Puyang Huicheng Electronic Material Co., Ltd.'s (SZSE:300481) Price Is Right But Growth Is Lacking After Shares Rocket 26%

Despite an already strong run, Puyang Huicheng Electronic Material Co., Ltd. (SZSE:300481) shares have been powering on, with a gain of 26% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 17% over that time.

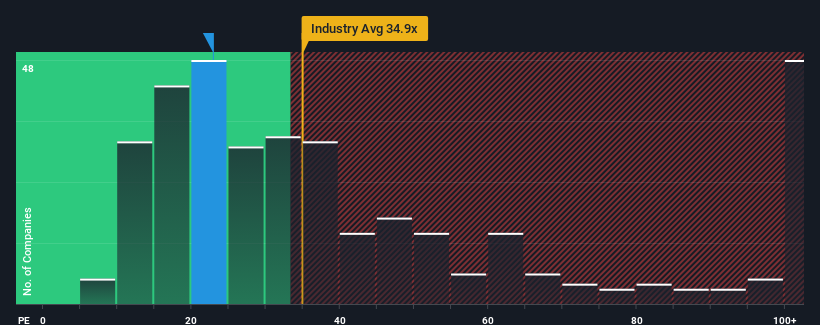

Even after such a large jump in price, Puyang Huicheng Electronic Material's price-to-earnings (or "P/E") ratio of 22.9x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 33x and even P/E's above 63x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Puyang Huicheng Electronic Material hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Puyang Huicheng Electronic Material

How Is Puyang Huicheng Electronic Material's Growth Trending?

Puyang Huicheng Electronic Material's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 46%. As a result, earnings from three years ago have also fallen 1.2% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 22% each year over the next three years. With the market predicted to deliver 25% growth per annum, the company is positioned for a weaker earnings result.

In light of this, it's understandable that Puyang Huicheng Electronic Material's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Puyang Huicheng Electronic Material's P/E

Despite Puyang Huicheng Electronic Material's shares building up a head of steam, its P/E still lags most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Puyang Huicheng Electronic Material maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You always need to take note of risks, for example - Puyang Huicheng Electronic Material has 2 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Puyang Huicheng Electronic Material, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300481

Puyang Huicheng Electronic Material

Puyang Huicheng Electronic Material Co., Ltd.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives