Investors Appear Satisfied With Shenzhen Cotran New Material Co.,Ltd.'s (SZSE:300731) Prospects As Shares Rocket 25%

Despite an already strong run, Shenzhen Cotran New Material Co.,Ltd. (SZSE:300731) shares have been powering on, with a gain of 25% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 26% in the last year.

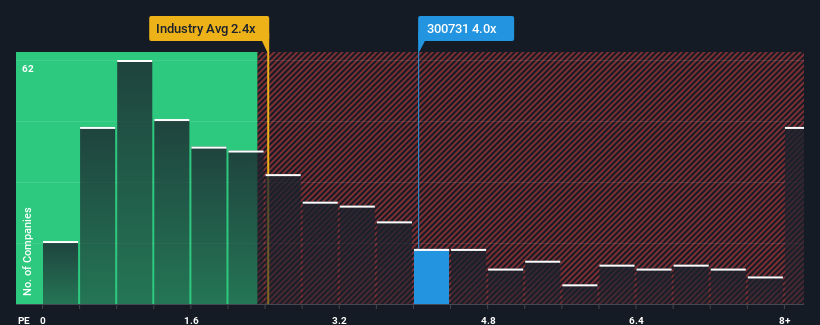

After such a large jump in price, given close to half the companies operating in China's Chemicals industry have price-to-sales ratios (or "P/S") below 2.4x, you may consider Shenzhen Cotran New MaterialLtd as a stock to potentially avoid with its 4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Shenzhen Cotran New MaterialLtd

What Does Shenzhen Cotran New MaterialLtd's Recent Performance Look Like?

Recent times have been advantageous for Shenzhen Cotran New MaterialLtd as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Shenzhen Cotran New MaterialLtd's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Shenzhen Cotran New MaterialLtd's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 58% gain to the company's top line. Pleasingly, revenue has also lifted 49% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 32% as estimated by the sole analyst watching the company. That's shaping up to be materially higher than the 25% growth forecast for the broader industry.

With this information, we can see why Shenzhen Cotran New MaterialLtd is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

The large bounce in Shenzhen Cotran New MaterialLtd's shares has lifted the company's P/S handsomely. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Shenzhen Cotran New MaterialLtd maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Chemicals industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Shenzhen Cotran New MaterialLtd that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300731

Shenzhen Cotran New MaterialLtd

Manufactures and provides waterproof and sealing insulation products and solutions in China.

High growth potential with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success