There's Reason For Concern Over Jiangsu Zhengdan Chemical Industry Co., Ltd.'s (SZSE:300641) Massive 178% Price Jump

Jiangsu Zhengdan Chemical Industry Co., Ltd. (SZSE:300641) shareholders would be excited to see that the share price has had a great month, posting a 178% gain and recovering from prior weakness. The annual gain comes to 137% following the latest surge, making investors sit up and take notice.

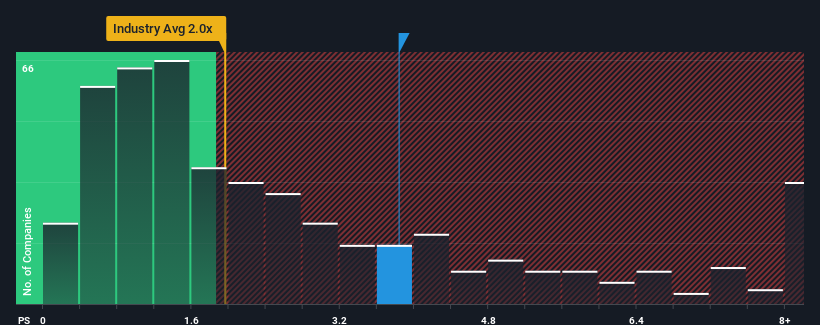

After such a large jump in price, given close to half the companies operating in China's Chemicals industry have price-to-sales ratios (or "P/S") below 2x, you may consider Jiangsu Zhengdan Chemical Industry as a stock to potentially avoid with its 3.8x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Jiangsu Zhengdan Chemical Industry

How Jiangsu Zhengdan Chemical Industry Has Been Performing

As an illustration, revenue has deteriorated at Jiangsu Zhengdan Chemical Industry over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Jiangsu Zhengdan Chemical Industry will help you shine a light on its historical performance.How Is Jiangsu Zhengdan Chemical Industry's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Jiangsu Zhengdan Chemical Industry's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 20% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 17% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 21% shows it's noticeably less attractive.

With this information, we find it concerning that Jiangsu Zhengdan Chemical Industry is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does Jiangsu Zhengdan Chemical Industry's P/S Mean For Investors?

Jiangsu Zhengdan Chemical Industry shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that Jiangsu Zhengdan Chemical Industry currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

It is also worth noting that we have found 2 warning signs for Jiangsu Zhengdan Chemical Industry (1 is potentially serious!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300641

Jiangsu Zhengdan Chemical Industry

Jiangsu Zhengdan Chemical Industry Co., Ltd.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives