Shenzhen Cotran New Material Co.,Ltd.'s (SZSE:300731) Shares Climb 38% But Its Business Is Yet to Catch Up

The Shenzhen Cotran New Material Co.,Ltd. (SZSE:300731) share price has done very well over the last month, posting an excellent gain of 38%. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 9.2% in the last twelve months.

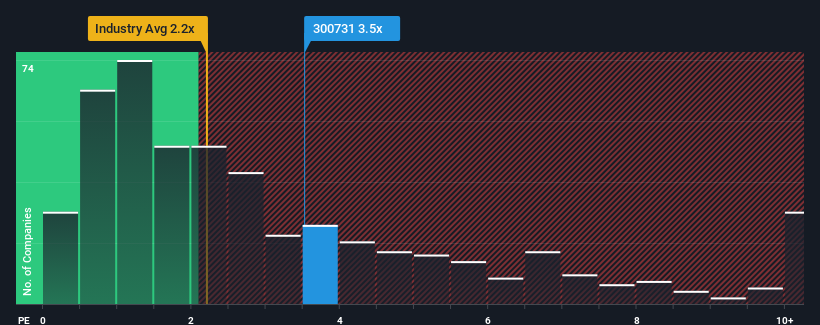

After such a large jump in price, when almost half of the companies in China's Chemicals industry have price-to-sales ratios (or "P/S") below 2.2x, you may consider Shenzhen Cotran New MaterialLtd as a stock probably not worth researching with its 3.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Shenzhen Cotran New MaterialLtd

What Does Shenzhen Cotran New MaterialLtd's P/S Mean For Shareholders?

Shenzhen Cotran New MaterialLtd certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Shenzhen Cotran New MaterialLtd will help you shine a light on its historical performance.How Is Shenzhen Cotran New MaterialLtd's Revenue Growth Trending?

Shenzhen Cotran New MaterialLtd's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered an exceptional 33% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 55% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 21% shows it's noticeably less attractive.

With this information, we find it concerning that Shenzhen Cotran New MaterialLtd is trading at a P/S higher than the industry. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

Shenzhen Cotran New MaterialLtd's P/S is on the rise since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

The fact that Shenzhen Cotran New MaterialLtd currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

It is also worth noting that we have found 2 warning signs for Shenzhen Cotran New MaterialLtd (1 is potentially serious!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Shenzhen Cotran New MaterialLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300731

Shenzhen Cotran New MaterialLtd

Research and development, production, and sales of polymer materials and thermal management system products in China.

High growth potential with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026