- China

- /

- Semiconductors

- /

- SHSE:688630

3 Asian Growth Stocks With Insider Ownership And 31% Revenue Growth

Reviewed by Simply Wall St

As global markets navigate a landscape marked by geopolitical tensions and economic uncertainties, the Asian market continues to capture investor attention with its diverse opportunities for growth. In this environment, companies that combine robust revenue growth with significant insider ownership often stand out as promising candidates, suggesting alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 59.9% |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 26.9% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Oscotec (KOSDAQ:A039200) | 21.1% | 94.4% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Laopu Gold (SEHK:6181) | 35.5% | 40.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

We're going to check out a few of the best picks from our screener tool.

Circuit Fabology Microelectronics EquipmentLtd (SHSE:688630)

Simply Wall St Growth Rating: ★★★★★☆

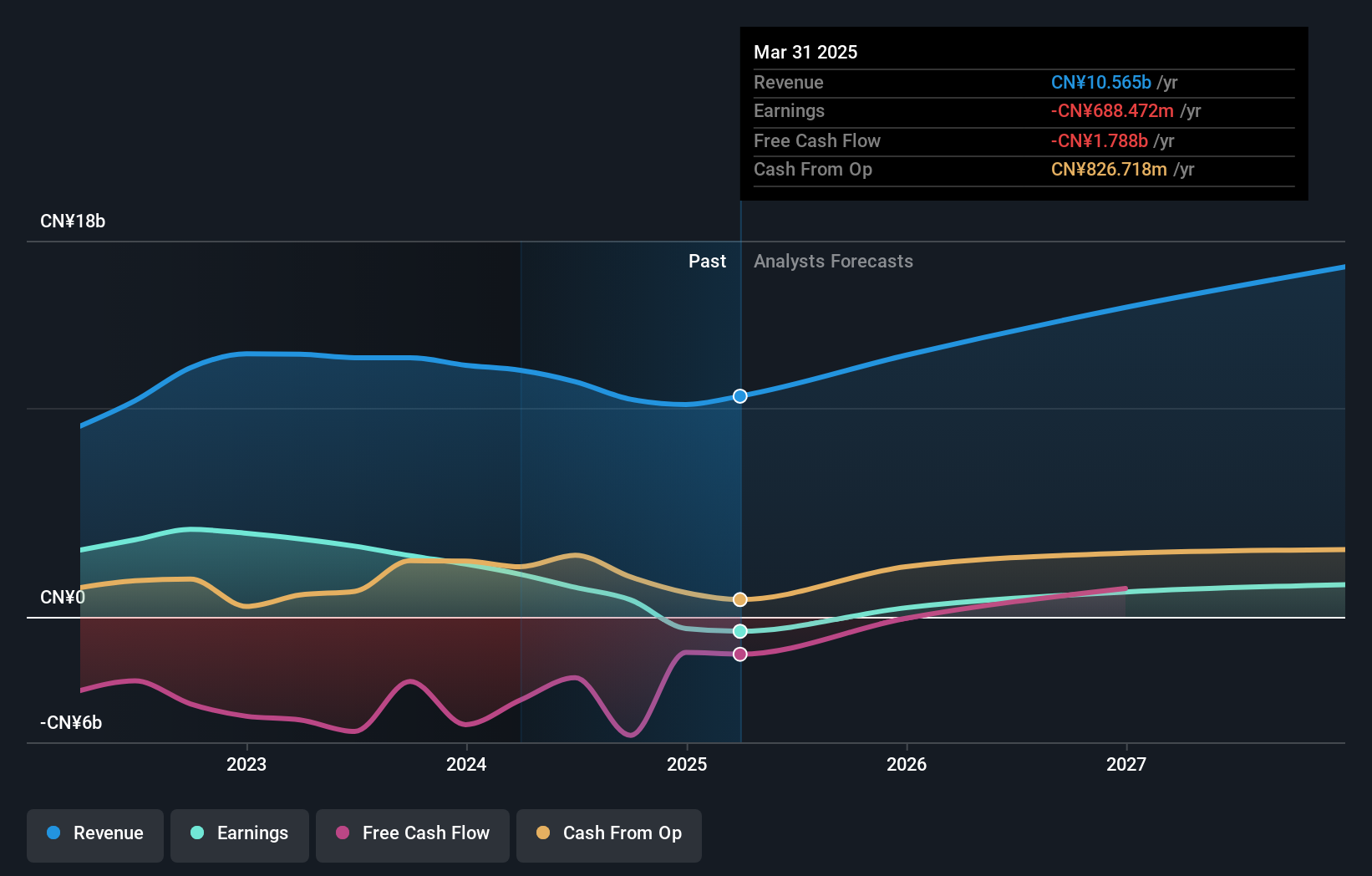

Overview: Circuit Fabology Microelectronics Equipment Co., Ltd. (SHSE:688630) operates in the microelectronics equipment sector with a market cap of approximately CN¥10.20 billion.

Operations: Circuit Fabology Microelectronics Equipment Co., Ltd. generates its revenue from various segments within the microelectronics equipment sector.

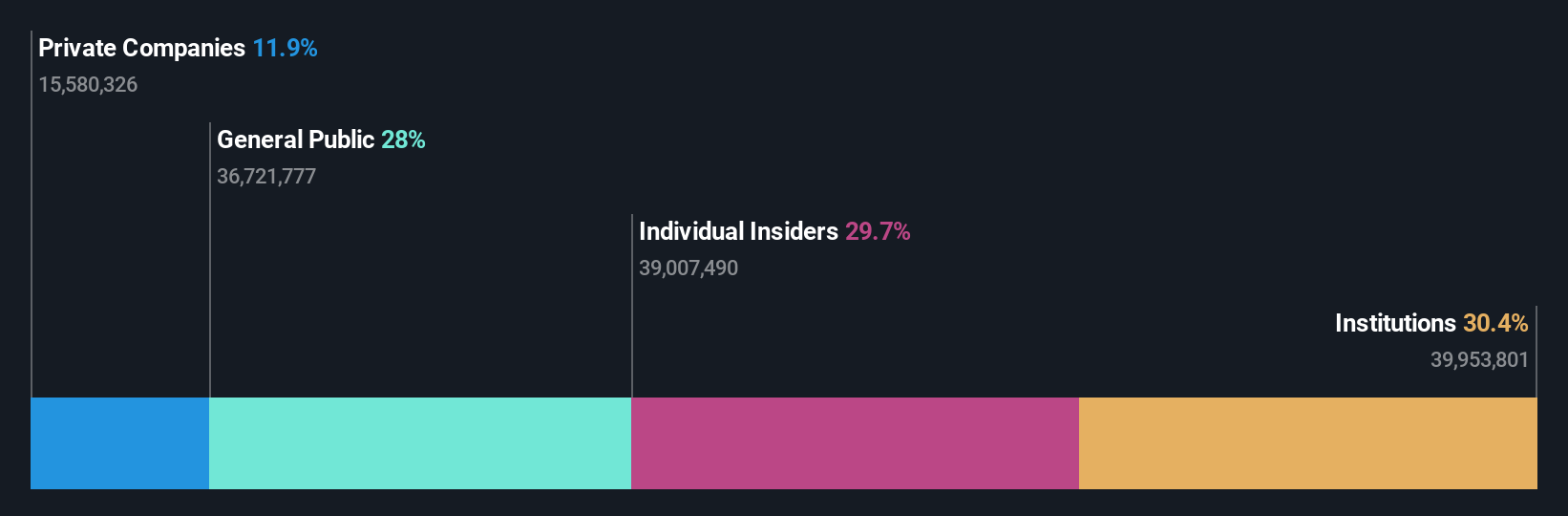

Insider Ownership: 29.7%

Revenue Growth Forecast: 31.7% p.a.

Circuit Fabology Microelectronics Equipment Ltd. demonstrates strong growth potential, with revenue and earnings expected to grow significantly above market averages at 31.7% and 32.5% annually, respectively. Despite a volatile share price recently, the company's insider ownership aligns with its growth prospects, though no substantial insider trading occurred in the past three months. Recent earnings showed improvement, with Q1 net income rising to CNY 51.87 million from CNY 39.76 million a year ago despite a reduced dividend payout announcement.

- Get an in-depth perspective on Circuit Fabology Microelectronics EquipmentLtd's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Circuit Fabology Microelectronics EquipmentLtd implies its share price may be too high.

Yunnan Energy New Material (SZSE:002812)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Yunnan Energy New Material Co., Ltd., along with its subsidiaries, provides film products both in China and internationally, with a market cap of CN¥25.80 billion.

Operations: Yunnan Energy New Material Co., Ltd. generates revenue through its film products offered domestically and internationally.

Insider Ownership: 30.8%

Revenue Growth Forecast: 17% p.a.

Yunnan Energy New Material is trading significantly below its estimated fair value, indicating potential growth opportunities. Despite a challenging financial position with debt not well covered by operating cash flow, the company is expected to become profitable within three years, outpacing average market growth. Recent changes in company bylaws and capital adjustments suggest strategic restructuring. However, recent earnings showed a decline in net income to CNY 25.99 million from CNY 158.14 million year-on-year, highlighting ongoing challenges.

- Navigate through the intricacies of Yunnan Energy New Material with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Yunnan Energy New Material's share price might be on the cheaper side.

Shenzhen Senior Technology Material (SZSE:300568)

Simply Wall St Growth Rating: ★★★★★☆

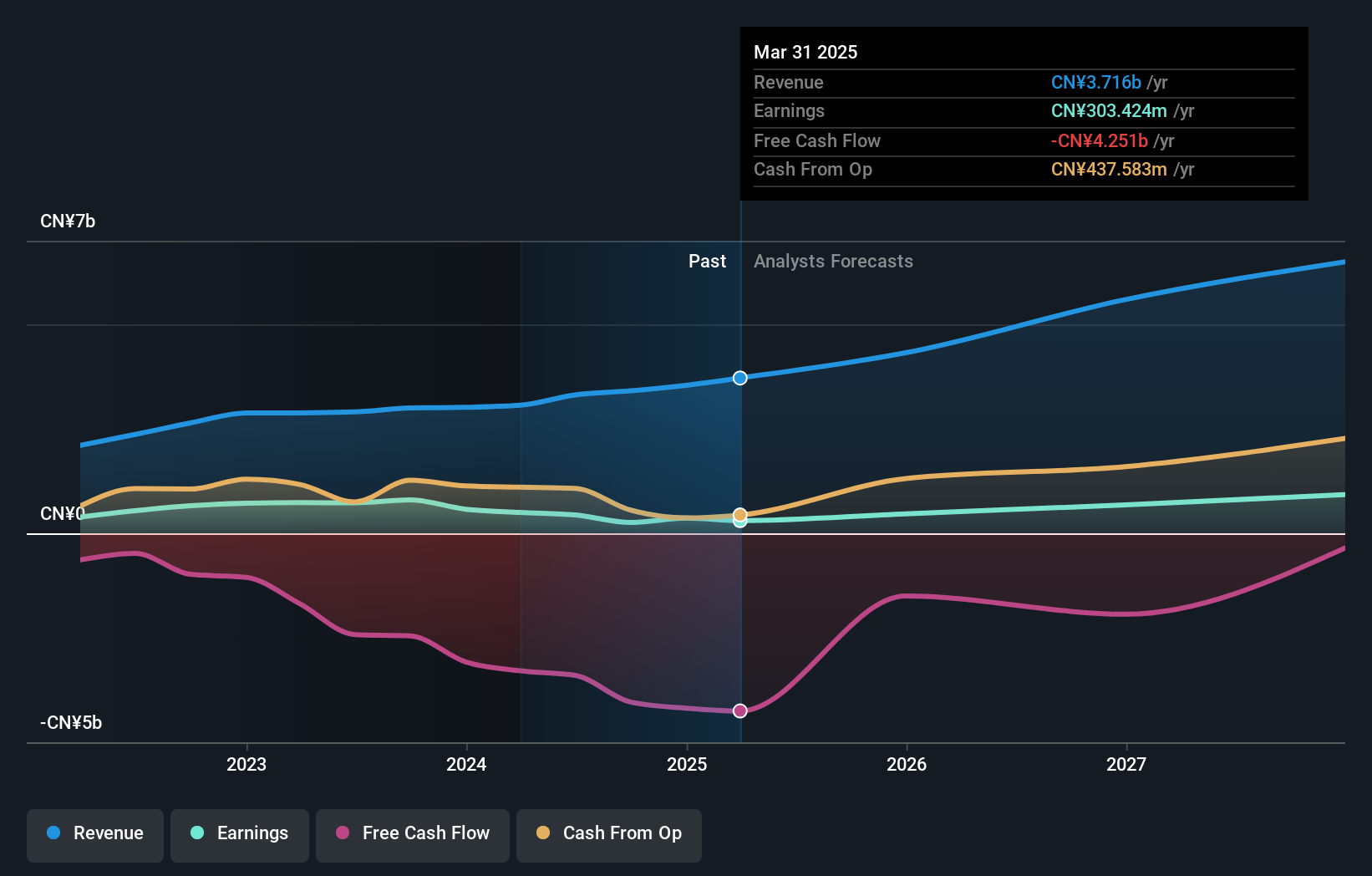

Overview: Shenzhen Senior Technology Material Co., Ltd. (SZSE:300568) operates in the manufacturing sector, focusing on producing materials for lithium-ion batteries, with a market cap of CN¥14.29 billion.

Operations: The company's revenue primarily comes from its Lithium-Ion Battery Separator New Energy Materials segment, generating CN¥3.68 billion.

Insider Ownership: 12.7%

Revenue Growth Forecast: 20.8% p.a.

Shenzhen Senior Technology Material demonstrates strong growth prospects, with earnings expected to grow significantly above the market average. Despite a decrease in profit margins from last year and low future return on equity forecasts, the company's revenue is projected to outpace market growth. Recent strategic moves include completing a share buyback worth CNY 199.98 million and amending company bylaws, indicating efforts to enhance shareholder value and streamline governance amidst financial challenges.

- Delve into the full analysis future growth report here for a deeper understanding of Shenzhen Senior Technology Material.

- In light of our recent valuation report, it seems possible that Shenzhen Senior Technology Material is trading beyond its estimated value.

Summing It All Up

- Embark on your investment journey to our 608 Fast Growing Asian Companies With High Insider Ownership selection here.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688630

Circuit Fabology Microelectronics EquipmentLtd

Circuit Fabology Microelectronics Equipment Co.,Ltd.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives