- China

- /

- Semiconductors

- /

- SHSE:688352

Fortior Technology Shenzhen And 2 Other Undiscovered Gems In China

Reviewed by Simply Wall St

In recent weeks, Chinese stocks have experienced a notable surge, driven by optimism surrounding Beijing's comprehensive support measures despite ongoing challenges in manufacturing and real estate sectors. As the market navigates these dynamics, identifying promising small-cap stocks like Fortior Technology Shenzhen becomes essential for investors seeking potential opportunities amidst China's evolving economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In China

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zhejiang Wellsun Intelligent TechnologyLtd | NA | 29.72% | 33.99% | ★★★★★★ |

| Xiangtan Electrochemical ScientificLtd | 50.35% | 14.78% | 38.33% | ★★★★★★ |

| Shenzhen TVT Digital Technology | 1.02% | 12.79% | 32.81% | ★★★★★★ |

| Forest Packaging GroupLtd | 14.94% | -8.49% | -7.06% | ★★★★★★ |

| Beijing Haohan Data TechnologyLtd | NA | 34.20% | 41.43% | ★★★★★★ |

| Center International GroupLtd | 28.69% | 3.14% | -40.36% | ★★★★★★ |

| Tibet Development | 52.25% | -1.03% | 55.10% | ★★★★★★ |

| Shenzhen Longtech Smart Control | 3.15% | 11.65% | 17.16% | ★★★★★☆ |

| Guangzhou LBP Medicine Science & Technology | 0.65% | 5.07% | -21.27% | ★★★★★☆ |

| Silvery Dragon Prestressed MaterialsLTD Tianjin | 22.46% | 0.77% | -3.26% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Fortior Technology (Shenzhen) (SHSE:688279)

Simply Wall St Value Rating: ★★★★★★

Overview: Fortior Technology (Shenzhen) Co., Ltd. specializes in providing driver and control IC chips for various motor systems across Asian, North American, and European markets, with a market cap of CN¥12.56 billion.

Operations: Fortior Technology's revenue streams primarily stem from the sale of driver and control IC chips. The company has reported a gross profit margin of 47.5%, reflecting its ability to manage production costs relative to sales.

Fortior Technology, a promising player in the semiconductor industry, reported impressive earnings growth of 51% over the past year, outpacing the industry's modest 0.3%. With no debt on its books, it stands strong financially compared to five years ago when its debt-to-equity ratio was 18.6%. Recent buybacks saw the company repurchase 193,000 shares for CNY 20.02 million. For the first half of 2024, sales reached CNY 282.32 million with net income at CNY 122.02 million.

Hefei Chipmore TechnologyLtd (SHSE:688352)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hefei Chipmore Technology Co., Ltd. operates as a packaging and testing service provider for integrated circuits with a market cap of CN¥13.82 billion.

Operations: Chipmore's primary revenue stream is derived from its semiconductor segment, generating CN¥1.87 billion. The company's financial performance can be further analyzed through its gross profit margin trends over time.

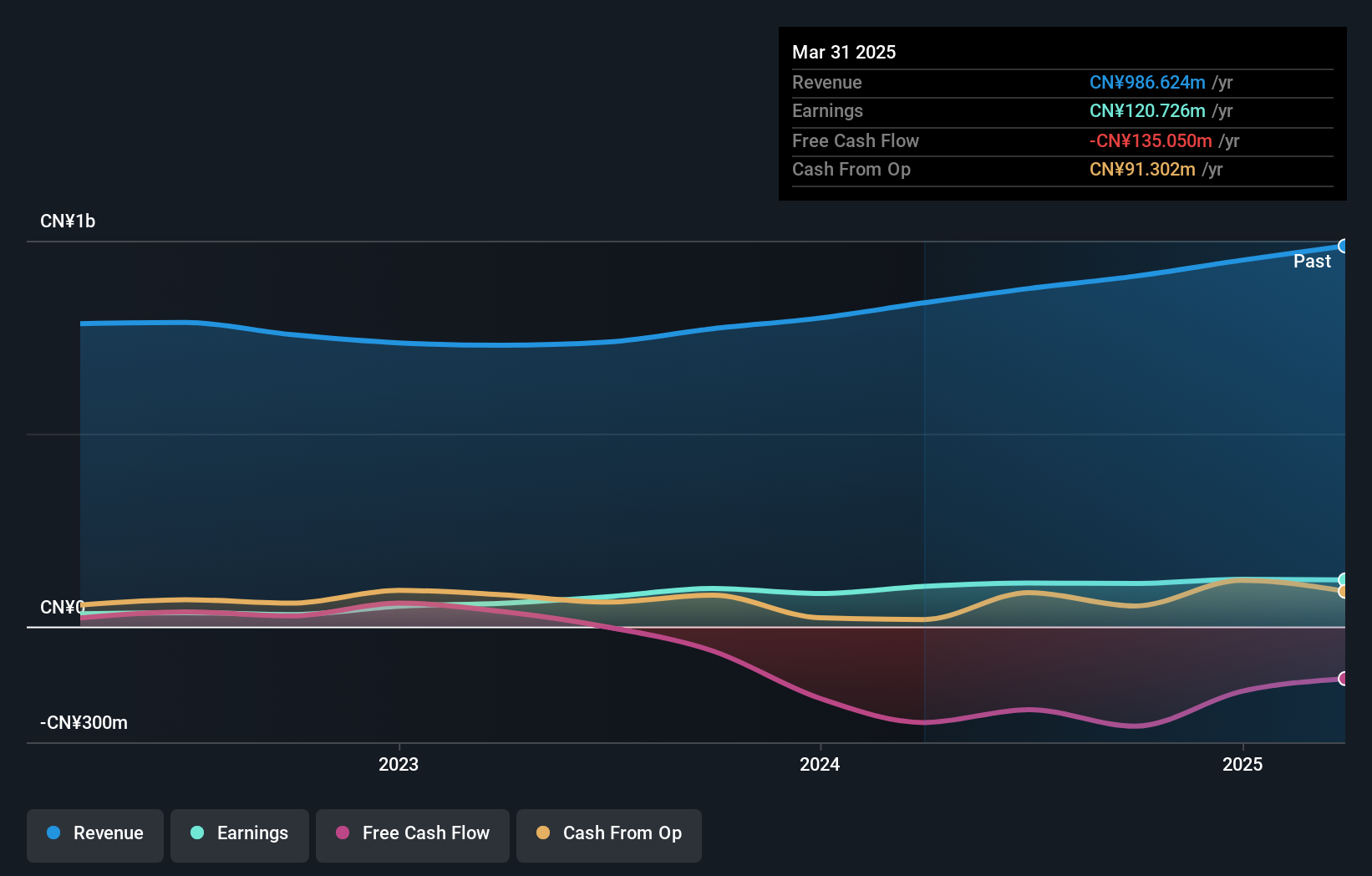

Chipmore Technology, a promising player in the semiconductor industry, showcases a notable earnings growth of 68.2% over the past year. The company recently reported half-year revenue of CNY 933.87 million, up from CNY 688.81 million last year, with net income reaching CNY 162.02 million compared to CNY 122.22 million previously. Despite its volatile share price and lack of free cash flow positivity, Chipmore's price-to-earnings ratio at 33.6x suggests value below the industry average of 58.7x while maintaining high-quality earnings and strong interest coverage capabilities.

- Take a closer look at Hefei Chipmore TechnologyLtd's potential here in our health report.

Understand Hefei Chipmore TechnologyLtd's track record by examining our Past report.

Shenzhen RongDa Photosensitive Science & Technology (SZSE:300576)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen RongDa Photosensitive Science & Technology Co., Ltd. operates in the photosensitive materials industry and has a market cap of CN¥12.24 billion.

Operations: RongDa Photosensitive Science & Technology generates its revenue primarily from the photosensitive materials sector. The company focuses on optimizing its cost structure to enhance profitability.

Shenzhen RongDa, a nimble player in the chemicals sector, has showcased impressive earnings growth of 46.5% over the past year, outpacing an industry average of -4.7%. The company is debt-free, eliminating concerns about interest coverage and highlighting its robust financial health. Recent half-year results reveal net income at CNY 72 million, up from CNY 44.9 million last year, with basic earnings per share rising to CNY 0.24 from CNY 0.16—a testament to its operational efficiency and potential for continued success in a competitive market landscape.

Taking Advantage

- Delve into our full catalog of 893 Chinese Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hefei Chipmore TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688352

Hefei Chipmore TechnologyLtd

Operates as a packaging and testing service provider for integrated circuits.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives