Revenues Tell The Story For Aerospace Intelligent Manufacturing Technology Co., Ltd. (SZSE:300446) As Its Stock Soars 30%

Those holding Aerospace Intelligent Manufacturing Technology Co., Ltd. (SZSE:300446) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Taking a wider view, although not as strong as the last month, the full year gain of 12% is also fairly reasonable.

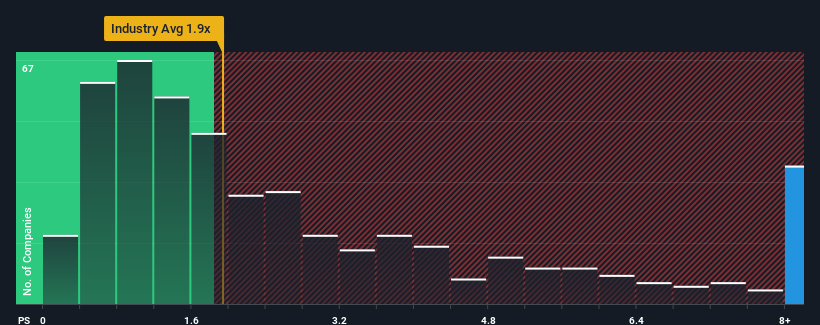

Following the firm bounce in price, given around half the companies in China's Chemicals industry have price-to-sales ratios (or "P/S") below 1.9x, you may consider Aerospace Intelligent Manufacturing Technology as a stock to avoid entirely with its 11.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Aerospace Intelligent Manufacturing Technology

What Does Aerospace Intelligent Manufacturing Technology's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Aerospace Intelligent Manufacturing Technology over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Aerospace Intelligent Manufacturing Technology's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

Aerospace Intelligent Manufacturing Technology's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 73%. In spite of this, the company still managed to deliver immense revenue growth over the last three years. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 25% shows it's noticeably more attractive.

In light of this, it's understandable that Aerospace Intelligent Manufacturing Technology's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What We Can Learn From Aerospace Intelligent Manufacturing Technology's P/S?

The strong share price surge has lead to Aerospace Intelligent Manufacturing Technology's P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Aerospace Intelligent Manufacturing Technology revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Aerospace Intelligent Manufacturing Technology, and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300446

Aerospace Intelligent Manufacturing Technology

Aerospace Intelligent Manufacturing Technology Co., Ltd.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives