareholders are no doubt pleased to see that the share price has bounced 37% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 25% over that time.

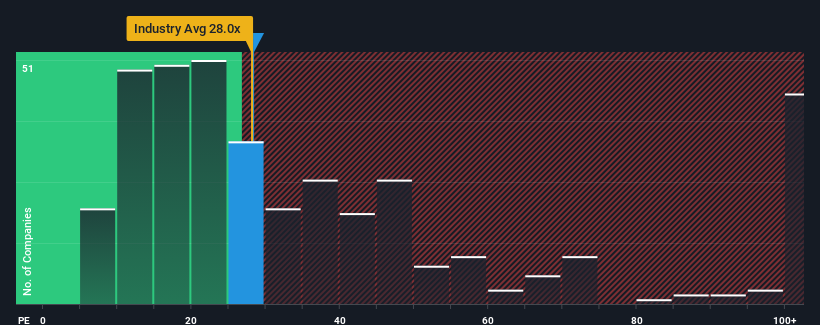

Even after such a large jump in price, it's still not a stretch to say that Poly Plastic Masterbatch (SuZhou)Ltd's price-to-earnings (or "P/E") ratio of 28.3x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 30x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

The earnings growth achieved at Poly Plastic Masterbatch (SuZhou)Ltd over the last year would be more than acceptable for most companies. It might be that many expect the respectable earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

See our latest analysis for Poly Plastic Masterbatch (SuZhou)Ltd

Is There Some Growth For Poly Plastic Masterbatch (SuZhou)Ltd?

The only time you'd be comfortable seeing a P/E like Poly Plastic Masterbatch (SuZhou)Ltd's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 30%. However, this wasn't enough as the latest three year period has seen a very unpleasant 50% drop in EPS in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 41% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's somewhat alarming that Poly Plastic Masterbatch (SuZhou)Ltd's P/E sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Final Word

Poly Plastic Masterbatch (SuZhou)Ltd appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Poly Plastic Masterbatch (SuZhou)Ltd revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 4 warning signs for Poly Plastic Masterbatch (SuZhou)Ltd (1 makes us a bit uncomfortable!) that you should be aware of.

Of course, you might also be able to find a better stock than Poly Plastic Masterbatch (SuZhou)Ltd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300905

Poly Plastic Masterbatch (SuZhou)Ltd

Engages in the research and development, production, and sale of chemical fiber solution colorings and advanced functional modified materials in China and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success