Subdued Growth No Barrier To Jiangsu Sidike New Materials Science & Technology Co., Ltd. (SZSE:300806) With Shares Advancing 31%

Jiangsu Sidike New Materials Science & Technology Co., Ltd. (SZSE:300806) shares have continued their recent momentum with a 31% gain in the last month alone. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 7.8% in the last twelve months.

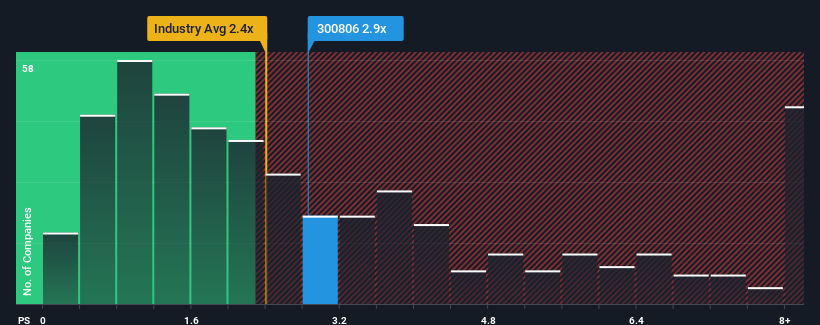

Although its price has surged higher, it's still not a stretch to say that Jiangsu Sidike New Materials Science & Technology's price-to-sales (or "P/S") ratio of 2.9x right now seems quite "middle-of-the-road" compared to the Chemicals industry in China, where the median P/S ratio is around 2.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Jiangsu Sidike New Materials Science & Technology

How Has Jiangsu Sidike New Materials Science & Technology Performed Recently?

Jiangsu Sidike New Materials Science & Technology certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Jiangsu Sidike New Materials Science & Technology.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Jiangsu Sidike New Materials Science & Technology would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 40%. The strong recent performance means it was also able to grow revenue by 33% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 19% during the coming year according to the sole analyst following the company. That's shaping up to be materially lower than the 25% growth forecast for the broader industry.

With this in mind, we find it intriguing that Jiangsu Sidike New Materials Science & Technology's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Jiangsu Sidike New Materials Science & Technology's P/S Mean For Investors?

Its shares have lifted substantially and now Jiangsu Sidike New Materials Science & Technology's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

When you consider that Jiangsu Sidike New Materials Science & Technology's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you settle on your opinion, we've discovered 4 warning signs for Jiangsu Sidike New Materials Science & Technology (2 are a bit concerning!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300806

Jiangsu Sidike New Materials Science & Technology

Jiangsu Sidike New Materials Science & Technology Co., Ltd.

High growth potential slight.

Market Insights

Community Narratives