There's No Escaping Shandong Taihe Technologies Co., Ltd.'s (SZSE:300801) Muted Earnings Despite A 25% Share Price Rise

Those holding Shandong Taihe Technologies Co., Ltd. (SZSE:300801) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 36% over that time.

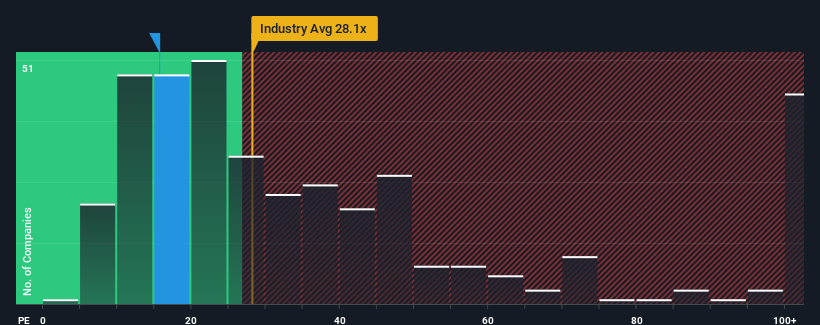

Although its price has surged higher, Shandong Taihe Technologies may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 15.7x, since almost half of all companies in China have P/E ratios greater than 30x and even P/E's higher than 55x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

As an illustration, earnings have deteriorated at Shandong Taihe Technologies over the last year, which is not ideal at all. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

See our latest analysis for Shandong Taihe Technologies

How Is Shandong Taihe Technologies' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Shandong Taihe Technologies' is when the company's growth is on track to lag the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 61%. The last three years don't look nice either as the company has shrunk EPS by 13% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 41% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we are not surprised that Shandong Taihe Technologies is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Key Takeaway

Shandong Taihe Technologies' stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Shandong Taihe Technologies revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Shandong Taihe Technologies, and understanding these should be part of your investment process.

Of course, you might also be able to find a better stock than Shandong Taihe Technologies. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300801

Shandong Taihe Technologies

Manufactures and sells water treatment chemicals in China.

Flawless balance sheet and good value.