Investors Don't See Light At End Of Zhuzhou Feilu High-Tech Materials Co., Ltd.'s (SZSE:300665) Tunnel And Push Stock Down 27%

Zhuzhou Feilu High-Tech Materials Co., Ltd. (SZSE:300665) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 43% share price drop.

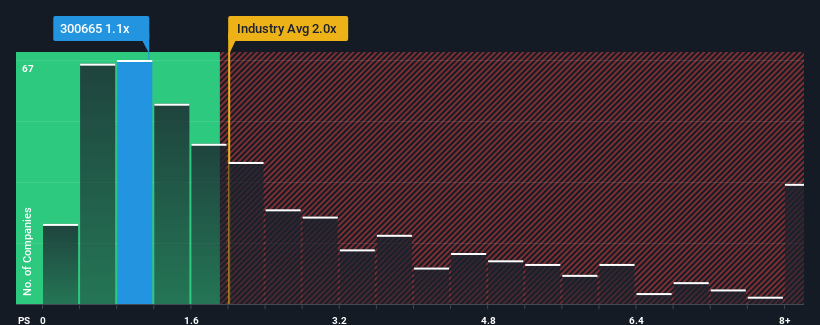

Although its price has dipped substantially, Zhuzhou Feilu High-Tech Materials may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.1x, considering almost half of all companies in the Chemicals industry in China have P/S ratios greater than 2x and even P/S higher than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Zhuzhou Feilu High-Tech Materials

What Does Zhuzhou Feilu High-Tech Materials' Recent Performance Look Like?

Revenue has risen firmly for Zhuzhou Feilu High-Tech Materials recently, which is pleasing to see. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Zhuzhou Feilu High-Tech Materials' earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Zhuzhou Feilu High-Tech Materials' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 9.1% gain to the company's revenues. Revenue has also lifted 24% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 23% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this information, we can see why Zhuzhou Feilu High-Tech Materials is trading at a P/S lower than the industry. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Final Word

Zhuzhou Feilu High-Tech Materials' P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

In line with expectations, Zhuzhou Feilu High-Tech Materials maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for Zhuzhou Feilu High-Tech Materials (3 are a bit concerning) you should be aware of.

If these risks are making you reconsider your opinion on Zhuzhou Feilu High-Tech Materials, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Zhuzhou Feilu High-Tech Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300665

Zhuzhou Feilu High-Tech Materials

Zhuzhou Feilu High-Tech Materials Co., Ltd.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives